EP2000989A2 - Dispositif de gestion de facture et procédé de pilotage pour un tel dispositif - Google Patents

Dispositif de gestion de facture et procédé de pilotage pour un tel dispositif Download PDFInfo

- Publication number

- EP2000989A2 EP2000989A2 EP08009517A EP08009517A EP2000989A2 EP 2000989 A2 EP2000989 A2 EP 2000989A2 EP 08009517 A EP08009517 A EP 08009517A EP 08009517 A EP08009517 A EP 08009517A EP 2000989 A2 EP2000989 A2 EP 2000989A2

- Authority

- EP

- European Patent Office

- Prior art keywords

- bill

- repository

- bills

- questionable

- handling device

- Prior art date

- Legal status (The legal status is an assumption and is not a legal conclusion. Google has not performed a legal analysis and makes no representation as to the accuracy of the status listed.)

- Withdrawn

Links

- 238000000034 method Methods 0.000 title claims description 22

- 230000032258 transport Effects 0.000 claims description 68

- 230000008569 process Effects 0.000 description 19

- 238000007689 inspection Methods 0.000 description 9

- 230000006378 damage Effects 0.000 description 6

- 230000004044 response Effects 0.000 description 4

- 230000006866 deterioration Effects 0.000 description 3

- 238000003780 insertion Methods 0.000 description 2

- 230000037431 insertion Effects 0.000 description 2

- 238000009434 installation Methods 0.000 description 2

- 230000002159 abnormal effect Effects 0.000 description 1

- 238000005516 engineering process Methods 0.000 description 1

- 239000011888 foil Substances 0.000 description 1

- 230000006870 function Effects 0.000 description 1

- 239000000976 ink Substances 0.000 description 1

- 238000005259 measurement Methods 0.000 description 1

- 239000002184 metal Substances 0.000 description 1

- 238000012986 modification Methods 0.000 description 1

- 230000004048 modification Effects 0.000 description 1

Images

Classifications

-

- G—PHYSICS

- G07—CHECKING-DEVICES

- G07D—HANDLING OF COINS OR VALUABLE PAPERS, e.g. TESTING, SORTING BY DENOMINATIONS, COUNTING, DISPENSING, CHANGING OR DEPOSITING

- G07D11/00—Devices accepting coins; Devices accepting, dispensing, sorting or counting valuable papers

- G07D11/10—Mechanical details

- G07D11/16—Handling of valuable papers

- G07D11/18—Diverting into different paths or containers

Definitions

- the present invention relates to a bill handling device for making deposits and withdrawals of currencies or bills or bank notes.

- the invention in a first aspect provides a bill handling device comprising: an accepting/dispensing slot for making a deposit or withdrawal of paper money bills or currencies; a bill discriminating unit for discriminating authenticity of bills which have been input to the accepting/dispensing slot; a first repository which escrows authentic bills; a second repository different from the first repository for storing the counterfeit bills; a third repository different from the first repository and the second repository for storing the questionable bills; and transport unit for transporting authentic bills in the first repository and questionable bills in the third repository to the accepting/dispensing slot in the event that a refund instruction from the user is detected.

- handling of questionable bills may take place in various ways. As a result, it is possible to return undeposited questionable bills, thus eliminating the problem of insufficient repository capacity, and reducing the labor entailed in discriminating authenticity for questionable bills.

- the bill handling device pertaining to the first aspect of the present invention may further comprise a safe; and a fourth repository disposed within the safe, and having a recycled bill repository for storing bills which are available for withdrawals and a rejected bill repository for storing bills which are unavailable for withdrawals, wherein in the event that a deposit instruction from the user is detected, the transport unit transports authentic bills from the first repository to the fourth repository. According to this mode, deposited authentic bills will be transported into the safe, thus affording enhanced security.

- the transport unit may transport questionable bills in the third repository to the rejected bill repository. According to this mode, it is possible to avoid putting questionable bills back in circulation.

- the transport unit may transport questionable bills stored in the third repository to the rejected bill repository instead of transporting the bill to the accepting/dispensing slot, even if a refund instruction from the user is detected. According to this mode, it is possible to avoid putting questionable bills back in circulation.

- the bill handling device pertaining to the first aspect of the present invention may further comprise a fifth repository disposed within the safe and which stores questionable bills, wherein in the event that a deposit instruction from the user is detected, the transport unit transports questionable bills stored in the third repository to the fifth repository.

- questionable bills will be transported into the safe, thus affording enhanced security.

- questionable bills will be kept separate from counterfeit bills, and the labor entailed in authenticity determination overall can be reduced by focusing on determining authenticity of questionable bills whose authenticity may be difficult to determine.

- the transport unit may transport questionable bills stored in the third repository to the fifth repository instead of transporting the bill to the accepting/dispensing slot, even if a refund instruction from the user is detected.

- questionable bills will be transported into the safe, thus affording enhanced security.

- questionable bills will be kept separate from counterfeit bills, and the labor entailed in authenticity determination overall can be reduced by focusing solely on determining authenticity of questionable bills whose authenticity may be difficult to determine.

- the bill handling device pertaining to the first aspect of the present invention may further comprise a counterfeit bill repository disposed within the safe and which stores counterfeit bills which have been stored in the second repository. According to this mode, counterfeit bills will be transported into the safe, thus affording enhanced security.

- At least either one of the second repository and the third repository may be installed in the paper money handling device removably from the paper money handling device. According to this mode, rapid response to questionable bills or counterfeit bills is possible.

- the invention in a second aspect provides a method of controlling a bill handling device comprising: discriminating bill which has been input to an accepting/dispensing slot; in the event that the bill is authentic bill, escrowing the bill in a first repository; in the event that the bill is counterfeit bill, storing the bill in a second repository different from the first repository; in the event that the bill is questionable bill of uncertain authenticity, storing the bill in a third repository different from the first repository and the second repository; and in the event that a refund instruction has been received, transporting authentic bills which have been stored in the first repository and questionable bills which have been stored in the third repository to the accepting/dispensing slot.

- handling of questionable bills may take place in various ways. As a result, it is possible to return undeposited questionable bills, thus eliminating the problem of insufficient repository capacity, and reducing the labor entailed in discriminating authenticity for questionable bills.

- FIG. 1 is a model depiction of the exterior of the ATM pertaining to Embodiment 1.

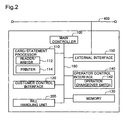

- FIG. 2 is an illustration depicting a model block configuration of the ATM pertaining to Embodiment 1.

- the ATM 10 includes a main controller 100, a card/statement processor 110, a customer control interface 120, a memory 130, an operator control interface 140, an external interface 150, and a bill handling unit 200.

- the main controller 100 controls operation of, for example, the card/statement processor 110, the customer control interface 120, the memory 130, the operator control interface 140, the external interface 150, and the bill handling unit200.

- the card/statement processor 110 includes a reader/writer 112 and a printer 114.

- the reader/writer 112 performs reading of data from or writing of data to a card.

- the printer 114 performs printing of transaction records or printing of passbook entries.

- the customer control interface 120 detects a deposit or withdrawal instruction input through operation by the customer.

- the detected deposit or withdrawal instruction is transmitted from the customer control interface 120 to the main controller 100.

- the customer control interface 120 it would be possible to employ, for example, a touch screen having a display function and capable of detecting instructions from customers and displaying messages from the ATM 10 to the customer.

- the memory 130 stores data being processed by the main controller 100, and bill templates utilized by the bill handling unit 200 when discriminating the authenticity and denomination of bills.

- the operator control interface 140 detects operations performed by operator from the financial institution.

- the external interface 150 connects the ATM 10 to a network 400.

- the ATM 10 is connected to a host computer (not shown) via the network 400.

- the bill handling unit 200 carries out discrimination of bills which have been deposited to the ATM 10, and transmits the discrimination results to the main controller 100 as well as sorting the bills and placing them in internal repositories. Upon receiving an instruction from the main controller 100, the bill handling unit 200 will retrieve and dispense bills from the internal repositories.

- FIG. 3 is an illustration depicting a model configuration of the bill handling unit 200.

- the bill handling unit 200 includes a controller 210, a bill accepting/dispensing slot 220, a bill validator 230 (we say "a bill discriminating unit 230"), a counterfeit bill repository 240, a questionable bill repository 250, an authentic bill repository 260, transport paths 270a through 270h, bill sorting gates 272a through 272e, and a safe 300.

- the transport paths are classified into two types: transport paths 270b, 270c, 270d, and 270e for two-way transit, and transport paths 270a, 270f, 270g, and 270h for one-way transit.

- the controller 210 controls operation of the bill accepting/dispensing slot 220, the bill discriminating unit 230, the counterfeit bill repository 240, the questionable bill repository 250, the authentic bill repository 260, the transport paths 270, and the bill sorting gates 272.

- the bill accepting/dispensing slot 220 accepts bills for deposit to the ATM 10 and dispenses bills from the ATM 10.

- the bill accepting/dispensing slot 220 is equipped with a door 220a and a sensor 220b for detecting whether a bill is present.

- the bill discriminating unit 230 discriminates the authenticity and denomination of bills being accepted by the ATM 10 or bills being dispensed from the ATM 10. Paper money input to the ATM 10 will be classified into the following four categories by the bill discriminating unit 230.

- the counterfeit bill repository 240 stores bills which have been classified into Category 2.

- the questionable bill repository 250 stores bills which have been classified into Category 3.

- the authentic bill repository 260 stores bills which have been classified into Category 4. Bills which have been classified into Category 1 will not be stored in any of the repositories, but instead transported to the bill accepting/dispensing slot 220 and returned to the customer.

- the counterfeit bill repository 240, the questionable bill repository 250, and the authentic bill repository 260 are escrow repositories for temporary storage of bills.

- the questionable bill repository 250 an escrow repository, for questionable bills, it becomes possible for subsequent handling of the questionable bills to take place in any of various ways, i.e. either being returned to the customer, or stored without being returned to the customer.

- the reason for making the authentic bill repository 260 an escrow repository is that, at the point in time at which a bill is stored in the authentic bill repository 260, it is not yet certain whether the bill will be subsequently deposited or returned.

- the safe 300 is situated in the lower part of the bill handling unit 200, and constitutes a repository whose exterior is encased in metal, for example.

- the safe 300 includes an in-safe counterfeit bill repository 340, an in-safe questionable bill repository 350, a recycled bill repository 360, and a rejected bill repository 370.

- the in-safe counterfeit bill repository 340 stores bills which were stored in the counterfeit bill repository 240.

- the in-safe questionable bill repository 350 stores bills which were stored in the questionable bill repository 250.

- Of bills that were stored in the authentic bill repository 260 those bills which will are suitable for reuse are stored in the recycled bill repository 360.

- the rejected bill repository 370 will store bills that were stored in the authentic bill repository 260 but which are unsuitable for reuse.

- Bills suitable for reuse are authentic bills with minimal damage such that reuse is possible. However, depending on the denomination of a bill, even bills with minimal damage may not be used as bill for dispensing purposes.

- Bills unsuitable for reuse are bills which, while authentic, are not bills suitable for reuse.

- the ATM 10 includes the in-safe counterfeit bill repository 340 and the in-safe questionable bill repository 350 in addition to the recycled bill repository 360 and the rejected bill repository 370 inside the safe 300, it will be possible to prevent destruction of evidence for questionable bills and counterfeit bills through theft and to provide enhanced security. Moreover, from a security standpoint, it is undesirable to store large numbers of questionable or counterfeit bills in escrow repositories located outside the safe 300; in the present embodiment, however, since the ATM 10 is equipped with the in-safe counterfeit bill repository 340 and the in-safe questionable bill repository 350 situated inside the safe 300, it will be possible to accommodate large numbers of counterfeit bills and questionable bills.

- the ATM 10 will be possible for the ATM 10 to handle questionable bills and counterfeit bills separately.

- discrimination of easily-discriminated counterfeit bills can be entrusted to the machine, permitting the human operator to focus on discriminating questionable bills which are more difficult to discriminate, thereby reducing the human labor entailed in discrimination overall.

- the recycled bill repository 360 is provided with multiple recycled bill repository receptacles 362 through 368 set apart for individual bill denominations. It would also be acceptable to provide two or more storage receptacles for storing bills of the same denomination.

- the transport paths 270 transport bills among the bill accepting/dispensing slot 220, the bill discriminating unit 230, the counterfeit bill repository 240, the questionable bill repository 250, the authentic bill repository 260, the in-safe counterfeit bill repository 340 and the in-safe questionable bill repository 350 inside the safe 300, the recycled bill repository receptacles 362 through 368 inside the safe 300, and the rejected bill repository 370 inside the safe 300.

- the bill sorting gates 272 are disposed at branch points along the transport paths 270, and shunt bills transported from a transport path 270 in any one three directions onto one of the transport paths 270 among the transport paths 270 in the remaining two directions.

- the transport path 270d rises upward on the left side of the bill discriminating unit 230, then veers to the right and passes over the bill discriminating unit 230, passing through the sorting gate 272c and the transport path 270e to connect with the bill sorting gate 272d in proximity of the authentic bill repository 260.

- the transport path 270d over the bill discriminating unit 230 can also be utilized as a transport path for gaining time for the purpose of the discrimination process, making possible efficient installation of the transport path 270d.

- this section of the transport path 270d is constituted, for example, by a conveyor belt, it will be possible to minimize installation space in the height direction.

- FIG. 4 is a flowchart illustrating operation of the ATM 10 from insertion of a bill to sorting into the repositories.

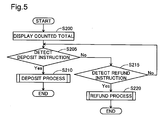

- FIG. 5 is a flowchart illustrating operation subsequent to sorting into the repositories.

- Step S100 When the main controller 100 of the ATM 10 detects that a Deposit Cash button displayed on the customer control interface 120 has been selected (Step S100), it will open the door 220a of the bill accepting/dispensing slot 220 via the controller 210 of the bill handling unit 200 (Step S105).

- Step S110 When the main controller 100 then detects that a Count Cash button displayed on the customer control interface 120 has been selected (Step S110), it will then shut the door 220a of the bill accepting/dispensing slot 220 via the controller 210 (Step S115).

- the controller 210 will then control the transport paths 270 and the bill sorting gates 272 to transport the bills which have been loaded into the bill accepting/dispensing slot 220 to the bill discriminating unit 230 one at a time (Step S120), where the authenticity and denomination of the bills will be determined.

- the bill discriminating unit 230 will then send the discrimination results to the controller 210. If the discrimination results indicate that a bill belongs to Category 1 (Step S125, Yes), the controller 210 will control the transport paths 270 and the bill sorting gates 272 to transport the bill identified as belonging to Category 1 to the bill accepting/dispensing slot 220 (Step S130).

- Step S140 If the discrimination results indicate that a bill does not belong to Category 1 (Step S125, No) but rather belongs to Category 2 (Step S135, Yes), the controller 210 will control the transport paths 270 and the bill sorting gates 272 to transport the bill identified as belonging to Category 2 to the counterfeit bill repository 240 (Step S140).

- Step S150 If the discrimination results indicate that a bill does not belong to either Category 1 or Category 2 (Step S135, No) but rather belongs to Category 4 (Step S145, Yes), the controller 210 will control the transport paths 270 and the bill sorting gates 272 to transport the bill identified as belonging to Category 4 to the authentic bill repository 260 (Step S150).

- the controller 210 will then control the transport paths 270 and the bill sorting gates 272 to transport the bill identified as belonging to Category 3 to the questionable bill repository 250 (Step S155).

- the controller 210 will then transmit to the main controller 100 the amount of money of the bills which were read by the bill discriminating unit 230. At this point, the money amount will be transmitted on a per-category basis.

- the main controller 100 receives the money amount, it will display the results on the customer control interface 120 (Step S200) and wait for an instruction from the customer. At this point, the main controller 100 may display bill denominations on a per-category basis.

- Step S205 If the main controller 100 detects that the Deposit Cash button displayed on the customer control interface 120 has been selected (Step S205, Yes), it will execute a cash deposit process sub-routine (Step S210). If on the other hand the main controller 100 detects that the Refund Cash button displayed on the customer control interface 120 has been selected (Step S215, Yes), it will execute a cash refund process sub-routine (Step S220).

- FIG. 6 is a flowchart illustrating operation of the cash deposit process sub-routine in Embodiment 1.

- the controller 210 will control the transport paths 270 and the bill sorting gates 272 to transport the Category 2 bill to the in-safe counterfeit bill repository 340 (Step S305).

- the controller 210 will control the transport paths 270 and the bill sorting gates 272 to transport the Category 4 bill to the bill discriminating unit 230 (Step S315), whereupon the bill discriminating unit 230 will decide the denomination of the bill, as well as deciding whether the bill is recyclable. If the bill is deemed not recyclable (Step S320, No), the controller 210 will transport the Category 4 bill to the rejected bill repository 370 (Step S325). If the bill is deemed recyclable (Step S320, Yes), the controller 210 will transport the Category 4 bill to the recycled bill repository 360 (Step S330). Depending on denomination, Category 4 bills will be transported to the appropriate recycled bill repository receptacle from the recycled bill repository receptacles 362 through 368.

- the controller 210 will control the transport paths 270 and the bill sorting gates 272 to transport the Category 3 bill to the rejected bill repository 370 (Step S335).

- the reason is that it would be undesirable to make bills not certified as authentic available for reuse.

- FIG. 7 is a flowchart illustrating operation of the refund process sub-routine in Embodiment 1.

- the controller 210 will control the transport paths 270 and the bill sorting gates 272 to transport the Category 2 bill to the in-safe counterfeit bill repository 340 (Step S405).

- the reason is that returning a counterfeit bill would allow the counterfeit bill to be returned to circulation.

- the controller 210 will control the transport paths 270 and the bill sorting gates 272 to transport the Category 3 bill or the Category 4 bill to the bill accepting/dispensing slot 220 (Step S415). For example, via the transport paths 270d, 270c the bill will be shunted onto the transport path 270g by the bill sorting gate 272b and transported to the bill accepting/dispensing slot 220. The controller 210 will then open the door 200a of the bill accepting/dispensing slot 220 (Step S420). Once the controller 210 detects from a signal from the sensor 220b that the bill has been retrieved (Step S425, Yes), it will shut the door 200a of the bill accepting/dispensing slot 220 (Step S430).

- Embodiment 1 it is possible to refund questionable bills which have not been deposited and to handle questionable bills in any of various ways, making it possible to eliminate the problem of insufficient repository capacity, as well as reduce the human labor entailed in discriminating authenticity for questionable bills.

- Embodiment 1 if a questionable bill is deposited, it will be transported to the rejected bill repository 370 and will not be made available for reuse. It is accordingly possible to prevent recirculation of questionable bills.

- deposited authentic bills will be transported to either the recycled bill repository 360 or rejected bill repository 370 inside the safe 300, questionable bills will be transported to the rejected bill repository 370 inside the safe 300, and counterfeit bills will be transported to the safe counterfeit bill repository 340 inside the safe 300, making it possible to prevent destruction of evidence through theft and provide enhanced security.

- Embodiment 2 will be described below.

- Embodiment 2 represents an embodiment wherein questionable bills will not be returned to customers. Since the configuration of Embodiment 2 is substantially identical to the configuration of Embodiment 1, identical parts will be assigned identical symbols and will not be discussed in detail.

- Embodiment 2 operation up to the point that a bill loaded into the ATM is placed in the counterfeit bill repository 240, the questionable bill repository 250, or the authentic bill repository 260 is the same as the operation in Embodiment 1, and will not be described. The differences in operation from Embodiment 1 will be discussed below.

- FIG. 8 is a flowchart illustrating operation of the cash deposit process sub-routine in Embodiment 2.

- the operation will be the same as the operation in Embodiment 1, so the steps have been assigned the same numbers and are not described.

- Step S310 the controller 210 will control the transport paths 270 and the bill sorting gates 272 to transport the Category 3 bill to the in-safe questionable bill repository 350 (Step S340). This is so that closer inspection may be carried out.

- the main controller 100 will then instruct the card/statement processor 110 to issue a receipt (Step S345). The reason is that subsequent closer inspection may lead to a determination that the bill is authentic. In the event that upon closer inspection the bill is determined as authentic, the funds will be deemed to have been deposited on the date of issue of the receipt.

- FIG. 9 is a flowchart illustrating operation of the refund process sub-routine in Embodiment 2.

- the operation will be the same as the operation in Embodiment 1, so the steps have been assigned the same numbers and are not described.

- the controller 210 will control the transport paths 270 and the bill sorting gates 272 to transport the Category 3 bill to the in-safe questionable bill repository 350 (Step S435). This is so that closer inspection may be carried out.

- the main controller 100 will then instruct the card/statement processor 110 to issue a receipt (Step S440). The reason is that subsequent closer inspection may lead to a determination that the bill is authentic. In the event that upon closer inspection the bill is determined as authentic, the funds will be deemed to have been deposited on the date of issue of the receipt.

- questionable bills will be transported into the in-safe questionable bill repository 350 and will not be refunded, thus preventing questionable bills from being put back into circulation.

- deposited authentic bills, counterfeit bills, and questionable bills will be respectively transported to the recycled bill repository 360 or the rejected bill repository 370 inside the safe 300, to the safe counterfeit bill repository 340, or to the in-safe questionable bill repository 350, making it possible to prevent destruction of evidence through theft and provide enhanced security.

- the host computer (not shown) could be configured to keep records of prior counterfeit bill use, and during each transaction the ATM 10 could query the host computer for a record of counterfeit bill use, and decide whether the customer has a record of counterfeit bill use. Instances in which a customer cannot be identified include instances where funds are deposited anonymously, for example.

- the controller 210 will send the results of discrimination of each individual bill to the main controller 100, and thus by counting the numbers thereof the main controller 100 will be able to calculate the proportion and number of questionable bills. If the proportion of questionable bills is high or where a large number of questionable bills have been detected, the main controller 100 may then switch the ATM 10 to operation wherein questionable bills will not be returned.

- the main controller 100 in response to a command from the host computer, may switch the ATM 10 to operation wherein questionable bills will not be returned.

- the device may be configured so as to be switchable between returning and not returning questionable bills on a case-by-case basis depending on conditions of utilization, to bill discrimination results, or to the bill circulation environment.

Landscapes

- Physics & Mathematics (AREA)

- General Physics & Mathematics (AREA)

- Financial Or Insurance-Related Operations Such As Payment And Settlement (AREA)

- Inspection Of Paper Currency And Valuable Securities (AREA)

Applications Claiming Priority (1)

| Application Number | Priority Date | Filing Date | Title |

|---|---|---|---|

| JP2007141821A JP5096042B2 (ja) | 2007-05-29 | 2007-05-29 | 紙葉類取扱装置及びその制御方法 |

Publications (2)

| Publication Number | Publication Date |

|---|---|

| EP2000989A2 true EP2000989A2 (fr) | 2008-12-10 |

| EP2000989A3 EP2000989A3 (fr) | 2009-05-06 |

Family

ID=39712470

Family Applications (1)

| Application Number | Title | Priority Date | Filing Date |

|---|---|---|---|

| EP08009517A Withdrawn EP2000989A3 (fr) | 2007-05-29 | 2008-05-23 | Dispositif de gestion de facture et procédé de pilotage pour un tel dispositif |

Country Status (4)

| Country | Link |

|---|---|

| EP (1) | EP2000989A3 (fr) |

| JP (1) | JP5096042B2 (fr) |

| KR (1) | KR100984534B1 (fr) |

| CN (1) | CN101339676B (fr) |

Families Citing this family (16)

| Publication number | Priority date | Publication date | Assignee | Title |

|---|---|---|---|---|

| JP5384278B2 (ja) * | 2009-10-05 | 2014-01-08 | 日立オムロンターミナルソリューションズ株式会社 | 紙幣取扱装置 |

| JP5410932B2 (ja) * | 2009-11-25 | 2014-02-05 | 日立オムロンターミナルソリューションズ株式会社 | 紙幣取扱装置 |

| JP5322901B2 (ja) * | 2009-11-30 | 2013-10-23 | 日立オムロンターミナルソリューションズ株式会社 | 紙幣取扱装置 |

| JP5607457B2 (ja) * | 2010-08-27 | 2014-10-15 | 日立オムロンターミナルソリューションズ株式会社 | 紙葉類取扱装置 |

| KR101467715B1 (ko) * | 2010-11-19 | 2014-12-01 | 히타치 오므론 터미널 솔루션즈 가부시키가이샤 | 지폐 입출금 장치 |

| JP5927811B2 (ja) * | 2011-08-30 | 2016-06-01 | 沖電気工業株式会社 | 紙葉類処理装置 |

| JP5778073B2 (ja) * | 2012-04-18 | 2015-09-16 | 日立オムロンターミナルソリューションズ株式会社 | 紙葉類取扱装置および紙葉類取扱方法 |

| JP5870008B2 (ja) * | 2012-11-21 | 2016-02-24 | 日立オムロンターミナルソリューションズ株式会社 | 紙幣取扱装置 |

| JP6119374B2 (ja) * | 2013-03-29 | 2017-04-26 | 沖電気工業株式会社 | 媒体処理装置及び媒体取引装置 |

| KR101460779B1 (ko) * | 2013-09-06 | 2014-11-19 | 기산전자 주식회사 | 지폐처리장치 및 그 제어방법 |

| CN104085722A (zh) * | 2014-06-20 | 2014-10-08 | 昆山古鳌电子机械有限公司 | 纸张类处理装置 |

| CN105513220B (zh) * | 2015-11-24 | 2018-02-09 | 深圳怡化电脑股份有限公司 | 基于atm机的验钞数据容错处理方法 |

| JPWO2018025308A1 (ja) * | 2016-08-01 | 2019-04-25 | 日立オムロンターミナルソリューションズ株式会社 | 紙幣取扱装置 |

| CN107507327A (zh) * | 2017-08-22 | 2017-12-22 | 昆山古鳌电子机械有限公司 | 一种纸币真伪辨别及处理装置 |

| CN107767528B (zh) * | 2017-11-13 | 2019-12-10 | 深圳怡化电脑股份有限公司 | 一种纸币检验方法、装置、atm机及存储介质 |

| JP7051646B2 (ja) * | 2018-08-31 | 2022-04-11 | 日立チャネルソリューションズ株式会社 | 紙葉類取扱装置、現金自動取引装置、及び現金自動取引システム |

Citations (3)

| Publication number | Priority date | Publication date | Assignee | Title |

|---|---|---|---|---|

| US4442541A (en) * | 1979-08-15 | 1984-04-10 | Gte Laboratories Incorporated | Methods of and apparatus for sensing the denomination of paper currency |

| US20030116478A1 (en) * | 2001-11-05 | 2003-06-26 | Diebold, Incorporated | Automated banking machine currency tracking method |

| EP1471474A1 (fr) * | 2003-04-14 | 2004-10-27 | Hitachi, Ltd. | Système et méthode de traitement de billets de banque |

Family Cites Families (9)

| Publication number | Priority date | Publication date | Assignee | Title |

|---|---|---|---|---|

| JPS6116391A (ja) * | 1984-07-03 | 1986-01-24 | 沖電気工業株式会社 | 自動入金装置 |

| MXPA04003838A (es) * | 2001-11-05 | 2005-02-17 | Diebold Inc Inc | Metodo y sistema de seguimiento de dinero en una maquina bancaria automatizada. |

| JP4102647B2 (ja) * | 2002-11-05 | 2008-06-18 | 日立オムロンターミナルソリューションズ株式会社 | 紙幣類取引装置 |

| JP4166098B2 (ja) * | 2003-02-06 | 2008-10-15 | 日立オムロンターミナルソリューションズ株式会社 | 紙幣取扱装置 |

| KR100735879B1 (ko) | 2003-03-14 | 2007-07-06 | 가부시키가이샤 히타치세이사쿠쇼 | 지엽류 취급장치 |

| JP2004310594A (ja) * | 2003-04-09 | 2004-11-04 | Glory Ltd | 紙葉類処理装置および紙葉類処理システム |

| JP4366104B2 (ja) | 2003-04-17 | 2009-11-18 | 日立オムロンターミナルソリューションズ株式会社 | 紙葉類判別装置 |

| JP4200055B2 (ja) * | 2003-06-12 | 2008-12-24 | 日立オムロンターミナルソリューションズ株式会社 | 紙幣取引システム |

| JP4448398B2 (ja) | 2004-07-20 | 2010-04-07 | 富士通株式会社 | 紙葉類処理装置 |

-

2007

- 2007-05-29 JP JP2007141821A patent/JP5096042B2/ja not_active Expired - Fee Related

-

2008

- 2008-05-23 EP EP08009517A patent/EP2000989A3/fr not_active Withdrawn

- 2008-05-28 KR KR1020080049741A patent/KR100984534B1/ko not_active IP Right Cessation

- 2008-05-29 CN CN2008101087469A patent/CN101339676B/zh active Active

Patent Citations (3)

| Publication number | Priority date | Publication date | Assignee | Title |

|---|---|---|---|---|

| US4442541A (en) * | 1979-08-15 | 1984-04-10 | Gte Laboratories Incorporated | Methods of and apparatus for sensing the denomination of paper currency |

| US20030116478A1 (en) * | 2001-11-05 | 2003-06-26 | Diebold, Incorporated | Automated banking machine currency tracking method |

| EP1471474A1 (fr) * | 2003-04-14 | 2004-10-27 | Hitachi, Ltd. | Système et méthode de traitement de billets de banque |

Also Published As

| Publication number | Publication date |

|---|---|

| JP2008299389A (ja) | 2008-12-11 |

| CN101339676B (zh) | 2011-08-24 |

| KR20080104994A (ko) | 2008-12-03 |

| JP5096042B2 (ja) | 2012-12-12 |

| CN101339676A (zh) | 2009-01-07 |

| KR100984534B1 (ko) | 2010-10-01 |

| EP2000989A3 (fr) | 2009-05-06 |

Similar Documents

| Publication | Publication Date | Title |

|---|---|---|

| EP2000989A2 (fr) | Dispositif de gestion de facture et procédé de pilotage pour un tel dispositif | |

| JP5322901B2 (ja) | 紙幣取扱装置 | |

| JP4166133B2 (ja) | 紙幣取扱装置 | |

| JP5631786B2 (ja) | 紙葉類処理装置、紙葉類仕分け装置及び紙葉類仕分けシステム | |

| JP5439489B2 (ja) | 貨幣処理装置 | |

| JP3878791B2 (ja) | 媒体処理装置 | |

| JP2003281603A (ja) | 紙幣取扱装置 | |

| JP2003346221A (ja) | 紙幣取扱装置およびatm | |

| KR20090097766A (ko) | 지폐 취급 장치 및 지폐 취급 방법 | |

| JP4387372B2 (ja) | 紙幣処理装置 | |

| JP2010272024A (ja) | 自動取引装置 | |

| JP2010267151A (ja) | 紙幣処理装置 | |

| JP2004318335A (ja) | 紙幣取扱装置 | |

| CN102737439A (zh) | 纸张类处理装置 | |

| JP2009104678A (ja) | 現金自動取引装置 | |

| JP5434025B2 (ja) | 現金管理装置 | |

| JPH11272922A (ja) | 自動取引装置及び自動取引方法 | |

| JP4387456B1 (ja) | 現金自動取引装置 | |

| JP5463744B2 (ja) | 券類処理装置及び方法 | |

| JPH08249524A (ja) | 紙幣鑑別および複数枚検知方法 | |

| JP3190884B2 (ja) | 自動取引システム | |

| JP2001307180A (ja) | 貨幣処理装置および貨幣処理システム | |

| WO2019159433A1 (fr) | Dispositif de transaction automatique | |

| JP2020057199A (ja) | 自動取引装置 | |

| JPH1173537A (ja) | 自動取引装置 |

Legal Events

| Date | Code | Title | Description |

|---|---|---|---|

| PUAI | Public reference made under article 153(3) epc to a published international application that has entered the european phase |

Free format text: ORIGINAL CODE: 0009012 |

|

| AK | Designated contracting states |

Kind code of ref document: A2 Designated state(s): AT BE BG CH CY CZ DE DK EE ES FI FR GB GR HR HU IE IS IT LI LT LU LV MC MT NL NO PL PT RO SE SI SK TR |

|

| AX | Request for extension of the european patent |

Extension state: AL BA MK RS |

|

| PUAL | Search report despatched |

Free format text: ORIGINAL CODE: 0009013 |

|

| AK | Designated contracting states |

Kind code of ref document: A3 Designated state(s): AT BE BG CH CY CZ DE DK EE ES FI FR GB GR HR HU IE IS IT LI LT LU LV MC MT NL NO PL PT RO SE SI SK TR |

|

| AX | Request for extension of the european patent |

Extension state: AL BA MK RS |

|

| AKX | Designation fees paid | ||

| STAA | Information on the status of an ep patent application or granted ep patent |

Free format text: STATUS: THE APPLICATION IS DEEMED TO BE WITHDRAWN |

|

| 18D | Application deemed to be withdrawn |

Effective date: 20091107 |

|

| REG | Reference to a national code |

Ref country code: DE Ref legal event code: 8566 |