WO2013100055A1 - 情報処理サーバ、情報処理方法、情報処理プログラム、情報処理プログラムが記録された記録媒体、携帯端末、携帯型コンピュータによる情報処理方法、携帯端末用プログラム、及び携帯端末用プログラムが記録された記録媒体 - Google Patents

情報処理サーバ、情報処理方法、情報処理プログラム、情報処理プログラムが記録された記録媒体、携帯端末、携帯型コンピュータによる情報処理方法、携帯端末用プログラム、及び携帯端末用プログラムが記録された記録媒体 Download PDFInfo

- Publication number

- WO2013100055A1 WO2013100055A1 PCT/JP2012/083884 JP2012083884W WO2013100055A1 WO 2013100055 A1 WO2013100055 A1 WO 2013100055A1 JP 2012083884 W JP2012083884 W JP 2012083884W WO 2013100055 A1 WO2013100055 A1 WO 2013100055A1

- Authority

- WO

- WIPO (PCT)

- Prior art keywords

- balance

- terminal

- information processing

- electronic money

- payment

- Prior art date

- Legal status (The legal status is an assumption and is not a legal conclusion. Google has not performed a legal analysis and makes no representation as to the accuracy of the status listed.)

- Ceased

Links

Images

Classifications

-

- G—PHYSICS

- G06—COMPUTING OR CALCULATING; COUNTING

- G06Q—INFORMATION AND COMMUNICATION TECHNOLOGY [ICT] SPECIALLY ADAPTED FOR ADMINISTRATIVE, COMMERCIAL, FINANCIAL, MANAGERIAL OR SUPERVISORY PURPOSES; SYSTEMS OR METHODS SPECIALLY ADAPTED FOR ADMINISTRATIVE, COMMERCIAL, FINANCIAL, MANAGERIAL OR SUPERVISORY PURPOSES, NOT OTHERWISE PROVIDED FOR

- G06Q20/00—Payment architectures, schemes or protocols

- G06Q20/22—Payment schemes or models

-

- G—PHYSICS

- G06—COMPUTING OR CALCULATING; COUNTING

- G06Q—INFORMATION AND COMMUNICATION TECHNOLOGY [ICT] SPECIALLY ADAPTED FOR ADMINISTRATIVE, COMMERCIAL, FINANCIAL, MANAGERIAL OR SUPERVISORY PURPOSES; SYSTEMS OR METHODS SPECIALLY ADAPTED FOR ADMINISTRATIVE, COMMERCIAL, FINANCIAL, MANAGERIAL OR SUPERVISORY PURPOSES, NOT OTHERWISE PROVIDED FOR

- G06Q20/00—Payment architectures, schemes or protocols

- G06Q20/04—Payment circuits

- G06Q20/06—Private payment circuits, e.g. involving electronic currency used among participants of a common payment scheme

- G06Q20/065—Private payment circuits, e.g. involving electronic currency used among participants of a common payment scheme using e-cash

- G06Q20/0655—Private payment circuits, e.g. involving electronic currency used among participants of a common payment scheme using e-cash e-cash managed centrally

-

- G—PHYSICS

- G06—COMPUTING OR CALCULATING; COUNTING

- G06Q—INFORMATION AND COMMUNICATION TECHNOLOGY [ICT] SPECIALLY ADAPTED FOR ADMINISTRATIVE, COMMERCIAL, FINANCIAL, MANAGERIAL OR SUPERVISORY PURPOSES; SYSTEMS OR METHODS SPECIALLY ADAPTED FOR ADMINISTRATIVE, COMMERCIAL, FINANCIAL, MANAGERIAL OR SUPERVISORY PURPOSES, NOT OTHERWISE PROVIDED FOR

- G06Q20/00—Payment architectures, schemes or protocols

- G06Q20/08—Payment architectures

- G06Q20/20—Point-of-sale [POS] network systems

-

- G—PHYSICS

- G06—COMPUTING OR CALCULATING; COUNTING

- G06Q—INFORMATION AND COMMUNICATION TECHNOLOGY [ICT] SPECIALLY ADAPTED FOR ADMINISTRATIVE, COMMERCIAL, FINANCIAL, MANAGERIAL OR SUPERVISORY PURPOSES; SYSTEMS OR METHODS SPECIALLY ADAPTED FOR ADMINISTRATIVE, COMMERCIAL, FINANCIAL, MANAGERIAL OR SUPERVISORY PURPOSES, NOT OTHERWISE PROVIDED FOR

- G06Q20/00—Payment architectures, schemes or protocols

- G06Q20/30—Payment architectures, schemes or protocols characterised by the use of specific devices or networks

- G06Q20/32—Payment architectures, schemes or protocols characterised by the use of specific devices or networks using wireless devices

-

- G—PHYSICS

- G06—COMPUTING OR CALCULATING; COUNTING

- G06Q—INFORMATION AND COMMUNICATION TECHNOLOGY [ICT] SPECIALLY ADAPTED FOR ADMINISTRATIVE, COMMERCIAL, FINANCIAL, MANAGERIAL OR SUPERVISORY PURPOSES; SYSTEMS OR METHODS SPECIALLY ADAPTED FOR ADMINISTRATIVE, COMMERCIAL, FINANCIAL, MANAGERIAL OR SUPERVISORY PURPOSES, NOT OTHERWISE PROVIDED FOR

- G06Q20/00—Payment architectures, schemes or protocols

- G06Q20/30—Payment architectures, schemes or protocols characterised by the use of specific devices or networks

- G06Q20/34—Payment architectures, schemes or protocols characterised by the use of specific devices or networks using cards, e.g. integrated circuit [IC] cards or magnetic cards

- G06Q20/352—Contactless payments by cards

Definitions

- the present invention records an information processing server, an information processing method, an information processing program, a recording medium on which an information processing program is recorded, a portable terminal, an information processing method using a portable computer, a portable terminal program, and a portable terminal program.

- the present invention relates to a processing medium for processing electronic money.

- FIG. 15 is a diagram for explaining a conventional electronic money system.

- the electronic money card 92 is an IC card carried by the user, and a balance of value, an IC chip ID for specifying the IC chip, an electronic money number, and the like are recorded on a built-in IC chip.

- the payment terminal 91 is installed in a store or the like, performs short-distance wireless communication with the electronic money card 92, and executes payment by value by decreasing or increasing the value of the electronic money card 92.

- the settlement terminal 91 records a transaction history with the electronic money card 92 as log data, and transmits the log data to the electronic money server 2 at once or irregularly.

- FIG. 16 is a flowchart for explaining a settlement process by a conventional electronic money system.

- the user installs in the payment terminal 91 an electronic money card 92 on which a value used for payment is recorded.

- the payment terminal 91 receives input of payment amount information from an employee of the store (step 5).

- the payment terminal 91 polls the IC chip of the electronic money card 92 (step 10).

- the IC chip returns a response to the settlement terminal 91 (step 15).

- the IC chip transmits its own IC chip ID to the settlement terminal 91.

- the payment terminal 91 When receiving the response from the IC chip, the payment terminal 91 requests an electronic money number from the IC chip (step 20).

- the electronic money number is information for specifying an IC chip in the electronic money server 2.

- the IC chip When the IC chip is requested by the payment terminal 91 for an electronic money number, the IC chip transmits it to the payment terminal 91 (step 25).

- the payment terminal 91 When receiving the electronic money number from the IC chip, the payment terminal 91 requests authentication information from the IC chip (step 30). On the other hand, the IC chip transmits authentication information to the payment terminal 91 (step 35). The settlement terminal 91 receives the authentication information from the IC chip, authenticates the IC chip, and requests the IC chip to notify the balance of value (step 40). When receiving the balance request from the payment terminal 91, the IC chip transmits the currently recorded value balance to the payment terminal 91 (step 45).

- the payment terminal 91 When the payment terminal 91 receives the balance from the IC chip, it requests the IC chip to update the balance so that the value balance is updated to the amount after payment (step 50). When receiving the balance update request from the payment terminal 91, the IC chip updates the value balance (step 55) and transmits an update completion notification to the payment terminal 91 (step 60). When the payment terminal 91 receives the update completion notification from the IC chip, the payment terminal 91 creates log data relating to the payment performed this time, and ends the payment processing.

- the settlement terminal 91 stores the log data in this way, and later transmits the log data to the electronic money server 2 by batch processing (for example, about once a day) (step 65).

- the electronic money server 2 receives and records log data from the payment terminal 91 (step 70).

- the value balance is recorded on the electronic money card 92 and processed locally with the payment terminal 91. Therefore, the conventional example does not manage the balance in real time on the electronic money server 2 side.

- the balance of electronic value is recorded in a server in association with a prepaid card

- the prepaid card is read by a card reader installed in a store, and is associated with the prepaid card.

- a technique for making a payment with a balance of electronic value recorded on a server is disclosed.

- Patent Document 1 in order to check the balance managed on the server side, the payment terminal is connected online to the server at the time of payment. Therefore, this technique cannot be applied when a payment terminal having an online connection function cannot be installed from the viewpoint of physical environment, cost performance, and the like.

- An object of the present invention is to enable a money transfer transaction with a value whose balance is managed by a server with a terminal that does not have an online connection function.

- a balance updating means for updating the balance stored in association with the payment terminal in the storage means for storing the balance of the electronic value, and a balance change response to the acquired balance change command via the payment terminal.

- a balance change response replying means for replying to the receiving terminal.

- the paying side comprising means for reading response information corresponding to the request information from the temporary storage means and returning the response information to the receiving side terminal

- Identification information acquisition means for acquiring identification information from the terminal; means for transmitting data stored in the storage means in association with the acquired identification information to the payment side terminal and storing the data in the temporary storage means;

- the information processing server further comprising:

- the storage means is capable of storing a balance for each type of electronic value, and a type that specifies the type of electronic value based on data transmitted from the receiving terminal.

- the balance update means updates the balance of the electronic value corresponding to the specified type among the electronic values stored in the storage means in association with the payment side terminal.

- An information processing server according to claim 1 or claim 2 is provided.

- the storage means is capable of storing a balance for each type of electronic value, and a type for specifying the type of electronic value based on data transmitted from the receiving terminal.

- the balance updating unit updates a balance of electronic value that does not correspond to the specified type among electronic values stored in the storage unit in association with the payment side terminal, and

- the information processing server according to claim 1 or 2 further comprising fund transfer information output means for outputting fund transfer information including the type of the electronic value.

- a balance update function for updating a balance stored in association with the payment-side terminal in the storage means for storing the balance of the electronic value, and a balance change response to the acquired balance change command via the payment-side terminal

- a balance change response reply function for replying to the receiving terminal, and a recording medium on which an information processing program for causing a computer to realize is recorded.

- the identification information transmitting means for transmitting the unique identification information to the information processing server, and the balance change command transmitted from the receiving side terminal are transferred to the information processing server, and the balance of the electronic value is determined.

- Balance change command transfer means for updating the balance stored in association with the identification information in the storage means for storing, and the balance change response transmitted from the information processing server in response to the balance change command, on the receiving terminal

- a balance change response transfer means for transferring to the mobile terminal.

- the mobile terminal according to claim 8 further comprising means for reading response information corresponding to the request information from the temporary storage means and returning the response information to the receiving terminal in the event that the request information is received.

- the invention according to claim 10 further comprises an authentication means for authenticating a payment source based on authentication information input from the outside, and the identification information transmitting means is only when authentication by the authentication means is successful.

- the identification information transmitting step for transmitting the unique identification information to the information processing server, the balance change command transmitted from the receiving terminal is transferred to the information processing server, and the balance of the electronic value is determined.

- a balance change command transfer step for updating a balance stored in association with the identification information in a storage means for storing, and a balance change response transmitted from the information processing server in response to the balance change command, on the receiving side terminal

- a balance change response transfer step for transferring to the mobile phone.

- An information processing method using a portable computer is provided.

- the identification information transmission function for transmitting the unique identification information to the information processing server, and the balance change command transmitted from the receiving terminal are transferred to the information processing server, and the balance of the electronic value is determined.

- a balance change command transfer function for updating the balance stored in association with the identification information in the storage means for storing, and a balance change response transmitted from the information processing server in response to the balance change command, on the receiving side terminal There is provided a portable terminal program that causes a portable computer to realize a balance change response transfer function for transferring to a portable computer.

- the identification information transmission function for transmitting the unique identification information to the information processing server and the balance change command transmitted from the receiving terminal are transferred to the information processing server, and the balance of the electronic value is determined.

- a balance change command transfer function for updating the balance stored in association with the identification information in the storage means for storing, and a balance change response transmitted from the information processing server in response to the balance change command, on the receiving side terminal There is provided a recording medium in which a portable terminal program that causes a portable computer to realize a balance change response transfer function for transferring to a mobile terminal is recorded.

- the balance can be managed by the server even when a terminal having no online connection function is used.

- the electronic money server 2 records a value balance in association with the electronic money card 4 and the portable terminal 5.

- the online payment terminal 6 has a function of connecting to the electronic money server 2 via the communication line 8 and a function of connecting to the electronic money card 4 and the portable terminal 5 by short-range wireless communication. Then, the electronic money server 2 connects to the electronic money card 4 and the portable terminal 5 via the online payment terminal 6 at the time of payment, specifies the account of the electronic money card 4 and the portable terminal 5, and uses the value of the account To settle.

- communication network technology has progressed, it has become possible to manage the balance of value by the server in this way.

- the offline payment terminal 7 does not have a constant connection function and cannot communicate directly with the electronic money server 2 every time payment is made.

- the portable terminal 5 can be connected to the electronic money server 2 via the Internet 3. Therefore, the offline payment terminal 7 uses the communication network connection function of the mobile terminal 5 at the time of payment, and connects the mobile terminal 5 to the electronic money server 2 as a relay device. In this way, the electronic money server 2 can connect to the offline payment terminal 7 and make a payment using the value of the account of the mobile terminal 5.

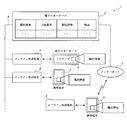

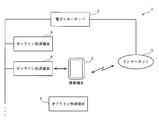

- FIG. 1 is a diagram for explaining a network configuration of an electronic money system 1 according to the first embodiment.

- the electronic money system 1 is configured using an electronic money server 2, the Internet 3, an electronic money card 4, a mobile terminal 5, an online payment terminal 6, an offline payment terminal 7, a communication line 8, and the like.

- the electronic money server 2 is a server that manages the movement of money value by value.

- the value is electronic information corresponding to the monetary value

- the electronic money system 1 moves the monetary value by increasing or decreasing the balance of the value.

- the business entity of the electronic money system 1 causes the value and the movement of the actual money to correspond by moving the actual money corresponding to the movement of the value.

- the electronic money server 2 records the identification number for identifying the electronic money card 4 and the portable terminal 5 by the user DB (database) in association with the account number of the electronic money account, authentication information, the balance of value, and the like. As described above, the electronic money server 2 records the value balance corresponding to the electronic money card 4 and the portable terminal 5.

- the electronic money card 4 is an IC card incorporating an IC chip.

- This IC chip may be either a non-contact type or a contact type, but in this embodiment mode, it is a non-contact type.

- the IC chip includes a CPU (Central Processing Unit), a ROM (Read Only Memory), a RAM (Random Access Memory), an EEPROM (Electrically Erasable and Programmable ROM), and the like.

- the IC chip records identification information for the electronic money server 2 to identify the IC chip in an EEPROM or the like.

- This identification information may be an IC chip ID given to the IC chip by the IC chip manufacturer, or may be ID information given by the electronic money server 2.

- the electronic money card 4 has an antenna connected to a high-frequency circuit of the IC chip, and generates electric power for driving the IC chip by the antenna or performs short-range wireless communication with the online payment terminal 6. .

- the mobile terminal 5 is, for example, a mobile terminal configured by a smartphone, a mobile phone, a game machine, a tablet computer, and the like, and has a function of connecting to the Internet 3 and an online payment terminal 6 or an offline payment terminal 7 and short-range wireless communication It has a function to connect by.

- the portable terminal 5 records identification information for the electronic money server 2 to identify the portable terminal 5.

- the online payment terminal 6 is installed in, for example, an accounting counter or a vending machine of a member store such as a convenience store (a store of a business that uses the electronic money system 1), the electronic money card 4 or a portable terminal. 5, short distance wireless communication is performed, and the identification information and the payment amount are transmitted to the electronic money server 2 via the communication line 8.

- the communication line 8 is a line connecting the electronic money server 2 and the online payment terminal 6.

- a dedicated line may be used as the communication line 8 or a general-purpose line such as the Internet 3 may be used.

- the offline payment terminal 7 is installed, for example, in a store or vending machine with insufficient network facilities, and has a function of performing short-range wireless communication with the mobile terminal 5.

- the offline payment terminal 7 is not always connected to the communication line 8.

- the offline payment terminal 7 is connected to the electronic money server 2 via the portable terminal 5 every time payment processing is performed.

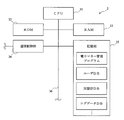

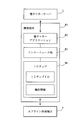

- FIG. 2A is a diagram illustrating a hardware configuration of the mobile terminal 5.

- a CPU 11, a ROM 12, a RAM 13, an input unit 14, an output unit 15, a communication control unit 16, a short-range communication control unit 17, a storage unit 18, and the like are connected by a bus line 19.

- the CPU 11 executes programs recorded in the ROM 12 and the storage unit 18 to control various information processing and the entire portable terminal 5.

- the electronic money application program 20 is executed to mediate communication between the offline payment terminal 7 and the electronic money server 2 to support payment processing by value.

- the ROM 12 is a read-only memory in which basic programs, parameters, data, and the like for operating the mobile terminal 5 are recorded.

- the RAM 13 is a readable / writable memory, and provides a working memory when the CPU 11 performs information processing.

- the output unit 15 is a functional unit that outputs information to the user, and includes a liquid crystal display for screen display, a speaker that outputs sound, and the like. For example, an icon for starting the electronic money application program 20 and a screen provided by the electronic money application 21 are displayed on the liquid crystal display.

- the input unit 14 is a functional unit that inputs information from the outside, and includes a touch panel installed on a liquid crystal display, a microphone that inputs sound, a camera that shoots a subject, and the like. The user can input information by touching the touch panel corresponding to the display on the liquid crystal display.

- the storage unit 18 is configured using, for example, a recording medium such as an EEPROM or a hard disk.

- the storage unit 18 is an OS (Operating System) that is a basic program for controlling the mobile terminal 5, an electronic money application program 20, other programs, Data is being recorded.

- OS Operating System

- the communication control unit 16 includes an antenna for wireless communication with a base station antenna of a mobile phone network, and connects the mobile terminal 5 to the Internet 3 or a telephone line.

- the short-range communication control unit 17 includes an antenna for short-range wireless communication with the reader / writer of the online payment terminal 6 or the offline payment terminal 7 and connects the portable terminal 5 to the online payment terminal 6 or the offline payment terminal 7. .

- FIG. 2B is a block diagram illustrating functions of the mobile terminal 5.

- the CPU 11 executes the electronic money application program 20

- an electronic money application 21 is formed on the portable terminal 5.

- the electronic money application 21 transmits identification information to the electronic money server 2 so that the electronic money server 2 identifies the portable terminal 5 and relays communication between the electronic money server 2 and the offline payment terminal 7.

- the offline payment terminal 7 having no network communication function can be connected to the electronic money server 2 using the mobile terminal 5 as a relay machine.

- FIG. 2C is a diagram showing the appearance of the mobile terminal 5.

- a touch panel 25 is installed on one side.

- an icon 26 for starting the electronic money application 21 is displayed, and an icon for starting a browser, a game, and other applications (not shown) is displayed.

- an application corresponding to the icon can be activated.

- the user touches the icon 26 for starting the electronic money application 21 the electronic money application 21 is started.

- FIG. 3 is a diagram for explaining the configuration of the electronic money server 2.

- a CPU 31, a ROM 32, a RAM 33, a communication control unit 34, a storage unit 35 and the like are connected by a bus line 36.

- the CPU 31 executes programs recorded in the ROM 32 and the storage unit 35 to control various information processing and the entire electronic money server 2.

- value-based payment processing is performed by updating the user's value balance in real time while communicating with the online payment terminal 6, offline payment terminal 7, electronic money card 4, and portable terminal 5.

- the ROM 32 is a read-only memory in which basic programs, parameters, data, and the like for operating the electronic money server 2 are recorded.

- the RAM 33 is a readable / writable memory and provides a working memory when the CPU 31 performs information processing.

- the communication control unit 34 communicates the electronic money server 2 with the online payment terminal 6, the electronic money card 4, and the mobile terminal 5 through the communication line 8, and communicates with the offline payment terminal 7 and the mobile terminal 5 through the Internet 3.

- the storage unit 35 is composed of, for example, a large-capacity hard disk, and an electronic money management program and other programs for the CPU 31 to perform settlement processing with value, a user DB for managing the balance of the user, and the value of the member store.

- a member store DB that manages settlement, a log data DB that stores log data recording each settlement process, and the like are recorded.

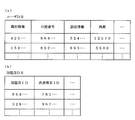

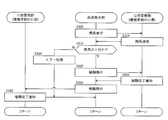

- FIG. 4A is a diagram for explaining a logical configuration of the user DB.

- the user DB includes items such as “identification information”, “account number”, “authentication information”, and “balance”.

- the item “identification information” is information for specifying the mobile terminal 5 or the electronic money card 4 associated with the electronic money account.

- the item “account number” is an account number of an electronic money account.

- the balance update is performed for an electronic money account.

- the item “authentication information” is information for the online payment terminal 6 and the offline payment terminal 7 to authenticate the authenticity of the electronic money account of the payment destination. Although common authentication information can be used, different information is used for each identification information in this embodiment.

- the item “balance” represents the balance amount of value stored in the electronic money account.

- each item of “identification information”, “account number”, “authentication information”, and “balance” has a one-to-one correspondence. For example, a plurality of identification information is assigned to one account number. By making it correspond, various modifications such as settlement from one electronic money account using a plurality of portable terminals 5 are possible.

- FIG. 4B is a diagram for explaining the logical configuration of the member store DB.

- the member store DB includes items such as “member store ID” and “settlement terminal ID”.

- the item “member store ID” is information for identifying a business operator who receives a settlement service using electronic money of the electronic money system 1.

- the item “payment terminal ID” is information for specifying the online payment terminal 6 and the offline payment terminal 7.

- the online payment terminal 6 and the offline payment terminal 7 notify the electronic money server 2 of their payment terminal IDs when connecting. Thereby, the electronic money server 2 can specify the member store ID of the member store related to the fund transfer.

- the member store ID functions as an account number for the member store.

- FIG. 5 is a diagram for explaining the configuration of the offline payment terminal 7.

- the offline payment terminal 7 includes a CPU 41, a ROM 42, a RAM 43, an input unit 44, an output unit 45, a reader / writer 46, a storage unit 47, and a communication control unit 48.

- the CPU 41 executes programs recorded in the ROM 42 and the storage unit 47 to control various information processing and the entire offline payment terminal 7.

- communication with the electronic money server 2 is performed via the mobile terminal 5, the payment amount is notified to the electronic money server 2, and the payment processing of the electronic money server 2 is supported.

- the ROM 42 is a read-only memory in which basic programs, parameters, data, and the like for operating the offline payment terminal 7 are recorded.

- the RAM 43 is a readable / writable memory, and provides a working memory when the CPU 41 performs information processing.

- the input unit 44 includes, for example, an input device such as a touch panel or a keyboard installed on the liquid crystal display, and accepts input of a settlement amount.

- the output unit 45 includes a liquid crystal display that displays an image for touch panel input, a speaker that outputs sound such as sound effects during settlement, and the like.

- the reader / writer 46 transmits / receives data to / from the portable terminal 5 by short-range communication with a built-in antenna.

- the storage unit 47 stores a program for the CPU 41 to perform a payment process with the electronic money server 2, security data (for example, key data) (not shown) used for authentication of the electronic money card, and the like. ing. Note that security data is not recorded in a general online payment terminal.

- the communication control unit 48 connects the electronic money server 2 and the offline payment terminal 7 via the communication line 8 at regular intervals, for example.

- the communication control unit of the online payment terminal always connects the electronic money server and the online payment terminal via a communication line.

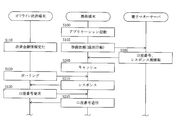

- FIG. 6 is a flowchart for explaining a payment process performed by the electronic money server 2 when the offline payment terminal 7 is connected to the electronic money server 2 via the portable terminal 5. The following processing is performed by the CPU 41 of the offline payment terminal 7, the CPU 11 of the portable terminal 5, and the CPU 31 of the electronic money server 2 according to a predetermined program.

- a user who makes a payment by shopping or charging touches the icon 26 of the mobile terminal 5 to activate the electronic money application 21.

- This can also be configured to start after the user is authenticated by entering a user ID, password, or the like. Moreover, you may comprise so that it may start, after authenticating using biometric personal authentication, such as a fingerprint.

- charging may be automatically performed by credit settlement or the like when the balance of the user DB becomes a certain amount or less.

- the electronic money application 21 accesses the electronic money server 2 via the Internet 3 and transmits identification information to the electronic money server 2 to make a preparation request (step 105).

- the electronic money server 2 receives the identification information from the mobile terminal 5

- the electronic money server 2 searches the user DB for the identification information, specifies the electronic money account number, authentication information, value balance, etc. associated with the mobile terminal 5,

- a preparation completion notification is transmitted to the portable terminal 5 (step 110).

- the mobile terminal 5 receives the preparation completion notification, the mobile terminal 5 enters a relay mode for relaying communication between the offline payment terminal 7 and the electronic money server 2.

- the offline payment terminal 7 receives payment amount information (step 115).

- the payment amount information includes whether the amount is transferred from the user to the member store (when the user purchases a product) or whether the amount is transferred from the member store to the user (when charging). Directions are also included.

- the offline payment terminal 7 polls the portable terminal 5 (step 120). This polling is relayed (transferred) to the electronic money server 2 by the portable terminal 5. That is, the offline payment terminal 7 polls the electronic money server 2 via the mobile terminal 5.

- the electronic money server 2 accepts polling from the offline payment terminal 7 using the mobile terminal 5 as a relay, and returns a response to the mobile terminal 5 (step 125). Then, the portable terminal 5 relays this response to the offline payment terminal 7. That is, the electronic money server 2 returns a response to the offline payment terminal 7 using the mobile terminal 5 as a relay machine.

- the offline payment terminal 7 and the electronic money server 2 communicate with the portable terminal 5 as a relay.

- the electronic money card 92 transmits an IC chip ID in response to the polling of the payment terminal 91.

- the electronic money server 2 is configured to transmit the IC chip ID to the offline payment terminal 7 as a response so as to be compatible with the conventional payment terminal 91 (if it is compatible, the specification change of the payment terminal 91 can be minimized). be able to.

- the mobile terminal 5 records the pseudo IC chip ID imitating the IC chip ID together with the identification information, and transmits the pseudo IC chip ID to the electronic money server 2 in response to the preparation request in step 105 or the user DB of the electronic money server 2

- the pseudo IC chip ID is recorded in association with the identification information, and the electronic money server 2 can be configured to transmit this to the offline settlement terminal 7 at the time of response.

- the offline payment terminal 7 When receiving the response from the electronic money server 2, the offline payment terminal 7 requests the electronic money number from the electronic money server 2 (step 130). On the other hand, the electronic money server 2 transmits the account number specified by the identification information of the portable terminal 5 to the offline payment terminal 7 as an electronic money number (step 135).

- the offline payment terminal 7 requests authentication information from the electronic money server 2 (step 140), and the electronic money server 2 transmits the authentication information to the offline payment terminal 7 (step 145).

- the offline payment terminal 7 confirms the authenticity of the communication partner (that is, the electronic money server 2) using the authentication information, and requests a balance of value from the electronic money server 2 (step 150).

- the electronic money server 2 transmits the value balance to the offline payment terminal 7 (step 155).

- the offline payment terminal 7 requests the electronic money server 2 to update the balance (step 160). For example, the following method can be considered for this request.

- Method 1 When an overwrite command is transmitted as an update request.

- the offline payment terminal 7 performs addition / subtraction on the balance received from the electronic money server 2 based on the payment amount information, and calculates the balance after payment.

- the offline settlement terminal 7 transmits an overwrite command for overwriting the calculated balance as a balance update request.

- the electronic money server 2 overwrites the balance of the user DB according to the overwrite command.

- Method 2 When an addition / subtraction instruction is transmitted.

- the offline payment terminal 7 transmits an addition command or a subtraction command based on the payment amount information to the electronic money server 2 as a balance update request.

- the electronic money server 2 performs addition / subtraction on the balance of the user DB in accordance with the instruction, and updates the balance to the balance after addition / subtraction.

- Method 3 Mixing of method 1 and method 2. For example, when the balance is increased, an overwrite command is used, and when the balance is decreased, a subtraction command is used. Alternatively, an addition command is used to increase the balance, and an overwrite command is used to decrease the balance.

- the electronic money server 2 When receiving the balance update request from the offline payment terminal 7, the electronic money server 2 updates the balance of the user DB (step 165). Then, the electronic money server 2 transmits an update completion notification to the offline payment terminal 7 (step 170). Furthermore, the electronic money server 2 transmits an update completion notification to the mobile terminal 5 (step 175).

- the update completion notification for the mobile terminal 5 may display that the update has been completed by the electronic money application 21 or may use e-mail.

- the electronic money server 2 After the balance update is completed, the electronic money server 2 generates log data related to the transaction and records it in the log data DB.

- the log data includes history information such as identification information of the mobile terminal 5, terminal ID of the offline payment terminal 7, payment amount information, and payment date and time. Funds will be settled later for log-in data for member stores.

- the offline payment terminal 7 does not have a constant connection function, but can be connected to the electronic money server 2 by using the network connection function of the mobile terminal 5. Further, since the electronic money server 2 returns the same information as the electronic money card 92 of the conventional example to the offline payment terminal 7, the offline payment terminal 7 is as if communicating with the conventional electronic money card 92. The same is true. That is, the offline payment terminal 7 can communicate using a conventional protocol. Therefore, the settlement terminal 91 of the conventional example can be used as the offline settlement terminal 7 and the cost of capital investment can be reduced.

- the payment amount information is generated by the offline payment terminal 7 and transmitted to the electronic money server 2, but the payment amount information may be generated by the mobile terminal 5.

- the settlement amount is input to the mobile terminal 5.

- the balance is recorded in the user DB, and the balance is increased or decreased.

- this balance may be prepaid by the user by a prepaid method, or may be the amount of credit given to the user. .

- the account is settled later by, for example, withdrawing a deposit from the user's bank account.

- the electronic money server 2 accumulates transactions performed between the mobile terminal 5, the online payment terminal 6, and the offline payment terminal 7 as log data, aggregates the log data on the closing date, and joins the user. Outputs the exchange of store funds. Then, the user and the member store pay separately based on the output data.

- Modification 1 In this modification, a part of information (such as an account number) is cached when the mobile terminal 5 starts connection with the electronic money server 2. Using the cached information, the mobile terminal 5 can respond to the offline payment terminal 7 itself. Therefore, when the offline payment terminal 7 requests cached information, the mobile terminal 5 responds to the offline payment terminal 7 using the cached information without relaying the request to the electronic money server 2. Thus, the portable terminal 5 can respond to a command that can respond itself, and can transfer a command that cannot be answered to the electronic money server 2 to reduce the amount of data communication and shorten the turnaround time. .

- FIG. 7 is a flowchart for explaining a payment processing procedure according to the first modification.

- the mobile terminal 5 activates the electronic money application 21 (step 100), and transmits a preparation request to the electronic money server 2 (step 105).

- the electronic money server 2 receives the preparation request from the portable terminal 5

- the account number associated with the identification information in the user DB and information necessary for the response (for example, a pseudo IC chip ID) together with the preparation completion notification are included in the portable terminal. 5 (step 200).

- the portable terminal 5 receives the account number and the information necessary for the response from the electronic money server 2

- the portable terminal 5 caches it by recording it in the RAM 13 (step 205).

- the offline payment terminal 7 receives the payment amount information (step 115) and polls the portable terminal 5 (step 120).

- the portable terminal 5 responds instead of the electronic money server 2 using the information cached in the RAM 13 without relaying polling to the electronic money server 2 (step 210).

- the offline payment terminal 7 requests an account number from the portable terminal 5 (step 130).

- the portable terminal 5 transmits the account number cached in the RAM 13 to the offline settlement terminal 7 without relaying the request to the electronic money server 2 (step 215).

- the subsequent processing is the same as in FIG.

- Modification 2 When there are a plurality of entities that provide settlement services based on value, it is common that the value issued by each entity cannot be used in an electronic money system of another entity. In this case, incompatible values such as the value of Company A, the value of Company B,. In this modified example, a case will be described in which an attribute indicating a type is attached to a value and it is necessary to perform settlement for each type. Note that this modification can be widely applied to cases where values are incompatible with each other, in addition to cases where values are provided by business entity.

- FIG. 8A is a diagram for explaining the second modification.

- balances are recorded for each type of value, such as A company balance (value balance for company A), B company balance (value balance for company B), and so on.

- the offline payment terminal 7 (the same applies to the online payment terminal 6) transmits a value attribute to the electronic money server 2 to notify which type of value is to be paid when requesting payment.

- the settlement processing unit 51 of the electronic money server 2 settles the value from the type of balance specified by the attribute information.

- FIG. 8B is a diagram for explaining another example of the second modification.

- utility value is used.

- the utility value is a value that can be converted into various values (for example, a deposit and savings account balance, a creditable balance, a prepaid payment means that can be converted into other types of electronic money, and the like).

- the utility value can be converted into the value of company A or the value of company B can be converted.

- a utility value balance is recorded as a balance.

- the offline payment terminal 7 (the same applies to the online payment terminal 6) transmits a value attribute to the electronic money server 2 to notify which type of value is to be paid when requesting payment.

- the settlement processing unit 51 of the electronic money server 2 When performing the reduction process, the settlement processing unit 51 of the electronic money server 2 generates a value for each attribute specified by the attribute information from the utility value (for example, the value of Company A, the value of Company B) and performs the settlement process.

- the utility value balance is reduced by the payment amount regardless of the type of value used for the payment.

- the settlement processing unit 51 In the case of an increase process, the settlement processing unit 51 generates a utility value from the value for each type and increases the balance of the utility value.

- the electronic money server 2 records in the log data which type of value is generated from the utility value, and sums up this later to perform settlement for each value.

- FIG. 9A is a diagram for explaining a case where payment is made between the electronic money card 4 and the mobile terminal 5.

- the portable terminal 5 has a reader / writer function, and can drive the electronic money card 4 by transmitting radio waves to the electronic money card 4.

- the electronic money card 4 transmits identification information to the electronic money server 2 via the portable terminal 5, and the portable terminal 5 transmits its own identification information and payment amount information to the electronic money server 2.

- the electronic money server 2 specifies two electronic money accounts to be settled based on the identification information of the electronic money card 4 and the portable terminal 5, and transfers funds between the two accounts according to the settlement amount information. That is, the value of the remittance source account is reduced by the settlement amount, and the value of the remittance destination account is increased by the settlement amount.

- FIG. 9B is a diagram for explaining a case where payment is made between two portable terminals 5.

- the mobile terminal 5a and the mobile terminal 5b perform near field communication by, for example, Bluetooth (registered trademark) or infrared communication.

- the mobile terminal 5a transmits its own identification information to the electronic money server 2, and the mobile terminal 5b transmits its own identification information to the electronic money server 2 using the mobile terminal 5a as a relay.

- the payment amount information may be generated by either the mobile terminal 5a or the mobile terminal 5b.

- the mobile terminal 5a When the mobile terminal 5a generates, the payment amount information is directly transmitted to the electronic money server 2, and when the mobile terminal 5b generates, the mobile terminal 5a is generated. It transmits to the electronic money server 2 as a relay machine.

- the electronic money server 2 specifies two electronic money accounts for settlement based on the identification information of the portable terminals 5a and 5b, and transfers funds between the two accounts according to the settlement amount information.

- Modification 4 a non-contact type IC chip is mounted on a portable terminal.

- the use of electronic money by value began with the electronic money card 4 having a non-contact type IC chip built therein. Therefore, the non-contact type IC chip is built in and the same as the electronic money card 4 by the IC chip. There are mobile terminals that are effective.

- FIG. 10 is a diagram for explaining a portable terminal equipped with a non-contact type IC chip.

- the portable terminal 81 has a non-contact type IC chip 84 mounted thereon.

- the non-contact type IC chip 84 can communicate with the electronic money application 82 via the interface unit 83.

- the IC chip 84 records an IC chip ID, which is identification information of the IC chip 84 itself, and identification information for specifying an electronic money account.

- the reader / writer 46 of the offline payment terminal 7 can communicate with the IC chip 84.

- the electronic money card 92 responds to the polling of the electronic money card 92 using the IC chip ID.

- the electronic money application 82 in the portable terminal 81 reads the IC chip ID and the identification information from the IC chip 84 and transmits them to the electronic money server 2 in step 105 of FIG. .

- the electronic money server 2 transmits the IC chip ID as a response to the offline payment terminal 7 in response to the polling in step 120.

- an IC chip ID can be used as identification information.

- the offline payment terminal 7 communicates with the electronic money server 2 using the IC chip 84, the interface unit 83, and the electronic money application 82 as a relay machine.

- the procedure of payment processing performed in cooperation by the electronic money server 2, the portable terminal 81, and the offline payment terminal 7 is the same as that in the embodiment.

- the mobile terminal 5 is connected to the online payment terminal 6 by short-range wireless communication and also connected to the electronic money server 2 via the Internet 3. .

- the electronic money server 2 is connected to the online payment terminal 6 via the portable terminal 5 and is also connected to the portable terminal 5 via the online payment terminal 6, the balance request is made.

- the subsequent processing is performed in the electronic money server 2 without performing the above.

- the electronic money server 2 matches the online payment terminal 6 and the mobile terminal 5 connected to itself in real time, and identifies the online payment terminal 6 and the mobile terminal 5 that are connected to each other. be able to.

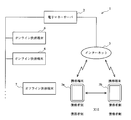

- FIG. 11 is a diagram for explaining a network configuration of the electronic money system according to the second embodiment.

- the same components as those in the first embodiment are denoted by the same reference numerals.

- the portable terminal 5 can be connected to the online payment terminal 6 by performing short-range wireless communication with the reader / writer 46 of the online payment terminal 6.

- the mobile terminal 5 can also be connected to the electronic money server 2 via the Internet 3.

- the online payment terminal 6 can be connected to the electronic money server 2 using the mobile terminal 5 as a relay machine, and the mobile terminal 5 can be connected to the electronic money server 2 using the online payment terminal 6 as a relay machine.

- the electronic money server 2 when the electronic money server 2 is connected to the mobile terminal 5 via the online payment terminal 6 and is connected to the online payment terminal 6 via the mobile terminal 5, the electronic money server 2 is connected to the electronic money server 2.

- Those that can be processed inside are processed internally without communicating with the mobile terminal 5 or the online payment terminal 6, thereby reducing the turnaround time and the occurrence of trouble.

- FIG. 12 is a flowchart for explaining the settlement processing of the present embodiment.

- two electronic money servers 2 are described for ease of illustration, but these are the same electronic money server 2.

- Two electronic money servers 2 may be used. In this case, it is possible to always communicate between the two electronic money servers 2 and to function as one electronic money server 2.

- the electronic money application 21 is activated (step 100), and the portable terminal 5 transmits identification information to the electronic money server 2 (step 105).

- the electronic money server 2 transmits a preparation completion notification to the mobile terminal 5 (step 110).

- the online payment terminal 6 receives payment amount information (step 115) and transmits a payment request to the electronic money server 2 (step 250).

- the electronic money server 2 polls the portable terminal 5 via the online payment terminal 6 (step 255).

- the portable terminal 5 relays the polling to the electronic money server 2.

- the electronic money server 2 When the electronic money server 2 receives polling from the mobile terminal 5, the electronic money server 2 returns a response to the mobile terminal 5 (step 125). This response is transmitted to the electronic money server 2 via the online payment terminal 6.

- the portable terminal 5 transfers this to the electronic money server 2.

- the electronic money server 2 transmits the account number as an electronic money number to the portable terminal 5 (step 135). The account number is transferred to the electronic money server 2 via the mobile terminal 5 and the online payment terminal 6.

- the online payment terminal 6 and the mobile terminal 5 that are connected to each other are simultaneously online with itself, that is, the mobile terminal 5 is connected to the electronic money server 2 via the online payment terminal 6. Then, it is determined whether or not the online payment terminal 6 is connected to the electronic money server 2 via the portable terminal 5 (step 265).

- This determination is made by confirming that the account number transmitted from the electronic money server 2 to the portable terminal 5 is transmitted from the online payment terminal 6 within a predetermined time.

- a certain amount of time is required until the account number transmitted from the electronic money server 2 to the portable terminal 5 is transmitted from the online payment terminal 6 due to network delay. Therefore, it is necessary to set the predetermined time longer than this delay time.

- the predetermined time is set too long, there is a possibility that the portable terminal 5 is detached from the online payment terminal 6 during that time. Therefore, in the electronic money system 1, the predetermined time is set to be longer than the delay time and the shortest time.

- step 265; N When it is determined that both terminals are not in an online state (step 265; N), the electronic money server 2 shifts to a normal online payment terminal 6 process. If it is determined that both terminals are online (step 265; Y), the electronic money server 2 performs a balance update process and settles (step 270). Then, the electronic money server 2 transmits an update completion notification to the online payment terminal 6 (step 275), and further transmits an update completion notification to the mobile terminal 5 (step 280).

- FIG. 13 is a flowchart for explaining the balance update processing in (Step 270).

- This flowchart shows processing performed by the settlement instruction unit and the account management unit formed in the electronic money server 2.

- the member store in addition to the user account balance, the member store is also registered as a user, and the member store account balance is recorded in the user DB.

- the debtor is a source of funds (value), and the creditor is a destination of funds.

- the member store is a creditor and the user is a debtor, and when charging, the member store is a debtor and the user is a creditor.

- the settlement instruction unit requests an account balance on the debtor side from the account management unit (step 305).

- the account management unit reads the balance of the debtor side account from the user DB and transmits it to the settlement instruction unit (step 310).

- the settlement instruction unit receives the balance from the account management unit and determines whether or not the balance is sufficient (step 315). For example, it is determined that the balance is sufficient when the balance is equal to or more than the settlement amount.

- step 315; N If it is determined that the balance is not sufficient (step 315; N), the settlement instruction unit performs error processing (step 320) and ends the processing.

- the settlement instruction unit instructs the account management unit to reduce the settlement amount (step 325).

- the account management unit reduces the account balance on the debtor side by the settlement amount, and transmits a reduction completion notice to the settlement instruction unit (step 330).

- the account management unit Upon receipt of the reduction completion notification, the account management unit instructs the account management unit to increase the creditor's account balance by the settlement amount (step 335). In response to the instruction, the account management unit increases the balance of the creditor's account by the settlement amount, and transmits an increase completion notice to the settlement instruction unit (step 340).

- the monetary value (value) corresponding to the settlement amount is transferred from the debtor side to the creditor side.

- the subsequent processing is performed inside the electronic money server 2, so that data transmission is omitted and the turnaround time is reduced. Is shortened. Further, since the internal processing of the electronic money server 2 is unlikely to cause a failure, the possibility of failure in settlement is reduced.

- both the member store and the user have a balance in the account, but various modifications are possible.

- the member store may accumulate the log data instead of updating the balance of the account and settle it later.

- the user side may accumulate the log data instead of updating the balance, and settle later.

- the second embodiment since the data transmission processing is reduced, it is possible to obtain the effects that the processing speed can be increased and the failure occurrence can be reduced.

- Modification 1 In this modification, when the electronic money server 2 transmits a pseudo IC chip ID to the portable terminal 5 at the time of polling response, and the online payment terminal 6 receives this from the portable terminal 5 and transfers it to the electronic money server 2, The electronic money server 2 determines that both terminals are in an online state, and performs subsequent payment processing within the electronic money server 2.

- the turnaround time is further shortened and the occurrence of failure is further suppressed.

- Modification 2 when it is determined in step 315 (FIG. 13) that the debtor side has a sufficient balance, the completion notification is sent to the mobile terminal 5 and the online payment terminal 6 before the account management unit increases or decreases the balance. Send to.

- the case where the balance is sufficient is an amount with a sufficiently low possibility that the balance will be insufficient for the settlement amount.

- a general payment amount can be calculated from an average value or the like, and a predetermined multiple of the average value can be set as a sufficient balance. Specifically, if the settlement amount per transaction is 1000 yen, and the balance is 30 times more than 30000 yen, it is very unlikely that there will be a shortage of the balance. it can.

- a sufficient balance amount can be dynamically set for each type of business of the member store when the user makes a payment.

- FIG. 14 is a diagram for explaining the third modification.

- the mobile terminal 5a and the mobile terminal 5b are connected to each other using short-range wireless communication such as Bluetooth or infrared communication. Furthermore, the mobile terminal 5 a and the mobile terminal 5 b are both connected to the electronic money server 2 via the Internet 3.

- the portable terminal 5a is made to correspond to the online payment terminal 6 (FIG. 11) of the second embodiment and the portable terminal 5b is made to correspond to the portable terminal 5

- funds are transferred between the portable terminal 5a and the portable terminal 5b. Can move.

- the electronic money server 2 is connected to the mobile terminal 5a via the mobile terminal 5b and is connected to the mobile terminal 5b via the mobile terminal 5a

- the electronic money server 2 Processing is performed inside the money server 2, and funds are transferred between the account of the mobile terminal 5a and the account of the mobile terminal 5b.

- Either the mobile terminal 5a or the mobile terminal 5b may send the payment amount information to the electronic money server 2. According to this modification, value can be transferred between users, and more flexible use of value can be performed.

- the electronic money server 2 includes a first connection unit that connects to the payment-side terminal, and a second connection unit that connects to the reception-side terminal via the connected payment-side terminal. ing.

- the electronic money server 2 is connected to identify an account (account number in the case of the portable terminal 5 or member store ID in the case of the offline payment terminal 7) that is information for identifying the source and destination of the funds transfer.

- Account specifying means for specifying a first account associated with the payment-side terminal and a second account associated with the connected receiving-side terminal is provided.

- the electronic money server 2 acquires the transfer source, transfer destination, and amount of funds from the settlement amount information, and therefore, the funds transfer between the specified first account and the specified second account is performed.

- Fund transfer information acquisition means for acquiring fund transfer information including direction and amount is provided.

- the electronic money server 2 records the transfer source, transfer destination, and amount of funds in the log data, so that the transfer of funds between the first account and the second account is performed according to the acquired funds transfer information.

- a fund transfer recording means for recording is provided.

- the electronic money server 2 records the balance for each electronic money account in the user DB, and updates the balance with payment amount information, so that the first balance recording means for recording the balance of the first account And updating means for updating the recorded first balance in accordance with the acquired funds transfer information.

- the electronic money server 2 acquires the type of value related to payment from the offline payment terminal 7 or the online payment terminal 6 and updates the value balance for each type. It comprises a type acquisition means for acquiring, and the update means updates a balance of monetary value corresponding to the acquired type among the balances of the first account.

- the type of value related to payment is acquired from the offline payment terminal 7 or the online payment terminal 6, and payment is made using the utility value. Then, the type of value converted to the utility value is recorded in the log data.

- the electronic money server 2 includes a type acquisition unit that acquires the type of monetary value used for the money transfer, and the update unit stores the first balance regardless of the type of the acquired monetary value.

- the funds transfer recording means records the funds transfer for each of the acquired types.

- the balance of the electronic money card 4 connected to the electronic money server 2 via the portable terminal 5 or another portable terminal 5 is recorded and updated.

- the electronic money server 2 includes a second balance recording unit that records the balance of the second account, and the updating unit is configured to record the second recorded value according to the acquired funds transfer information. Update balance.

- the mobile terminal 5 of the first embodiment transmits its own identification information to the electronic money server 2 and makes it communicate with the offline settlement terminal 7 and the electronic money server 2 using itself as a relay,

- mediating means for mediating communication of the predetermined server.

- the mobile terminal 5 caches the account number and responds to the offline payment terminal 7 instead of the electronic money server 2, so that the predetermined server Information recording means for acquiring and recording predetermined information requested by the receiving terminal from the predetermined server when connected, and the receiving terminal storing the predetermined information in the predetermined server And responding means for responding the recorded predetermined information in place of the predetermined server.

- the electronic money server 2 of the second embodiment can be connected to the online payment terminal 6 via the mobile terminal 5 and can be connected to the mobile terminal 5 via the online payment terminal 6, the payment side terminal And a second connection means for connecting to the payment terminal via the receiving terminal.

- the electronic money server 2 is connected to at least one of the first connection means and the second connection means to identify the account number of the mobile terminal 5 and the payment terminal ID of the online payment terminal 6.

- Account specifying means for specifying an account associated with the terminal and an account associated with the receiving terminal is provided.

- the electronic money server 2 acquires funds transfer information including the direction and amount of money transfer performed between the specified payer account and the specified receiver account in order to acquire payment amount information.

- Information acquisition means is provided.

- the electronic money server 2 is connected to the online payment terminal 6 via the mobile terminal 5 and confirms in real time that the electronic money server 2 is connected to the mobile terminal 5 via the online payment terminal 6.

- the first connecting means is connected to the receiving terminal via the paying terminal

- the second connecting means is connected to the paying terminal via the receiving terminal.

- Confirmation means for confirming is provided. Then, the electronic money server 2 performs the subsequent settlement processing in the electronic money server 2 when the confirmation is made. When the confirmation is made, the electronic money server 2 performs the first account according to the acquired money transfer information. And fund transfer recording means for recording the fund transfer between the second account and the second account. (9) The electronic money server 2 records the balance of the account corresponding to the portable terminal 5, and updates the first balance recording means for recording the balance of the first account in order to update the balance. Updating means for updating the recorded first balance according to the fund transfer information. (10) In the second embodiment, the account number of the electronic money account is used as the terminal specifying information, and in the first modification, the pseudo IC chip ID is used as the terminal specifying information.

- the update means immediately receives the first balance when the payment terminal identification information acquired from the payment terminal matches the payment terminal identification information acquired from the payment terminal via the reception terminal. Has been updated.

- the completion notification is issued without waiting for the completion of the settlement.

- an update for transmitting an update completion notification to the payment terminal after completion of the update by the update means after confirmation by the confirmation means when the acquired balance is equal to or greater than a predetermined amount Completion notification transmission means is provided.

- the electronic money server 2 stores the second balance in which the balance of the second account is recorded.

- the update means updates the recorded second balance in accordance with the acquired funds transfer information.

Landscapes

- Business, Economics & Management (AREA)

- Engineering & Computer Science (AREA)

- Accounting & Taxation (AREA)

- Strategic Management (AREA)

- Physics & Mathematics (AREA)

- General Business, Economics & Management (AREA)

- General Physics & Mathematics (AREA)

- Theoretical Computer Science (AREA)

- Finance (AREA)

- Computer Networks & Wireless Communication (AREA)

- Microelectronics & Electronic Packaging (AREA)

- Financial Or Insurance-Related Operations Such As Payment And Settlement (AREA)

Priority Applications (4)

| Application Number | Priority Date | Filing Date | Title |

|---|---|---|---|

| US14/369,499 US10546286B2 (en) | 2011-12-28 | 2012-12-27 | Information processing server, information processing method, information processing program product, recording medium on which information processing program product is recorded, portable terminal, information processing method executed by handheld computer, program product for portable terminal, and recording medium on which program product for portable terminal is recorded |

| CN201280064935.5A CN104025133A (zh) | 2011-12-28 | 2012-12-27 | 信息处理服务器、信息处理方法、信息处理程序、记录了信息处理程序的记录介质、便携终端、便携式计算机的信息处理方法、便携终端用程序、以及记录了便携终端用程序的记录介质 |

| EP12861460.9A EP2800039A4 (en) | 2011-12-28 | 2012-12-27 | INFORMATION PROCESSING SERVER, INFORMATION PROCESSING METHOD, INFORMATION PROCESSING PROGRAM, RECORDING MEDIUM CONTAINING INFORMATION PROCESSING PROGRAM, PORTABLE TERMINAL, INFORMATION PROCESSING METHOD USING PORTABLE COMPUTER, PROGRAM D PORTABLE COMPUTER AND RECORDING MEDIUM CONTAINING A PORTABLE COMPUTER PROGRAM |

| KR1020147017883A KR101652840B1 (ko) | 2011-12-28 | 2012-12-27 | 정보 처리 서버, 정보 처리 방법, 정보 처리 프로그램이 기록된 기록 매체, 휴대 단말기, 휴대형 컴퓨터에 의한 정보 처리 방법, 및 휴대 단말기용 프로그램이 기록된 기록 매체 |

Applications Claiming Priority (2)

| Application Number | Priority Date | Filing Date | Title |

|---|---|---|---|

| JP2011290191A JP5553821B2 (ja) | 2011-12-28 | 2011-12-28 | 情報処理サーバ、情報処理方法、情報処理プログラム、情報処理プログラムが記録された記録媒体、携帯端末、携帯端末用プログラム、及び携帯端末用プログラムが記録された記録媒体 |

| JP2011-290191 | 2011-12-28 |

Publications (1)

| Publication Number | Publication Date |

|---|---|

| WO2013100055A1 true WO2013100055A1 (ja) | 2013-07-04 |

Family

ID=48697534

Family Applications (1)

| Application Number | Title | Priority Date | Filing Date |

|---|---|---|---|

| PCT/JP2012/083884 Ceased WO2013100055A1 (ja) | 2011-12-28 | 2012-12-27 | 情報処理サーバ、情報処理方法、情報処理プログラム、情報処理プログラムが記録された記録媒体、携帯端末、携帯型コンピュータによる情報処理方法、携帯端末用プログラム、及び携帯端末用プログラムが記録された記録媒体 |

Country Status (7)

| Country | Link |

|---|---|

| US (1) | US10546286B2 (enExample) |

| EP (1) | EP2800039A4 (enExample) |

| JP (1) | JP5553821B2 (enExample) |

| KR (1) | KR101652840B1 (enExample) |

| CN (1) | CN104025133A (enExample) |

| MY (1) | MY175907A (enExample) |

| WO (1) | WO2013100055A1 (enExample) |

Cited By (1)

| Publication number | Priority date | Publication date | Assignee | Title |

|---|---|---|---|---|

| JP2018077641A (ja) * | 2016-11-08 | 2018-05-17 | 株式会社ブイシンク | 決済システム |

Families Citing this family (22)

| Publication number | Priority date | Publication date | Assignee | Title |

|---|---|---|---|---|

| KR101534146B1 (ko) * | 2013-05-22 | 2015-07-14 | 박복태 | 데이터로 관리되는 무형화폐인 비트머니의 생성 방법과 제공서비스 시스템 |

| JP6109675B2 (ja) * | 2013-08-05 | 2017-04-05 | 株式会社ぐるなび | 決済システム及び決済方法 |

| US10977650B2 (en) * | 2013-10-30 | 2021-04-13 | Tencent Technology (Shenzhen) Company Limited | Information transmission method, apparatus and system |

| JP6384137B2 (ja) * | 2014-03-03 | 2018-09-05 | 大日本印刷株式会社 | 情報処理装置、情報処理方法、情報処理プログラム、及び情報処理システム |

| JP6648964B2 (ja) * | 2014-12-08 | 2020-02-19 | 任天堂株式会社 | 決済システム及び不正取得防止方法 |

| US10706403B2 (en) | 2014-12-08 | 2020-07-07 | Nintendo Co., Ltd. | Settlement system, information processing device and server device |

| JP6567829B2 (ja) * | 2015-01-16 | 2019-08-28 | Line株式会社 | 決済サーバ装置、決済システム、及びプログラム |

| WO2016123793A1 (zh) * | 2015-02-06 | 2016-08-11 | 华为技术有限公司 | 一种支付方法、支付终端及收款终端 |

| CN106062798A (zh) * | 2015-02-13 | 2016-10-26 | 华为技术有限公司 | 一种账户信息管理的方法及装置 |

| JP6224289B2 (ja) | 2015-02-17 | 2017-11-01 | 楽天株式会社 | 携帯端末、制御方法およびプログラム |

| JP2016207043A (ja) | 2015-04-24 | 2016-12-08 | Line株式会社 | 端末装置、決済サーバ、決済システム、決済方法、及びプログラム |

| JP6359488B2 (ja) * | 2015-06-10 | 2018-07-18 | 株式会社 ゆうちょ銀行 | 情報処理システム、情報処理装置、ユーザ端末、情報処理方法及びプログラム |

| CN105118159A (zh) * | 2015-09-18 | 2015-12-02 | 杭州锦业科技有限公司 | 一种基于嵌入式和移动互联网的自动售货机的售货系统 |

| US20170140358A1 (en) * | 2015-11-18 | 2017-05-18 | Andrew Orrock | Network Bridge for Local Transaction Authorization |

| CN107230050B (zh) * | 2016-03-25 | 2021-05-25 | 中国人民银行数字货币研究所 | 基于可视数字货币芯片卡进行数字货币支付的方法和系统 |

| CN107230068B (zh) * | 2016-03-25 | 2021-03-16 | 中国人民银行数字货币研究所 | 使用可视数字货币芯片卡支付数字货币的方法和系统 |

| CN107230067B (zh) * | 2016-03-25 | 2021-04-09 | 中国人民银行数字货币研究所 | 基于数字货币芯片卡的兑换和支付方法以及数字货币系统 |

| JP6854684B2 (ja) * | 2017-03-30 | 2021-04-07 | Tfペイメントサービス株式会社 | 決済システム、決済端末、および決済方法 |

| CN111340479A (zh) * | 2020-02-24 | 2020-06-26 | 支付宝(杭州)信息技术有限公司 | 业务处理方法及装置 |

| JP7371579B2 (ja) * | 2020-07-03 | 2023-10-31 | トヨタ自動車株式会社 | 情報処理装置、情報処理プログラム及び情報処理システム |

| CN114327316B (zh) * | 2020-09-30 | 2024-04-19 | 伊姆西Ip控股有限责任公司 | 获取视觉内容的方法、设备和计算机程序产品 |

| JP7005802B1 (ja) | 2021-03-02 | 2022-01-24 | 株式会社 みずほ銀行 | 支払管理システム及び支払管理方法 |

Citations (5)

| Publication number | Priority date | Publication date | Assignee | Title |

|---|---|---|---|---|

| JPH0887655A (ja) * | 1994-09-19 | 1996-04-02 | Toshiba Corp | 情報処理システム |

| JP2002298041A (ja) * | 2001-03-29 | 2002-10-11 | J-Phone East Co Ltd | 決済方法、決済用情報処理方法、決済用情報処理システム及びプログラム |

| JP2004133693A (ja) * | 2002-10-10 | 2004-04-30 | Casio Comput Co Ltd | プリペイド型電子マネー決済システム、方法、及びプログラム |

| JP2004171527A (ja) | 2002-11-06 | 2004-06-17 | Jcb:Kk | サーバ管理型決済システム |

| JP2005115876A (ja) * | 2003-10-10 | 2005-04-28 | Kenichi Oga | 携帯端末を利用した決済処理システム、店舗装置、サーバ、携帯端末 |

Family Cites Families (58)

| Publication number | Priority date | Publication date | Assignee | Title |

|---|---|---|---|---|

| JP3594180B2 (ja) | 1999-02-18 | 2004-11-24 | 松下電器産業株式会社 | コンテンツ提供方法 |

| JP3848799B2 (ja) | 1999-07-06 | 2006-11-22 | 株式会社日本コンラックス | 自動販売機の制御方法およびシステム |

| US7729986B1 (en) | 1999-07-30 | 2010-06-01 | Visa International Service Association | Smart card transactions using wireless telecommunications network |

| US6584309B1 (en) | 1999-12-16 | 2003-06-24 | The Coca-Cola Company | Vending machine purchase via cellular telephone |

| KR100314174B1 (ko) * | 1999-12-28 | 2001-11-16 | 이종일 | 이동 통신 단말기를 이용한 전자 화폐 운용 방법 및 시스템 |

| US7203158B2 (en) | 2000-12-06 | 2007-04-10 | Matsushita Electric Industrial Co., Ltd. | OFDM signal transmission system, portable terminal, and e-commerce system |

| EP2293263A3 (en) * | 2001-03-29 | 2012-01-04 | Ebestcard Ltd | On-line and/or off-line card transaction system and method |

| US20030078895A1 (en) * | 2001-10-19 | 2003-04-24 | Mackay George | Use of cellular phones for payment of vending machines |

| JP2003281397A (ja) | 2002-03-20 | 2003-10-03 | Nippon Conlux Co Ltd | キャッシュレス自動販売機システム |

| JP2003317020A (ja) | 2002-04-23 | 2003-11-07 | Nec Infrontia Corp | 個人認証システム及びこれに用いられる個人認証プログラム |

| JP2004062511A (ja) | 2002-07-29 | 2004-02-26 | Magic Software Japan Kk | 認証処理機能付き携帯電話及びその認証システム |

| JP2004240858A (ja) * | 2003-02-07 | 2004-08-26 | Nec Corp | 電子マネーシステム、電子マネー交換サーバ及び携帯端末 |

| JP2004272561A (ja) * | 2003-03-07 | 2004-09-30 | Bitwallet Inc | 携帯端末装置、携帯端末方法、携帯端末プログラム、提供サーバ装置、提供サーバ方法、及び提供サーバプログラム |

| JP2004348325A (ja) | 2003-05-21 | 2004-12-09 | Nec Corp | 電子マネーシステム及び装置並びに電子マネーの発行・決済方法 |

| JP2005251056A (ja) | 2004-03-08 | 2005-09-15 | Matsushita Electric Ind Co Ltd | 決済システムおよび決済端末および決済確認方法 |

| FR2870067B1 (fr) | 2004-05-05 | 2006-06-16 | Radiotelephone Sfr | Procede de rechargement d'une carte d'abonnement grace a un equipement sans fil |

| JP4516399B2 (ja) * | 2004-10-08 | 2010-08-04 | フェリカネットワークス株式会社 | 情報処理装置および方法、並びにプログラム |

| JPWO2006082907A1 (ja) * | 2005-02-04 | 2008-06-26 | ソフトバンクBb株式会社 | 電子マネー決済システムおよび電子マネー決済方法 |

| JP2006301780A (ja) * | 2005-04-18 | 2006-11-02 | Sanden Corp | 電子マネー端末 |

| US7635083B2 (en) * | 2005-09-20 | 2009-12-22 | American Express Travel Related Services Company, Inc. | System and method for utilizing a mobile device to obtain a balance on a financial transaction instrument |

| JP2007219656A (ja) * | 2006-02-14 | 2007-08-30 | Sanden Corp | 電子マネー入金システム |

| JP2007241448A (ja) * | 2006-03-06 | 2007-09-20 | Matsushita Electric Ind Co Ltd | ユーザ端末、決済端末、決済方法、決済証書配送方法および譲渡方法 |

| US8095475B2 (en) * | 2006-03-23 | 2012-01-10 | Exceleron Software, Inc. | System and method for prepay account management system |

| JP5130469B2 (ja) * | 2006-08-10 | 2013-01-30 | 楽天Edy株式会社 | 情報処理装置、情報処理方法及び情報処理プログラム |

| US20080126261A1 (en) * | 2006-11-25 | 2008-05-29 | Robert Lovett | Cashless vending system and method |

| JP5396001B2 (ja) * | 2006-12-13 | 2014-01-22 | 楽天Edy株式会社 | 情報処理装置、情報処理装置の制御方法、及び情報処理装置の制御プログラム |

| US8045956B2 (en) * | 2007-01-05 | 2011-10-25 | Macronix International Co., Ltd. | System and method of managing contactless payment transactions using a mobile communication device as a stored value device |

| JP2008186297A (ja) * | 2007-01-30 | 2008-08-14 | Kyocera Corp | 電子マネー決済システムおよび携帯端末 |

| US9483757B2 (en) * | 2007-02-16 | 2016-11-01 | Sony Corporation | Monetary information processing server and monetary information processing method |

| US7926713B2 (en) * | 2007-02-16 | 2011-04-19 | Sony Corporation | Settlement server, settlement request server and settlement execution terminal |

| US20080208762A1 (en) * | 2007-02-22 | 2008-08-28 | First Data Corporation | Payments using a mobile commerce device |

| US20080208743A1 (en) * | 2007-02-22 | 2008-08-28 | First Data Corporation | Transfer of value between mobile devices in a mobile commerce system |

| US20080208741A1 (en) * | 2007-02-22 | 2008-08-28 | First Data Corporation | Account information lookup systems and methods in mobile commerce |

| US7946475B2 (en) * | 2007-03-23 | 2011-05-24 | Sony Corporation | Financial server, IC card terminal, and financial information processing method |