WO2020218169A1 - Procédé et système de débit et de versement pour diverses valeurs, telles qu'une valeur de monnaie légale, d'argent électronique et autres points - Google Patents

Procédé et système de débit et de versement pour diverses valeurs, telles qu'une valeur de monnaie légale, d'argent électronique et autres points Download PDFInfo

- Publication number

- WO2020218169A1 WO2020218169A1 PCT/JP2020/016770 JP2020016770W WO2020218169A1 WO 2020218169 A1 WO2020218169 A1 WO 2020218169A1 JP 2020016770 W JP2020016770 W JP 2020016770W WO 2020218169 A1 WO2020218169 A1 WO 2020218169A1

- Authority

- WO

- WIPO (PCT)

- Prior art keywords

- user

- card

- terminal

- electronic money

- value

- Prior art date

Links

Images

Classifications

-

- G—PHYSICS

- G06—COMPUTING; CALCULATING OR COUNTING

- G06Q—INFORMATION AND COMMUNICATION TECHNOLOGY [ICT] SPECIALLY ADAPTED FOR ADMINISTRATIVE, COMMERCIAL, FINANCIAL, MANAGERIAL OR SUPERVISORY PURPOSES; SYSTEMS OR METHODS SPECIALLY ADAPTED FOR ADMINISTRATIVE, COMMERCIAL, FINANCIAL, MANAGERIAL OR SUPERVISORY PURPOSES, NOT OTHERWISE PROVIDED FOR

- G06Q20/00—Payment architectures, schemes or protocols

- G06Q20/04—Payment circuits

- G06Q20/06—Private payment circuits, e.g. involving electronic currency used among participants of a common payment scheme

Definitions

- the present invention relates to various value charging methods and systems.

- values intangible assets

- a person purchases a product or service sold by a member store by charging a certain amount of electronic money in advance or immediately and handing it to a member store that is an electronic money user by a predetermined method, and becomes a member.

- the store receives payment of cash, etc. from the electronic money issuer in exchange for electronic money equivalent to the sales proceeds.

- Patent Document 1 As a method of charging electronic money, in addition to charging by cash, there is a charging method linked to an object capable of guaranteeing the solvency of a credit card, a bank account, etc. (for example, Patent Document 1). Further, a method in which a user can select a plurality of charging methods (funding sources) from options is also disclosed (for example, Patent Document 2).

- a provider of a payment medium such as a value payment card such as electronic money or a code capable of payment provides a payment medium to a user such as an individual or a corporation

- the provider provides it in advance. Limited to the charging method, it lacks flexibility.

- an object of the present invention is to provide a more flexible value charging method.

- a value charging method provided by a media provider that provides a payment medium for payment by value when a user purchases a product or service provided by a member store or business owner through value.

- the authority request for the transaction of the product or service is received from the member store or the business owner terminal, the balance of the value of the user is confirmed, and the balance is less than the purchase price of the product or service, the user advances in advance. Charge value from the set funding source.

- FIG. 1 is a block configuration diagram showing a charge system according to the first embodiment of the present invention.

- this embodiment is applied to a value having a certain monetary value such as legal currency value, electronic money and various points, and in addition to a card medium such as a prepaid card, a sheet medium on which a QR code or the like is printed.

- a card medium such as a prepaid card, a sheet medium on which a QR code or the like is printed.

- It can also be applied to payment media provided by various media providers such as electronic media such as Web pages displaying QR codes and virtual media such as Web services and applications, but in the present embodiment, it can be applied.

- a card company terminal 100 which is a terminal of a card company that issues a prepaid card for using electronic money

- a user terminal 200 which is a terminal of a user who uses the card

- It consists of a store terminal 300, which is a terminal of a member store that can use electronic money issued by a card company in exchange for goods or services, and a funding source that is a charging source when the user charges the electronic money.

- the system will be described as an example.

- a card company is a so-called issuer of a credit card or a prepaid card, which issues a card to a user and manages credit, and if it is a prepaid card, manages and uses the balance of the user's electronic money.

- a person uses a prepaid card in exchange for a product at a member store, the transaction is authorized (approved).

- the user can be an individual user or a corporate user, and in the case of a corporation, the corporation issues a card to another corporation as a secondary issuer (partner), and the company provides the card. It is also conceivable to add a function to provide the service. If the user is a corporation and the card company issues the card as a corporate card, the user issues the card to the employee, and the employee accompanies business trips, meetings, entertainment, etc. It is also conceivable to use the card for the purpose of doing so.

- card companies issue prepaid cards, so-called virtual cards, which are displayed via applications installed on mobile terminals such as smartphones, and are called physical cards in response to requests from users. It is also possible to issue a magnetic card or an IC card with a built-in IC chip.

- virtual cards are used for transactions such as online purchases of goods such as online shopping

- physical cards are used for transactions such as purchases of goods or services at physical stores.

- the card company terminal 100, the user terminal 200, the store terminal 300, and the funding source 400 are connected via the network NW.

- the network NW is composed of the Internet, an intranet, a wireless LAN (Local Area Network), a WAN (Wide Area Network), and the like.

- the card company terminal 100 may be, for example, a general-purpose computer such as a workstation or a personal computer, or may be logically realized by cloud computing. In the present embodiment, one card company terminal is illustrated for convenience of explanation, but the present invention is not limited to this, and a plurality of cards may be used.

- the user terminal 200 is, for example, an information processing device such as a personal computer or a tablet terminal, but may be configured by a smartphone, a mobile phone, a PDA, or the like.

- the store terminal 300 is a terminal installed in a member store of the card, and for example, a terminal such as a POS / CCT / CAT installed in a supermarket, a shopping center, a convenience store, or the like can be considered, but it has the same function. Personal computers, smartphones, tablet terminals, etc. with built-in applications are also conceivable. Further, it can be replaced not only with a store but also with a business owner terminal installed by a business owner who conducts business activities.

- the store terminal 300 can be used to perform operations such as payment of credit cards, prepaid cards, and debit cards at member stores. Further, the store terminal 300 is communicably connected to the card company terminal 100 and the terminals of other credit card issuing companies (not shown) via the network NW. It is also conceivable to connect to the card terminal 100 or the like via an international brand card system such as VISA (registered trademark).

- the system 1 is described as having a card company terminal 100, a user terminal 200, a store terminal 300, and a funding source 400, but as described above, the secondary issuer (partner) is the user terminal. Also, in the case where the partner's card user becomes another corporation or individual, the partner is replaced with the card company (card company terminal 100) in this system, and the user of the card issued by the partner. Can be replaced with the user (user terminal 200) in this system. If the partner is replaced by a credit card company, it is possible to use the API (Application Programming Interface) of the original credit card company.

- API Application Programming Interface

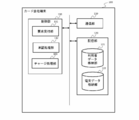

- FIG. 2 is a functional block configuration diagram of the card company terminal 100 of FIG.

- the credit card company terminal 100 includes a communication unit 110, a storage unit 120, and a control unit 130.

- the communication unit 110 is a communication interface for communicating with the user terminal 200 and the store terminal 300 via the network NW, and the communication is performed according to a communication protocol such as TCP / IP (Transmission Control Protocol / Internet Protocol). ..

- the storage unit 120 stores programs for executing various control processes and each function in the control unit 130, input data, and the like, and is composed of a RAM (RandomAccessMemory), a ROM (ReadOnlyMemory), and the like.

- the storage unit 120 is a member of the user data storage unit 121, which stores various data necessary for authorization (approval) of transactions and charging of electronic money when a card user purchases a product or service at a member store. It has a message data storage unit 122 and the like for storing data related to the authority message received from the store. Further, the storage unit 120 can temporarily store the data that has communicated with the user terminal 200 and the store terminal 300.

- a database (not shown) storing various data may be constructed outside the storage unit 120.

- the control unit 130 controls the entire operation of the card company terminal 100 by executing a program stored in the storage unit 120, and is used from a CPU (Central Processing Unit), a GPU (Graphics Processing Unit), or the like. It is composed.

- the functions of the control unit 130 are related to the request reception unit 131 that receives instructions from the user terminal 200 or the store terminal 300, the approval processing unit 132 that processes the authorization request for approval, and the charging of electronic money. It has a charge processing unit 133 and a charge processing unit 133.

- the request receiving unit 131, the approval processing unit 132, and the charge processing unit 133 are activated by a program stored in the storage unit 120 and executed by the card company terminal 100 which is a computer (electronic computer).

- the request receiving unit 131 for example, in a user interface displayed via an application installed on the user terminal 200, allows the user to register user information or issue a virtual or physical prepaid card, for example.

- the request is received from the user terminal 200 via the communication unit 110.

- the communication unit 110 For example, when a user purchases a product or service using a card at a member store, reads a magnetic card with a reader of a store terminal 300, and sends an authority message to make an authority request. , The request is received from the store terminal 300 via the communication unit 110.

- the approval processing unit 132 When the approval processing unit 132 receives an authorization request for a specific transaction from the store terminal 300, the approval processing unit 132 performs a predetermined process for approving the transaction.

- the charge process 133 performs the charge process of the user's electronic money by a request from the user terminal 200 or by an automatic process.

- FIG. 3 is a functional block configuration diagram showing the user terminal 200 of FIG.

- the user terminal 200 includes a communication unit 210, a display operation unit 220, a storage unit 230, and a control unit 240.

- the communication unit 210 is a communication interface for communicating with the card company terminal 100 via the network NW, and communication is performed according to a communication convention such as TCP / IP.

- the display operation unit 220 is a user interface used for the user to input an instruction and display text, an image, etc. according to the input data from the control unit 240, and the user terminal 200 is composed of a personal computer. If the user terminal 200 is composed of a tablet terminal, it is composed of a display, a keyboard, a mouse, and the like.

- the display operation unit 220 is activated by a control program such as an application program stored in the storage unit 230 and executed by the user terminal 200 which is a computer (electronic computer).

- the storage unit 230 stores various control processes, programs for executing each function in the control unit 240, input data, and the like, and is composed of a RAM, a ROM, and the like. In addition, the storage unit 230 temporarily stores the communication content with the card company terminal 100.

- the control unit 240 controls the entire operation of the user terminal 200 by executing the program stored in the storage unit 230, and is composed of a CPU, a GPU, and the like.

- the card company terminal 100 may have all or part of the functions of a control program such as an application program stored in the user terminal 200.

- FIG. 4 is a functional block configuration diagram showing the store terminal 300 of FIG.

- the store terminal 300 includes a communication unit 310, a display operation unit 320, a storage unit 330, a reader 340, and a control unit 350.

- the communication unit 310 is a communication interface for communicating with a card company terminal 100 (in the case of passing through an international brand card system, with an international brand card system (not shown)) via a network NW, for example, TCP. Communication is performed according to communication rules such as / IP.

- the display operation unit 320 is a user interface used for the store staff to input an instruction and display text, an image, etc. according to the input data from the control unit 350, and the store terminal 300 is a POS / CCT /. If it is a CAT terminal, it is composed of a display and buttons, a pointing device, a keyboard, etc., if it is composed of a personal computer, it is composed of a display, a keyboard, a mouse, etc., and if the store terminal 300 is composed of a tablet terminal. Is composed of a touch panel and the like. Further, the display operation unit 220 is activated by a control program such as an application program stored in the storage unit 230 and executed by the user terminal 200 which is a computer (electronic computer).

- a control program such as an application program stored in the storage unit 230 and executed by the user terminal 200 which is a computer (electronic computer).

- the storage unit 330 stores various control processes, programs for executing each function in the control unit 350, input data, and the like, and is composed of a RAM, a ROM, and the like. In addition, the storage unit 230 temporarily stores the communication content with the card company terminal 100.

- the reader 340 is a reader 114 composed of devices such as a magnetic card reader, a barcode reader, and an IC chip reader, and can read information on prepaid cards, credit cards, debit cards, and the like.

- the control unit 350 controls the overall operation of the store terminal 300 by executing the program stored in the storage unit 330, and is composed of a CPU, a GPU, and the like.

- FIG. 5 is a schematic diagram showing an example of user data stored in the server 100.

- the user data 1000 shown in FIG. 5 stores various data related to the user who uses the prepaid card.

- an example of one user (user specified by the user ID “10001”) is shown, but information of a plurality of users can be stored.

- Various data related to the user for example, the user's registration information (in the case of a corporation, the corporate name, representative name, address and contact information, etc., in the case of an individual or employee, the name, date of birth, gender, etc. , Address and contact information (phone number, e-mail address, etc.), and in the case of employees, employee ID and department, etc.), and card information (for example, card number (PAN), card member name).

- PAN card number

- EXP Expiration date

- PIN personal identification number

- CAV / CVC2 / CVV2 / CID security code

- track data etc.

- credit-related information for example, electronic money balance, usage limit, etc.

- user funding source information credit card information, debit card information, bank account information, virtual currency account information, and carrier payment information. Etc.

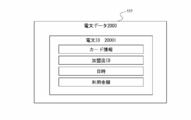

- FIG. 6 is a schematic diagram showing an example of telegram data stored in the server 100.

- the telegram data 2000 shown in FIG. 6 stores various data stored in the authority telegram.

- Various data related to the authority telegram include, for example, information such as card information used at the member store, member store ID, date and time of use, and amount of money used.

- FIG. 7 is an example of a flowchart relating to the charging method according to the first embodiment of the present invention.

- a user in order to issue a prepaid card, a user installs an application on his / her own user terminal 200, starts the application, registers registration information in the provided user interface, and performs the card. Make a request to issue.

- a prepaid card called a virtual card, which is displayed through an application installed on the user terminal 200 by the user, and / or a magnetic card, which is called a physical card and has predetermined card information printed on plastic, or

- An IC card with a built-in IC chip can be issued.

- the user uses the application in advance to charge desired funding source information (for example, credit card information, debit card information, bank account information, virtual currency account information, and carrier payment information) for charging electronic money.

- desired funding source information for example, credit card information, debit card information, bank account information, virtual currency account information, and carrier payment information

- Etc. can be set and electronic money equivalent to a predetermined amount can be charged in advance. It is also possible to charge with cash using an ATM installed in a store such as a convenience store.

- a predetermined amount for example, 50,000 yen

- the charge in a predetermined amount unit for example, 1000 yen, 5000 yen, 10000 yen unit

- the user terminal 200 uses a prepaid card to purchase a product or service at a member store.

- a prepaid card to purchase a product or service at a member store.

- the user when the user purchases a product or service at a physical store, the user presents a real prepaid card to the person in charge of the store.

- information about the virtual card is input to the purchase screen of the online store.

- the store terminal 300 of the member store performs a payment operation of the product or service, and transmits an authorization request for the transaction of the product or service to the card company terminal 100.

- the store terminal 300 receives a purchase request for a product or service from the user terminal 200 via a network and performs payment processing.

- the store terminal 300 causes a terminal such as POS / CCT / CAT to read the prepaid card and perform payment processing.

- the store terminal 300 transmits the authority message and the sales data to the card company terminal 100 as an authority request.

- the information included in the authority message for example, the information shown in FIG.

- a message generated as a message based on the ISO8583 standard is transmitted, or a message generated by the ISO8583 standard is converted into another given format (for example, JSON format) and transmitted. Is possible.

- the approval processing unit 132 confirms the balance of the electronic money with respect to the usage amount of the user.

- the card company terminal 100 searches for a user ID based on the card number, and refers to the balance of electronic money of the target user in the user data 1000 shown in FIG.

- the approval processing unit 132 of the card company terminal 100 approves the transaction if the balance of the user's electronic money is equal to or exceeds the usage amount. (If the balance of the user's electronic money is less than the usage amount, the process proceeds to SQ106)

- the communication unit 110 of the card company terminal 100 transmits a transaction approval response to the store terminal 300.

- the charge processing unit 133 of the card company terminal 100 confirms the registration information in the user data 1000 shown in FIG. 5 as the processing of the SQ106. And check the funding source of the user.

- the funding sources registered by the individual or legal entity include, but are limited to, for example, credit cards, debit cards, bank accounts, cryptocurrency accounts and carrier payments. Not possible).

- the user is a partner company as a secondary company, check the funding source registered by that company.

- the user is linked to a cost-bearing department in a corporate company, identify that department and check the funding source registered by that department.

- the charge processing unit 133 of the card company terminal 100 charges electronic money equivalent to a predetermined amount from the funding source according to the funding source of the user.

- the charge amount electronic money corresponding to the shortage amount with respect to the usage amount can be charged, or electronic money equivalent to the amount preset by the card company or the user can be charged.

- the charge processing unit 133 converts, for example, the shortage of cash into electronic money from the bank account. Convert and increase the amount of electronic money.

- the charge processing unit 133 performs a process of increasing the electronic money from the funding source set in the sales department.

- the approval processing unit 132 of the card company terminal 100 confirms that the balance of the user's electronic money is equal to or greater than the usage amount, approves the transaction, and processes SQ109.

- the communication unit 110 of the card company terminal 100 transmits a transaction approval response to the store terminal 300.

- the card company can provide a flexible electronic money charging method based on the funding source set by the card user.

- a card company issues a card to a corporate company such as a partner company

- the corporate company including the partner company has a need to utilize its own funding source as a charge resource, and this embodiment According to the charging method of, it is possible to flexibly meet such needs.

- FIG. 8 is a modified example of the flowchart relating to the charging method according to the first embodiment of the present invention.

- This modification has the same basic part as the charging method shown in FIG. 7, but in particular, the card user is a corporation, and the corporation sets the funding source according to the business use. It is an electronic money charging method that can be applied in such cases.

- the user terminal 200 uses a prepaid card to purchase a product or service at a member store.

- a prepaid card to purchase a product or service at a member store.

- the user presents a real prepaid card to the person in charge of the store.

- information about the virtual card is input to the purchase screen of the online store.

- the store terminal 300 of the member store performs a payment operation of the product or service, and transmits an authorization request for the transaction of the product or service to the card company terminal 100.

- the store terminal 300 receives a purchase request for a product or service from the user terminal 200 via a network and performs payment processing.

- the store terminal 300 causes a terminal such as POS / CCT / CAT to read the prepaid card and perform payment processing.

- the store terminal 300 transmits the authority message and the sales data to the card company terminal 100 as an authority request.

- the information included in the authority message for example, the information shown in FIG.

- a message generated as a message based on the ISO8583 standard is transmitted, or a message generated by the ISO8583 standard is converted into another given format (for example, JSON format) and transmitted. Is possible.

- the approval processing unit 132 confirms the balance of the electronic money with respect to the usage amount of the user.

- the card company terminal 100 searches for a user ID based on the card number, and refers to the balance of electronic money of the target user in the user data 1000 shown in FIG.

- the approval processing unit 132 of the card company terminal 100 approves the transaction if the balance of the user's electronic money is equal to or exceeds the usage amount. (If the balance of the user's electronic money is less than the usage amount, the process proceeds to SQ206)

- the communication unit 110 of the card company terminal 100 transmits a transaction approval response to the store terminal 300.

- the charge processing unit 133 of the card company terminal 100 uses the information of the telegram data 2000 shown in FIG. 6 for the business use of the transaction. And check the funding source according to the application. For example, the attribute of the store (for example, restaurant, hotel, taxi, etc.) is confirmed from the member store ID of the telegram data 2000, and if the attribute is a restaurant, the business use is determined as entertainment expenses. Then, the funding source (including, but not limited to, credit card, debit card, bank account, virtual currency account and carrier payment) according to the business use is specified.

- the charge processing unit 133 of the card company terminal 100 charges electronic money equivalent to a predetermined amount from the funding source according to the funding source for business use.

- the charge amount electronic money corresponding to the shortage amount with respect to the usage amount can be charged, or electronic money equivalent to the amount preset by the card company or the user can be charged.

- the charge processing unit 133 converts, for example, the shortage of cash into electronic money from the bank account and increases the electronic money. Perform the processing.

- the approval processing unit 132 of the card company terminal 100 confirms that the balance of the user's electronic money is equal to or greater than the usage amount, approves the transaction, and processes SQ109.

- the communication unit 110 of the card company terminal 100 transmits a transaction approval response to the store terminal 300.

- the card company can provide a flexible electronic money charging method based on the funding source set according to the business use of the user.

- this modification can be applied not only to corporate enterprises but also to sole proprietors and individual card users.

- FIG. 9 is an example of a flowchart relating to the charging method according to the second embodiment of the present invention.

- This embodiment is a method of charging value such as electronic money, which can be applied when an individual or a corporation serving as a card user wants to set a plurality of funding sources.

- the basic system configuration is the same as the configuration of the first embodiment shown in FIG. 1, and the basic processing in the card company terminal 100 is the first embodiment shown in FIG. 7. Since it is the same as the process related to the form, the description of the process other than the process of charging the electronic money from the funding source will be omitted.

- the charge processing unit 133 of the card company terminal 100 performs the first funding source (for example, , Bank account) to make a charge request.

- the user can register a plurality of funding sources as charging sources in advance, and can set the funding sources for preferentially performing charging.

- the terminal that manages the first funding source accepts the request from the card company terminal 100 and confirms the user's account balance.

- the card company terminal 100 can also confirm the balance by acquiring the user's balance information from the first funding source. Further, when the card company terminal 100 determines the amount in advance (such as the shortage amount or the set amount) and requests the first funding source to charge the electronic money equivalent to the amount, this step is omitted. You can also do it.

- the charge processing unit 133 of the card company terminal 100 charges the electronic money from the first funding source.

- the first funding source is a bank account

- a predetermined amount of cash is converted into electronic money and charged.

- the charge amount electronic money corresponding to the shortage amount with respect to the usage amount can be charged, or electronic money equivalent to the amount preset by the card company or the user can be charged.

- the card company terminal 100 ends the charge processing.

- the charge processing unit 133 of the card company terminal 100 performs the second as the processing of the SQ304.

- the funding source for example, credit card

- the user can set the order of requesting charge from which source for a plurality of funding sources.

- the terminal that manages the second funding source accepts the request from the card company terminal 100 and confirms the user's account balance.

- the card company terminal 100 can also confirm the balance by acquiring the user's balance information from the second funding source.

- the credit card company terminal confirms the available amount of the user as a balance confirmation.

- the card company terminal 100 determines the amount in advance (such as the shortage amount or the set amount) and requests the second funding source to charge the electronic money equivalent to the amount, this step is omitted. You can also do it.

- the charge processing unit 133 of the card company terminal 100 charges the electronic money from the second funding source.

- the charge processing unit 133 of the card company terminal 100 charges electronic money equivalent to a predetermined amount and transmits the amount information to the credit card company terminal.

- the charge amount electronic money corresponding to the shortage amount with respect to the usage amount can be charged, or electronic money equivalent to the amount preset by the card company or the user can be charged.

- the card company terminal 100 ends the charge processing. If the balance of electronic money for the usage amount is insufficient, or if another funding source is set, the card company terminal 100 makes a charge request to the funding source or makes a transaction. Send a notification of non-approval to the store terminal.

- the card company can provide the user with a more flexible method of charging electronic money.

- FIG. 10 is an example of a flowchart relating to the charging method according to the third embodiment of the present invention.

- This embodiment is another example of a value charging method such as electronic money that can be applied when an individual or a corporation serving as a card user wants to set a plurality of funding sources.

- the basic system configuration is the same as the configuration of the first embodiment shown in FIG. 1, and the basic processing in the card company terminal 100 is the first embodiment shown in FIG. 7. Since it is the same as the process related to the form, the description of the process other than the process of charging the electronic money from the funding source will be omitted.

- the charge processing unit 133 of the card company terminal 100 has a plurality of preset fans.

- a first funding source for example, a bank account

- a second funding source for example, another bank account

- the funding source is also set.

- the amount to be charged from the first funding source and the amount to be charged from the second funding source are determined based on a certain ratio or other criteria, and the total of the charging amounts from both funding sources is It can be decided that the amount will be the same as or greater than the shortfall amount.

- the charge processing unit 133 of the card company terminal 100 makes a charge request to the first funding source (for example, a bank account).

- the first funding source for example, a bank account

- the charge processing unit 133 of the card company terminal 100 charges the electronic money from the first funding source.

- the first funding source is a bank account

- a predetermined amount of cash is converted into electronic money and charged.

- the charge amount it is possible to charge a certain percentage (for example, equivalent to 600 yen) of the electronic money (for example, equivalent to 1000 yen) corresponding to the shortage amount with respect to the usage amount.

- the charge processing unit 133 of the card company terminal 100 makes a charge request to the second funding source (for example, another bank account).

- the second funding source for example, another bank account

- the charge processing unit 133 of the card company terminal 100 charges the electronic money from the second funding source.

- the second funding source is a bank account

- a predetermined amount of cash is converted into electronic money and charged.

- the charge amount a certain percentage (for example, equivalent to 400 yen) of the electronic money equivalent to the shortage amount with respect to the usage amount (for example, equivalent to 1000 yen) can be charged.

- the sum of the charge amount from the first funding source and the charge amount from the second funding source is the same as the shortage amount, and the card company terminal 100 can approve the transaction. ..

- the card company can provide the user with a more flexible method of charging electronic money through the cooperation of a plurality of funding sources.

- FIG. 11 is an example of a flowchart relating to the charging method according to the third embodiment of the present invention.

- This embodiment is still another example of a method of charging value such as electronic money, which can be applied when an individual or a corporation serving as a card user wants to set a plurality of funding sources.

- the basic system configuration is the same as the configuration of the first embodiment shown in FIG. 1, and the basic processing in the card company terminal 100 is the first embodiment shown in FIG. 7. Since it is the same as the process related to the form, the description of the process other than the process of charging the electronic money from the funding source will be omitted.

- the charge processing unit 133 of the card company terminal 100 has a plurality of preset fans. Inquire about the credit score of the user from the first funding source (for example, social network system) that is accessed first among the funding sources.

- the first funding source for example, social network system

- the first funding source calculates the credit score by referring to the attribute information of the user and the action history on the social network.

- a social network system confirms the profile information of the user and calculates the credit score of the user based on a predetermined standard.

- a social network system may include profile information of its users (eg, work, age, number of friends, etc.) and / or user actions (eg, the number of likes received for a post, posts.

- the credit score is calculated based on the number of comments received.

- Various distribution of scores can be considered. For example, the higher the input content of the profile, the higher the score can be set, or the score can be assigned for each predetermined action and the score can be integrated according to the number of actions.

- the social network system transmits the calculated credit score to the card company terminal 100.

- the social network system transmits the calculated credit score (for example, 90 points) to the card company terminal 100.

- the charge processing unit 133 of the card company terminal 100 transmits the credit score of the user to the second funding source (for example, a credit card).

- the charge processing unit 133 can transmit information necessary for credit such as the amount of goods or services purchased by the user in the form of an authorization message or the like.

- the second funding source (for example, a credit card company terminal) refers to the received user's credit score and / or confirms other credit information.

- the credit information includes, for example, the usage limit of the user's credit card, usage history, and the like.

- the second funding source provides credit to the card company terminal 100 based on the result of credit confirmation. If the second funding source is a credit card, purchase a T-shirt for, for example, 500 yen, based on the user's credit score (eg, 90 points) and / or other credit information. A notification to the effect of permission is given to the card company terminal 100.

- the second funding source is a credit card

- purchase a T-shirt for, for example, 500 yen based on the user's credit score (eg, 90 points) and / or other credit information.

- a notification to the effect of permission is given to the card company terminal 100.

- the card company can provide a more flexible method of charging electronic money by providing credit through the cooperation of a plurality of funding sources.

- the application of the first to fourth embodiments is not limited to the charging method for the prepaid card for using electronic money, and the value having a certain monetary value including legal currency value and various points.

- payment media provided by media providers, such as sheet media printed with QR codes, electronic media such as Web pages displaying QR codes, virtual media such as Web services and apps, etc. Can also be applied.

- the application of the first to fourth embodiments is not limited to the charging method for the value having monetary value, but can also be applied to the deposit method by remittance from the value held by another user.

Abstract

La présente invention concerne un procédé de débit plus souple. Selon l'invention, un procédé de débit d'argent électronique fourni par un émetteur de carte qui délivre une carte prépayée pour un paiement électronique, consiste : à recevoir d'un terminal de magasin membre, lorsqu'un utilisateur achète un produit ou un service fourni par un magasin membre par l'intermédiaire d'argent électronique, une demande d'autorisation pour la transaction du produit ou du service ; à confirmer le solde d'argent électronique que l'utilisateur possède ; et à débiter de l'argent électronique provenant d'une source de financement prédéfinie par l'utilisateur lorsque le solde est inférieur au montant d'achat du produit ou du service.

Applications Claiming Priority (2)

| Application Number | Priority Date | Filing Date | Title |

|---|---|---|---|

| JP2019-081473 | 2019-04-23 | ||

| JP2019081473A JP7421741B2 (ja) | 2019-04-23 | 2019-04-23 | 法定通貨バリュー、電子マネー、その他ポイント等の各種バリューのチャージ、入金方法及びシステム |

Publications (1)

| Publication Number | Publication Date |

|---|---|

| WO2020218169A1 true WO2020218169A1 (fr) | 2020-10-29 |

Family

ID=72936685

Family Applications (1)

| Application Number | Title | Priority Date | Filing Date |

|---|---|---|---|

| PCT/JP2020/016770 WO2020218169A1 (fr) | 2019-04-23 | 2020-04-16 | Procédé et système de débit et de versement pour diverses valeurs, telles qu'une valeur de monnaie légale, d'argent électronique et autres points |

Country Status (2)

| Country | Link |

|---|---|

| JP (2) | JP7421741B2 (fr) |

| WO (1) | WO2020218169A1 (fr) |

Cited By (1)

| Publication number | Priority date | Publication date | Assignee | Title |

|---|---|---|---|---|

| JP7134325B1 (ja) | 2021-12-23 | 2022-09-09 | PayPay株式会社 | 電子決済システム、決済管理装置、カード、電子決済方法、およびプログラム |

Citations (5)

| Publication number | Priority date | Publication date | Assignee | Title |

|---|---|---|---|---|

| JP2010061509A (ja) * | 2008-09-05 | 2010-03-18 | Fuji Electric Retail Systems Co Ltd | 電子マネー決済端末の決済方法 |

| JP2012178105A (ja) * | 2011-02-28 | 2012-09-13 | Rakuten Edy Inc | 情報処理プログラム、情報処理方法、及び携帯端末 |

| JP2015038692A (ja) * | 2013-08-19 | 2015-02-26 | 楽天株式会社 | 受付装置、受付装置の制御方法、及びプログラム |

| JP2016071655A (ja) * | 2014-09-30 | 2016-05-09 | Kddi株式会社 | 電子通貨管理装置、電子通貨管理方法及び電子通貨管理システム |

| JP2017037594A (ja) * | 2015-08-14 | 2017-02-16 | エヌ・ティ・ティ・コムウェア株式会社 | 決済処理装置、決済システム、決済処理方法、及びプログラム |

Family Cites Families (2)

| Publication number | Priority date | Publication date | Assignee | Title |

|---|---|---|---|---|

| JP5852218B1 (ja) * | 2014-12-19 | 2016-02-03 | ヤフー株式会社 | 生成装置、生成方法及び生成プログラム |

| CN106991565A (zh) * | 2017-01-03 | 2017-07-28 | 阿里巴巴集团控股有限公司 | 一种货币类型的切换方法及装置 |

-

2019

- 2019-04-23 JP JP2019081473A patent/JP7421741B2/ja active Active

-

2020

- 2020-04-16 WO PCT/JP2020/016770 patent/WO2020218169A1/fr active Application Filing

-

2023

- 2023-12-28 JP JP2023223561A patent/JP2024029164A/ja active Pending

Patent Citations (5)

| Publication number | Priority date | Publication date | Assignee | Title |

|---|---|---|---|---|

| JP2010061509A (ja) * | 2008-09-05 | 2010-03-18 | Fuji Electric Retail Systems Co Ltd | 電子マネー決済端末の決済方法 |

| JP2012178105A (ja) * | 2011-02-28 | 2012-09-13 | Rakuten Edy Inc | 情報処理プログラム、情報処理方法、及び携帯端末 |

| JP2015038692A (ja) * | 2013-08-19 | 2015-02-26 | 楽天株式会社 | 受付装置、受付装置の制御方法、及びプログラム |

| JP2016071655A (ja) * | 2014-09-30 | 2016-05-09 | Kddi株式会社 | 電子通貨管理装置、電子通貨管理方法及び電子通貨管理システム |

| JP2017037594A (ja) * | 2015-08-14 | 2017-02-16 | エヌ・ティ・ティ・コムウェア株式会社 | 決済処理装置、決済システム、決済処理方法、及びプログラム |

Cited By (2)

| Publication number | Priority date | Publication date | Assignee | Title |

|---|---|---|---|---|

| JP7134325B1 (ja) | 2021-12-23 | 2022-09-09 | PayPay株式会社 | 電子決済システム、決済管理装置、カード、電子決済方法、およびプログラム |

| JP2023094452A (ja) * | 2021-12-23 | 2023-07-05 | PayPay株式会社 | 電子決済システム、決済管理装置、カード、電子決済方法、およびプログラム |

Also Published As

| Publication number | Publication date |

|---|---|

| JP2020177597A (ja) | 2020-10-29 |

| JP2024029164A (ja) | 2024-03-05 |

| JP7421741B2 (ja) | 2024-01-25 |

Similar Documents

| Publication | Publication Date | Title |

|---|---|---|

| US11049125B2 (en) | Payment account processing which conveys financial transaction data and non-financial transaction data | |

| AU2019200882B2 (en) | System and method of registering stored-value cards into electronic wallets | |

| US11093919B2 (en) | Merchant-consumer bridging platform apparatuses, methods and systems | |

| US20220270078A1 (en) | Method and system for reloading prepaid card | |

| US10546287B2 (en) | Closed system processing connection | |

| US8864023B2 (en) | Automated submission of prepaid programs | |

| AU2021261960A1 (en) | System and method for providing a security code | |

| KR20190041539A (ko) | 전자 지갑을 통한 결제 시스템 | |

| WO2018193280A1 (fr) | Système de paiement à base de points | |

| JP2018014106A (ja) | 取引記録との関連付けのための取引額の識別 | |

| JP2024029164A (ja) | 法定通貨バリュー、電子マネー、その他ポイント等の各種バリューのチャージ、入金方法及びシステム | |

| WO2017135282A1 (fr) | Dispositif de traitement de pension financée, procédé et programme informatique | |

| CA2912066C (fr) | Systeme et methode de recharge de cartes prepayees | |

| KR20180089136A (ko) | 가상결제정보를 이용한 전자 거래 방법 및 시스템 | |

| WO2021015217A1 (fr) | Procédé et système de validation de support de règlement | |

| KR100897498B1 (ko) | 유비쿼터스 환경에서의 통합형 금융 서비스 시스템 | |

| US20200265454A1 (en) | Incentive processing device, incentive processing method, incentive processing system, and computer program thereof | |

| US20140222638A1 (en) | System and Method for Merchant Transfer of a Forward-Sold Good Contract | |

| AU2014200145B2 (en) | Payment account processing which conveys financial transaction data and non-financial transaction data | |

| JP2018060577A (ja) | 積立年金処理装置、方法、及びコンピュータプログラム | |

| NZ787204A (en) | Points based payment system |

Legal Events

| Date | Code | Title | Description |

|---|---|---|---|

| 121 | Ep: the epo has been informed by wipo that ep was designated in this application |

Ref document number: 20795969 Country of ref document: EP Kind code of ref document: A1 |

|

| NENP | Non-entry into the national phase |

Ref country code: DE |

|

| 122 | Ep: pct application non-entry in european phase |

Ref document number: 20795969 Country of ref document: EP Kind code of ref document: A1 |