EP1531432B1 - Automatic teller machine - Google Patents

Automatic teller machine Download PDFInfo

- Publication number

- EP1531432B1 EP1531432B1 EP04026559A EP04026559A EP1531432B1 EP 1531432 B1 EP1531432 B1 EP 1531432B1 EP 04026559 A EP04026559 A EP 04026559A EP 04026559 A EP04026559 A EP 04026559A EP 1531432 B1 EP1531432 B1 EP 1531432B1

- Authority

- EP

- European Patent Office

- Prior art keywords

- notes

- note

- unit

- input

- user

- Prior art date

- Legal status (The legal status is an assumption and is not a legal conclusion. Google has not performed a legal analysis and makes no representation as to the accuracy of the status listed.)

- Expired - Fee Related

Links

Images

Classifications

-

- G—PHYSICS

- G07—CHECKING-DEVICES

- G07D—HANDLING OF COINS OR VALUABLE PAPERS, e.g. TESTING, SORTING BY DENOMINATIONS, COUNTING, DISPENSING, CHANGING OR DEPOSITING

- G07D13/00—Handling of coins or of valuable papers, characterised by a combination of mechanisms not covered by a single one of groups G07D1/00 - G07D11/00

-

- G—PHYSICS

- G07—CHECKING-DEVICES

- G07D—HANDLING OF COINS OR VALUABLE PAPERS, e.g. TESTING, SORTING BY DENOMINATIONS, COUNTING, DISPENSING, CHANGING OR DEPOSITING

- G07D11/00—Devices accepting coins; Devices accepting, dispensing, sorting or counting valuable papers

- G07D11/0087—Banknote changing devices

-

- G—PHYSICS

- G07—CHECKING-DEVICES

- G07D—HANDLING OF COINS OR VALUABLE PAPERS, e.g. TESTING, SORTING BY DENOMINATIONS, COUNTING, DISPENSING, CHANGING OR DEPOSITING

- G07D11/00—Devices accepting coins; Devices accepting, dispensing, sorting or counting valuable papers

- G07D11/20—Controlling or monitoring the operation of devices; Data handling

- G07D11/22—Means for sensing or detection

-

- G—PHYSICS

- G07—CHECKING-DEVICES

- G07D—HANDLING OF COINS OR VALUABLE PAPERS, e.g. TESTING, SORTING BY DENOMINATIONS, COUNTING, DISPENSING, CHANGING OR DEPOSITING

- G07D9/00—Counting coins; Handling of coins not provided for in the other groups of this subclass

-

- G—PHYSICS

- G07—CHECKING-DEVICES

- G07F—COIN-FREED OR LIKE APPARATUS

- G07F19/00—Complete banking systems; Coded card-freed arrangements adapted for dispensing or receiving monies or the like and posting such transactions to existing accounts, e.g. automatic teller machines

- G07F19/20—Automatic teller machines [ATMs]

-

- G—PHYSICS

- G07—CHECKING-DEVICES

- G07F—COIN-FREED OR LIKE APPARATUS

- G07F19/00—Complete banking systems; Coded card-freed arrangements adapted for dispensing or receiving monies or the like and posting such transactions to existing accounts, e.g. automatic teller machines

- G07F19/20—Automatic teller machines [ATMs]

- G07F19/203—Dispensing operations within ATMs

Definitions

- This invention relates to an automatic teller machine, and more particularly to an automatic teller machine which has a function of exchanging spoiled notes for unspoiled notes, an automatic teller method, and an automatic teller program.

- GB-A-2 247 097 discloses a bank note processing apparatus including a mechanism for counting and verifying bank notes.

- the two-part form of present claims 1 and 2 has been based on this document.

- JP-A-09 062 895 discloses a money transaction device which can pay out new and circulating bank notes and is also able to exchange money input by a user.

- EP-A-0 871 149 discloses a self-service deposit apparatus including means for identifying the user.

- This invention has been made in light of the aforementioned problems, and it is therefore an object of this invention to provide an automatic teller machine and an automatic teller method which enable exchanging of spoiled notes for unspoiled notes (mint notes) in note transaction (withdrawal).

- the automatic teller machine includes a note input/output unit, a control unit for controlling each unit, a memory, a note housing unit for housing notes, and an input unit for accepting user's operation, allows withdrawal of a sum of notes according to an input from the user, accepts a redeposit of at least a part of the notes withdrawn before completion of a transaction, and allows withdrawal of a sum equivalent to the redeposited notes from the notes housed in the housing unit and determined to be mint notes.

- note exchanging can be executed by a series of note input/output transactions

- the user can exchange spoiled notes for unspoiled notes (mint notes) without going to the other device or stopping the transaction, and usability can be improved for the user.

- FIG. 1 is a block diagram showing a constitution of an automatic teller machine according to a first illustrative example.

- a note input/output unit 101 is a unit that notes are put in and withdrawn from thereof.

- the note input/output unit 101 includes a note deposit opening and a note withdrawal opening, passes notes which is put into the note deposit opening to a conveying device 141, and allows withdrawal of the notes conveyed by the conveying device 141 to the outside of the automatic teller machine.

- a note separator 102 separates the notes put into the note input/output unit 101, and passes the notes one by one to a note validator 103.

- the note validator 103 is a unit which validates fitness or classify counterfeit/ genuine notes. Fitness means quality of a note. And validating fitness means checking whether the note has good quality to be used in the market or not.

- the note validator 103 includes a main memory 104 and a sensor 105, detects a deposited/withdrawn note by the sensor 105, and collates the note with a pattern previously stored in the main memory 104 to check fitness or classify counterfeit/genuine thereof.

- a control unit 106 includes a CPU (not shown) and a main memory 107.

- An auxiliary memory 108 consists of a large-capacity memory such as a hard disk drive, and stores programs for controlling the note input/output unit 101, note housing units (120 to 124), the note validator 103 and the like to carry out note transactions.

- a temporary stacker 110 temporarily houses notes put into the note input/output unit 101.

- Note recycling boxes 120, 121 are notes housing devices for put in and withdrawing notes, and housing notes withdrawn from the note input/output unit 101.

- the note recycling boxes 120,121 also house notes suited to withdrawal among the notes put into the note input/output unit 101.

- a note box 122 for spoiled notes houses much degraded notes.

- Note boxes 123, 124 for counterfeit notes house notes determined to be counterfeit by the note validator 103. Notes may be housed in different boxes for counterfeit notes depending on suspicions of counterfeit notes (apparent counterfeit notes, notes suspected to be counterfeit).

- the note conveying device 141 includes a belt, a roller and the like. An arrow of the conveying device 141 indicates a note conveying direction.

- a card input/output unit 202, a bankbook input/output unit 203, and a display and input device (e.g., touch panel type liquid crystal display device) 204 are connected to the control unit 106.

- a display and input device e.g., touch panel type liquid crystal display device

- a user of the automatic teller machine puts a card into the card input/output unit 202.

- the user puts a bankbook into the bankbook input/output unit 203 when necessary.

- the user starts a transaction according to contents displayed in the display and input device 204.

- the notes put into the note input/output unit 101 are separated one by one by the note separator 102, and sent one by one to the note validator 103 by the conveying device 141.

- the notes are sent to the note recycling boxes 120, 121, the note box 122 for spoiled notes, or the note boxes 123, 124 for counterfeit notes, and housed therein.

- Notes withdrawn by an operation of the user are sent out from the note recycling boxes 120, 121 to the note validator 103 by the conveying device 141. Then the notes are subjected to check fitness and to classify into the notes counterfeit/ genuine thereof and the like by the note validator 103.

- the notes housed in the note input/output unit 101 are withdrawn by opening its cover.

- FIGS. 2A and 2B are appearance diagrams of the automatic teller machine according to the first example.

- FIG. 2A shows an appearance of the automatic teller machine

- FIG. 2B shows a screen example displayed in the display and input device 204 of the automatic teller machine.

- An automatic teller machine 201 includes the card input/output unit 202, the bankbook input/output unit 203, the display and input device 204, a card box 206, a banknote box 207, and the like.

- a card inserted into the card input/output unit 202 is housed in the card box 206, and information recorded in a magnetic stripe, an IC chip or the like of the card is obtained.

- a bankbook inserted into the bankbook input/ output unit 203 is housed in the bankbook box 207, and information recorded in a magnetic stripe, an IC chip or the like of the bankbook is obtained.

- the display and input device 204 is, for example, a touch panel type LCD ( Liquid Crystal Display ), displays transaction contents to the user and a button for accepting user's input, and information indicating pressing/non-pressing of the button is obtained.

- FIGS. 3 and 4 are explanatory views showing screen examples displayed in the display and input device 204.

- FIG. 3 shows a screen example displayed to the user when the user finishes a transaction by the automatic teller machine and notes are withdrawn from the note input/output unit 101. This screen is displayed to prompt the user to select "end transaction" or "execute exchange”.

- FIG. 4 is a screen example displayed when the user puts notes to be exchanged into the note input/output unit 101, and the automatic teller machine verifies the sum of the put notes. This screen is displayed to prompt verification of coincidence of the sum of the notes put by the user with a displayed sum.

- the user of the automatic teller machine inserts a card into the card input/output unit 202.

- the user inserts a bankbook into the bankbook input/output unit 203.

- the display and input device 204 includes, e.g., a touch panel type LCD.

- the user presses a button of a screen 205 displayed in the display and input device 204 to select a desired type of transaction (e.g., deposit, withdrawal, transfer, bankbook balance update or the like).

- a desired type of transaction e.g., deposit, withdrawal, transfer, bankbook balance update or the like.

- the user further operates the display and input device 204 to input necessary information (e.g., password or the like), and subsequently inputs the sum of money to be withdrawn.

- necessary information e.g., password or the like

- notes corresponding to the sum of money to be withdrawn are delivered one by one from the note recycling box 120.

- the note recycling boxes 120, 121 are note housing devices which can take in/pay notes, and house notes altogether for, e.g., each denomination.

- the delivered notes are passed through the sensor 105 of the note validator 103 to be housed in the note input/output unit 101, and then withdrawn.

- the user receives the notes withdrawn.

- the transaction is finished here, and the card is ejected from the card input/output unit 202. If the bankbook has been inserted, the bankbook is ejected from the bankbook input/output unit 203.

- a display screen 301 shown in FIG. 3 is displayed in the display and input device 204 to prompt the user to select "end transaction" or "execute exchange".

- the user presses an "END TRANSACTION" button.

- the card is ejected from the card input/output unit 202.

- the bankbook is ejected from the bankbook input/output unit 203 to finish the transaction.

- the user when determining that the notes withdrawn include notes (namely spoiled notes) degraded due to wearing, staining, tearing, wrinkling, foreign object sticking thereon or the like, the user can exchange the spoiled notes for other notes.

- the user puts the notes determined to be spoiled into the note input/output unit 101.

- the put notes are separated one by one by the note separator 102 installed in the note input/output unit 101, and sent to the sensor 105.

- the note validator 103 determines a denomination of the notes by using a signal output from the sensor 105.

- the control unit 106 makes control to send notes whose denomination is unclear in the denomination determination again to the note input/output unit 101, thereby rejecting acceptance thereof.

- the note whose denomination is unclear is referred to as a "category 1".

- the notes determined to be counterfeit are sent to the note input/output unit 101 to reject acceptance.

- the note boxes 123, 124 for counterfeit notes need not be disposed.

- the counterfeit notes are stored in the auxiliary memory 108, and the notes determined to be counterfeit are housed in the note boxes 123, 124 for counterfeit notes in order of coincidence with a memorizing sequence of the ID's.

- the counterfeit notes may be further classified, notes determined to be apparently counterfeit may be housed in the note box 123 for counterfeit notes, and notes suspected to be counterfeit may be housed in the note box 124 for counterfeit notes.

- the counterfeit notes may not be classified, and notes determined to be counterfeit may be housed in one note box for counterfeit notes.

- the note determined to be apparently counterfeit is referred to as a "category 2"

- the note suspected to be counterfeit is referred to as a "category 3".

- Each of notes whose counterfeit-genuine determination result is genuine is subjected to fitness check by the note validator 103, and a minimum value of a degree of spoilage, i.e., a value of a note of least degradation among the put notes, is stored in the main memory 104.

- the note determined to be genuine is referred to as a "category 4".

- the control unit 106 makes control to house the put notes in the temporary stacker 110. Then, to obtain acceptance from the user, a display screen 401 shown in FIG. 4 is displayed in the display and input device 204 to indicate the sum of notes to be exchanged.

- the automatic teller machine returns the notes housed in the temporary stacker 110 through the sensor 105 to the note input/output unit 101. Subsequently, the display screen 301 of FIG. 3 is displayed again in the display and input device 204, and the process stands by until a button is pressed.

- control unit 106 makes control to first pass the notes housed in the temporary stacker 110 sequentially through sensor 105, and houses them in the note box 122 for spoiled notes. Next, the control unit 106 makes control to send notes corresponding to the sum of the notes put into the note input/output unit 101 by the user from the note recycling boxes 120, 121. The notes are sequentially passed through the sensor 105, and subjected to fitness check by the note validator 103.

- Notes determined to be higher in a degree of spoilage (degraded) than the degree of spoilage stored in the main memory 104 as a result of the fitness check are first housed in the temporary stacker 110.

- the temporary stacker 110 is filled, the notes are sent therefrom to the sensor 105, and subjected to denomination determination by the note validator 103. Then, based on a result of the denomination determination, the notes are housed in one of the note recycling boxes 120, 121.

- Notes determined to be lower in a degree of spoilage (not degraded) than the degree of spoilage stored in the main memory 104 as a result of the fitness check are sent to the note input/output unit 101, and withdrawn when notes equivalent to the sum of money put into by the user are prepared. The user receives the notes withdrawn. At this time, the card is ejected from the card input/output unit 202. If the bankbook has been inserted, the bankbook is ejected from the bankbook input/output unit 203.

- FIG. 5 is a flowchart showing a note exchanging operation of the automatic teller machine.

- the withdrawal operation of the user causes the automatic teller machine to pay notes to the user (501).

- the control unit 106 displays the display screen 310 shown in FIG. 3 to prompt the user to select "end transaction” or "execute exchange” (502). With the screen, the user selects “execute exchange” or "end transaction” by the button on the screen. In the case of exchanging notes, the user must put the notes into the note input/output unit 101 before button pressing. Then, the control unit 106 determines whether the user has pressed the "END TRANSACTION” button or not (503). If the "END TRANSACTION" button has been pressed, the transaction is finished.

- the control unit 106 determines whether the "EXEC EXCHANGE” button has been pressed or not (504). If the "EXEC EXCHANGE” button has not been pressed, the control unit 106 returns to the step 503 to repeat the process. If the "EXEC EXCHANGE” button has been pressed, the control unit 106 makes control to take the notes out which put into the note input/output unit 101 one by one, and to send said notes to the note validator 103 (505). Then, each of the put notes is subjected to denomination determination by the note validator 103 (506), and fitness check and classification of counterfeit/genuine are carried out (550). Referring to FIG. 6 , the fitness check and the classification of counterfeit/ genuine will be detailed later. By the fitness check and the classification of counterfeit/genuine, a degree of spoilage of each note is determined, and the note is determined to be genuine or counterfeit.

- the control unit 106 determines whether the fitness check and the classification of counterfeit/ genuine have been completed or not for all the notes in the note input/output unit 101 (514). If not completed, the notes put the note input/output unit 101 are sent again to note validator 103 (505), and the fitness check and the classification of counterfeit/genuine are repeated. When it is determined that the fitness check and the classification of counterfeit/genuine have been completed for all the notes, the control unit 106 displays the sum of money put into the note input/output unit 101 in the display and input device 204 shown in FIG. 4 to prompt verification (515). The user verifies the returned notes and the sum of put notes, presses the "CANCEL” button when the sum of put notes is determined to be incorrect, and presses the "ACCEPT" button when the sum is determined to be correct.

- the control unit 106 determines whether the "CANCEL” button has been pressed or not (516). Determination that the "CANCEL” button has been pressed is a case in which the user has canceled the note exchanging. In this case, the notes housed in the temporary stacker 110 are sent to the note input/output unit 101, and withdrawn (522). Then, the control unit 106 returns to the step 502, and executes displaying again to prompt the user to select "end transaction" or "execute exchange".

- the control unit 106 determines whether the "ACCEPT” button has been pressed or not (517). When it determines that the "ACCEPT” button has not been pressed, the control unit 106 returns to the step 516. When it is determined that the "ACCEPT” button has been pressed, the notes are sequentially delivered from the note recycling box (518).

- the control unit 106 executes fitness check for the delivered notes (519), and determines, based on the fitness check and classification of counterfeit/genuine in the step 550, whether a degree of spoilage of the delivered notes is smaller or not than a minimum value (value of a note determined to be cleanest) of the degree of spoilage of the put notes stored in the main memory (511 of FIG. 6 ) (520).

- a degree of spoilage of the delivered notes is smaller or not than a minimum value (value of a note determined to be cleanest) of the degree of spoilage of the put notes stored in the main memory (511 of FIG. 6 ) (520).

- the notes not cleaner than the put notes are sent to the note recycling box to be housed (523).

- other notes are delivered from the note recycling box to repeat the process.

- FIG. 6 is a flowchart showing the fitness check and the classification of counterfeit/genuine (550 of FIG. 5 ) in detail.

- the control unit 106 first determines whether the denomination has been classified correctly or not (507). If the denomination has not been classified correctly, i.e., in the case of the unclarified denomination, acceptance of the notes is rejected, and the notes are sent to the note input/output unit 101 (513), and returned to the user.

- the control unit 106 executes classification of counterfeit/genuine notes if the denomination has been classified correctly (508). If a result of the counterfeit/genuine classification determines that the notes are not genuine (509), acceptance of the notes is rejected, the notes are sent to the note input/output unit 101 (513), and returned to the user. If the result of the counterfeit/genuine classification determines that the notes are genuine (509), the notes are subjected to fitness check (510).

- the control unit 106 makes control to store a degree of spoilage of the notes in the main memory(511).

- the spoilage degree is determined by the fitness check. In this event, when a plurality of notes are put into the note input/output unit 101, degrees of spoilage are determined for all the notes, and a smallest degree of spoilage (cleanest) is stored in the main memory 104. Next, the notes are housed in the temporary stacker 110 (512), and the process returns to the note exchanging shown in FIG. 5 .

- FIG. 7 is a flowchart showing another example of fitness check and classification of counterfeit/ genuine in detail.

- the control unit 106 returns the notes determined to be counterfeit to the user.

- the notes determined to be counterfeit are housed in the note boxes 123, 124 for counterfeit notes.

- identification information e.g., note serial number

- ID of the user e.g., user's account number

- the control unit 106 makes control to first store the ID of the user in the main memory 104 (601). Then, the control unit 106 determines whether the notes determined to be counterfeit are apparently counterfeit or not (the notes are apparently counterfeit, or the notes are suspected to be counterfeit) (602).

- the control unit 106 makes control to house the notes in the note box 123 for counterfeit notes (603).

- the control unit 106 makes control to house the notes in the note box for counterfeit notes (note box 124 for counterfeit notes) different from the note box 123 for counterfeit notes which houses the apparently counterfeit notes (603).

- FIG. 8 is a flowchart showing the process of classification of counterfeit (508 of FIG. 6 ) and fitness check (510 of FIG. 6 ) executed by the note validator 103.

- the note validator 103 first senses the notes input thereto by the sensor 105, and obtains a sensor signal (701). Then, features of the notes used for the fitness check or the classification of counterfeit/genuine are extracted from the sensor signal (702).

- FIG. 9 is an explanatory diagram showing the feature extraction of the step 702.

- the features used for the fitness check or the classification of counterfeit/genuine include, e.g., a difference value from a standard signal, an integral value, a differential value, amplitude, variation, and the like.

- the note validator 103 executes the note fitness check or the classification of counterfeit/ genuine by using one or a plurality of such bits of information.

- the note validator 103 inputs information regarding the extracted feature to a classifier (703), and a classification result of the classifier (i.e., fitness degree or counterfeit/genuine) is output (704).

- a classification result of the classifier i.e., fitness degree or counterfeit/genuine

- a linear discriminant function, a quadratic discriminant function, a neural network, a support vector machine or the like can be used.

- the classification result in the case of the fitness check is a discrete value indicating an unspoiled/ spoiled note.

- values of spoilage degrees can be directly output.

- a method of calculating a degree of spoilage for example, there are a method of identification which prepares a class for each degree of spoilage, a method which uses a ratio or a difference of distances from a template of an unspoiled note class and a template of a spoiled note class, and a method which uses projection to an axis indicating the spoilage feature in the feature space.

- the classification result in the case of the classification of counterfeit/genuine becomes a discrete value corresponding to each of genuine and counterfeit notes, or a discrete value corresponding to each of a genuine note, an apparently counterfeit note and a note suspected to be counterfeit.

- the automatic teller machine of the first illustrative example of this invention in a series of withdrawal transactions, the user puts notes determined to be spoiled among the notes withdrawn again, and thus the spoiled notes can be exchanged for unspoiled notes. Moreover, since the note exchanging is executed without finishing the transaction, convenience of withdrawal to the user can be improved. If the notes are determined to be counterfeit, the measures can be taken to reject acceptance of the notes and to return the notes to the user, house the notes together with the ID of the user, or the like. Thus, it is possible to improve safety of the automatic teller machine without mixing counterfeit notes during the note transaction.

- the automatic teller machine of the first example the notes of low degrees of spoilage are withdrawn from the housed notes in response to the spoiled note exchanging request from the user.

- the automatic teller machine of the second example is constituted to pay mint notes in response to a spoiled note exchanging request from a user. Components similar in operation to those of the first example are denoted by similar reference numerals, and description thereof will be omitted.

- FIG. 10 is a block diagram showing a constitution of the automatic teller machine according to the second illustrative example of this invention.

- a note box 901 for mint notes houses unused notes or substantially unused notes (mint notes).

- the user of the automatic teller machine inserts a card into the card input/output unit 202.

- the user inserts the bankbook into the bankbook input/output unit 203.

- the user presses a button on the screen 205 displayed in the display and input device 204 to select a desired type of transaction (e.g., deposit, withdrawal, transfer, bankbook balance update or the like).

- a desired type of transaction e.g., deposit, withdrawal, transfer, bankbook balance update or the like.

- the user further operates the display and input device 204 to input necessary information (e.g., password or the like), and subsequently inputs the sum of money to be withdrawn.

- necessary information e.g., password or the like

- notes corresponding to the sum of money to be withdrawn are delivered one by one from the note recycling box 120.

- the delivered notes are passed through the sensor 105 of a note validator 103 to be housed in a note input/output unit 101, and then withdrawn.

- the user receives the notes withdrawn.

- the transaction is finished here, and the card is ejected from the card input/output unit 202. If the bankbook has been inserted, the bankbook is ejected from the bankbook input/ output unit 203.

- the transaction further continues here.

- the display screen 301 shown in FIG. 3 is displayed in the display and input device 204 to prompt the user to select "end transaction" or "execute exchange".

- the user presses an "END TRANSACTION" button.

- the card is ejected from the card input/output unit 202.

- the bankbook is ejected from the bankbook input/output unit 203 to finish the transaction.

- the user when determining that the notes withdrawn include spoiled notes, the user can exchange the spoiled notes for other notes.

- the user puts the notes determined to be spoiled into the note input/output unit 101.

- the put notes are separated one by one by the note separator 102 installed in the note input/output unit 101, and sent to the sensor 105.

- the note validator 103 determines a denomination of the notes by using a signal output from the sensor 105.

- the control unit 106 makes control to send notes (category 1) whose denomination is unclear in the denomination determination again to the note input/output unit 101, thereby rejecting acceptance thereof.

- the control unit 106 displays the display screen 401 shown in FIG. 4 in the display and input device 204 to notify the sum of notes (category 4) determined to be genuine as a result of the counterfeit-genuine classification to the user.

- the automatic teller machine returns the notes housed in the temporary stacker 110 through the sensor 105 to the note input/output unit 101.

- the display screen 301 of FIG. 3 is displayed again in the display and input device 204, and the process stands by until a button is pressed.

- the control unit 106 makes control to first house the notes of the temporary stacker 110 in the note box 122 for spoiled notes. Next, the control unit 106 makes control to send notes corresponding to the sum of money put into by the user from the note box 901 for mint notes, and send the notes through the sensor 105 to the note input/output unit 101. When notes equivalent to the sum of money put into by the user are prepared, the notes are withdrawn. The user receives the notes withdrawn. At this time, the card is ejected from the card input/ output unit 202. If the bankbook has been inserted, the bankbook is ejected from the bankbook input/output unit 203.

- FIG. 11 is a flowchart showing a note exchanging operation according to the second example.

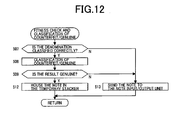

- FIGS. 12 and 13 are flowcharts of detailed operations of fitness check and classification of counterfeit/genuine.

- the second example is different from the first example in that fitness check (510 of FIG. 6 ) and spoilage degree memorizing operation (511 of FIG. 6 ) are not executed for notes put into again, in that fitness check (519 of FIG. 5 ) and spoilage degree determination (520 of FIG, 5 ) are not executed, and in that notes withdrawn to be exchanged are not subjected to fitness check, and notes previously housed in the note box 901 for mint notes are delivered to be withdrawn (1001 of FIG. 11 ).

- Other operations are similar to those ( FIGS. 5 , 6 , and 7 ) of the first example, and thus description thereof will be omitted.

- the user puts notes determined to be spoiled again into the note input/output unit 101, and thus the spoiled notes can be always exchanged for mint notes.

- the spoiled notes can be always exchanged for mint notes.

- the first embodiment is a modification of the first example. By identifying notes when note exchanging is carried out, exchanging of notes alone withdrawn from the automatic teller machine is allowed. Components similar in operation to those of the first example are denoted by similar reference numerals, and description thereof will be omitted.

- FIG. 14 is a flowchart of a note exchanging operation according to the first embodiment.

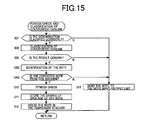

- FIGS. 15 and 16 are flowcharts of detailed operations of fitness check and classification of counterfeit/genuine. Description of operations similar to those ( FIGS. 5 , 6 , and 7 ) of the first example will be omitted.

- information to identify a note is obtained before notes are withdrawn to a user, and stored in the main memory 104 (1201 of FIG. 14 ).

- the information to identify the notes is, for example, a symbol or a number written in each note, a barcode, an IC chip embedded in a note or the like.

- the control unit 106 obtains information which enables identification of each note from such note identification information.

- the control unit 106 similarly obtains note identification information for notes put thereinto to be exchanged. Then, the control unit 106 compares the obtained note identification information with the note identification information stored in the step 1201 (1202). Subsequently, determination is made as to whether the notes have been withdrawn from the same automatic teller machine or not (1203). If the notes have been withdrawn from the same automatic teller machine, as described above, the control unit 106 executes fitness check (510), and stores the smallest value (cleanest) of a degree of spoilage of the notes (511) in main memory 104. Then, the accepted note is housed in the temporary stacker 110 (512).

- control unit 106 rejects acceptance of the notes, sends the notes to the note input/output unit 101 (513), and returns the notes to the user.

- the notes of a category 2 may be housed in a note box 123 for counterfeit notes, and the notes of a category 3 may be housed in a note box 124 for counterfeit notes.

- control unit 106 may display a display screen 1601 shown in FIG. 17 .

- the denomination and the number of notes not accepted because the notes have not been withdrawn from the same automatic teller machine may be displayed to the user.

- the second embodiment is a modification of the second example. As in the first embodiment, by identifying notes when note exchanging is carried out, exchanging of notes alone withdrawn from the automatic teller machine is accepted. Components similar in operation to those of the second example are denoted by similar reference numerals, and description thereof will be omitted.

- FIG. 18 is a flowchart of a note exchanging operation according to the second embodiment.

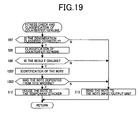

- FIGS. 19 and 20 are flowcharts of detailed operations of fitness check and classification of counterfeit/ genuine. Description of operations similar to those ( FIGS. 11 , 12 , and 13 ) of the second example will be omitted.

- the control unit 106 first obtains information to identify a note before notes are withdrawn to a user, and stores the information in the main memory 104 (1201 of FIG. 18 ).

- the information to identify the notes is, for example, a symbol or a number written in each note, a barcode, an IC chip embedded in a note and the like.

- the control unit 106 obtains information which enables identification of each note from such note identification information.

- the control unit 106 similarly obtains note identification information for notes put thereinto to be exchanged. Then, the control unit 106 compares the obtained note identification information with the note identification information stored in the step 1201 (1202). Subsequently, determination is made as to whether the notes have been withdrawn from the same automatic teller machine or not (1203). If the notes have been withdrawn from the same automatic teller machine, as in the first example the control unit 106 executes fitness check (510), and houses the notes of a smallest value (cleanest) of a degree of spoilage (511). Then, the accepted note is housed in the temporary stacker 110 (512).

- control unit 106 rejects acceptance of the notes, sends the notes to the note input/output unit 101 (513), and returns the notes to the user.

- the notes of a category 2 may be housed in the note box 123 for counterfeit notes, and the notes of a category 3 may be housed in a note box 124 for counterfeit notes.

- control unit 106 may display a display screen 1601 shown in FIG. 17 .

- the denomination and the number of notes not accepted because the notes have not been withdrawn from the same automatic teller machine may be displayed to the user.

- the automatic teller machine includes a sensor for detecting a position of a user, and determines whether or not the user is near the device to be able to operate the same.

- a sensor for detecting a position of a user and determines whether or not the user is near the device to be able to operate the same.

- Components similar in operation to those of the first example are denoted by similar reference numerals, and thus description thereof will be omitted.

- FIG. 21 is an external view of the automatic teller machine of the third example.

- FIG. 22 is a block diagram showing a constitution of the automatic teller machine of the third example.

- the automatic teller machine of the third example includes at least one of a camera 1701, a distance sensor 1702, and a pressure sensor 1703 to check presence of a user in front of the automatic teller machine.

- the camera 1701 is disposed in a position to photograph a front portion of the automatic teller machine, to determine the presence of the user in front of the automatic teller machine by recognizing a taken image.

- the distance sensor 1702 uses, e.g., infrared rays to measure a distance from an object.

- the pressure sensor 1703 uses, e.g., a piezoelectric element to determine whether pressure has been applied to the pressure sensor 1703 or not (e.g., whether the user is on the pressure sensor 1703 or not).

- FIG. 23 is a flowchart of a note exchanging operation carried out by the control unit 106 according to the third example.

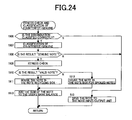

- FIGS. 24 and 25 are flowcharts of detailed operations of fitness check and classification of counterfeit/ genuine.

- the control unit 106 makes control to put notes into the note input/output unit 101 (501), and detects a position of the user by the camera 1701 or the sensor (distance sensor 1702 or pressure sensor 1703) (1901).

- the position of the user is detected based on a difference between an input image and the background.

- the distance sensor 1702 the position of the user is detected based on a distance between the automatic teller machine and the user.

- the pressure sensor 1703 the position of the user is detected based on weight of the user on the sensor.

- the control unit 106 determines whether the user detected in the step 1901 is in a prescribed area (area in which the user can operate the automatic teller machine) or not (1902). If the user is in the prescribed area, i.e., the user can operate the automatic teller machine, the process moves to a step 1917. If the user is not in the prescribed area, i.e., the user cannot operate the automatic teller machine, the process moves to a step 1903.

- a prescribed area area in which the user can operate the automatic teller machine

- the control unit 106 determines whether note exchanging has been executed or not (execution/non-execution of note exchanging). If note exchanging has not been executed, the control unit 106 displays the display screen 301 of FIG. 3 (502). On the other hand, if note exchanging has been executed, the control unit 106 determines whether an "END TRANSACTION" button has been pressed or not (503). If the "END TRANSACTION" button has been pressed, a card is ejected from a card input/output unit 202. If a bankbook has been inserted, the bankbook is ejected from a bankbook input/output unit 203.

- the control unit 106 determines whether an "EXEC EXCHANGE” button has been pressed or not (504). If the "EXEC EXCHANGE” button has not been pressed, the process returns to the step 503. If the "EXEC EXCHANGE” button has been pressed (1918), the process moves to the step 1901.

- the control unit 106 determines whether deposited notes are left in the cask input/ output unit 101 or not. If deposited notes are left in the note input/output unit 101, the notes are delivered from the note input/output unit 101, sent to the note validator 103 (1904), classification of denomination is executed (1905), and fitness check and classification of counterfeit/genuine shown in FIG. 24 are executed.

- the control unit 106 determines whether fitness check and classification of counterfeit/genuine have been completed or not for all the notes (1915). If fitness check and classification of counterfeit/genuine have not been completed for all the notes, the control unit 106 returns to the step 1904 to make determination for the remaining notes. On the other hand, if fitness check and classification of counterfeit/ genuine have been completed for all the notes, a card is housed in the card box 206. If a bankbook has been inserted, the bankbook is housed in a bankbook box 207 (1917), and the transaction is finished.

- FIG. 24 is a flowchart showing the fitness check and the classification of counterfeit/ genuine in detail.

- the control unit 106 first determines whether the denomination has been classified correctly or not as a result of the note denomination determination in the step 1905 (1906). If the denomination has not been classified correctly, i.e., in the case of the unclarified denomination, acceptance of the notes is rejected. The notes are sent to the note input/ output unit 101 (1914), and returned to the user. On the other hand, the control unit 106 executes classification of counterfeit/genuine notes if the denomination has been classified correctly (1907).

- the control unit 106 determines whether the notes are genuine or not as a result of the classification of counterfeit/genuine (1908). If the result of the counterfeit/genuine classification confirms that the notes are not genuine, acceptance of the notes is rejected, and the notes are sent to the note input/ output unit 101 (1914), and returned to the user. On the other hand, if the result of the counterfeit/genuine classification confirms that the notes are genuine, the notes are subjected to fitness check (1910).

- the control unit 106 makes control to house the notes in a note recycling box 120 or 121 according to the denomination (1911). If the notes are not unspoiled, the control unit 106 determines that the notes are spoiled, and the notes are housed in the note box 122 for spoiled notes (1912). Then, the control unit 106 adds the sum in the note input/output unit 101 to user's bank balance (1912). With the step 1912, if the user is not in front of the automatic teller machine (user cannot operate the automatic teller machine) after an end of the transaction, the sum of notes is added to user's bank balance. Accordingly, stealing of withdrawn note by a third party is prevented.

- an ID of the user may be stored, and the notes may be housed in the note boxes 123, 124 for counterfeit notes shown in FIG. 25 .

- the automatic teller machine of the third illustrative example of this invention when it is determined that the user cannot operate the automatic teller machine (e.g., user is not in front of the automatic teller machine), the notes are housed in the automatic teller machine, and the sum thereof is added to user's bank balance.

- the automatic teller machine when it is determined that the user cannot operate the automatic teller machine (e.g., user is not in front of the automatic teller machine), the notes are housed in the automatic teller machine, and the sum thereof is added to user's bank balance.

- the degree of spoilage of the note is based on the deposited note.

- a process of withdrawing notes alone whose degrees of spoilage are equal to or less than a prescribed threshold value is carried out, and the threshold value is dynamically updated.

- the control unit 106 executes fitness check for notes put to be exchanged, and calculates degrees of spoilage. Then, by using the calculated degrees of spoilage, the parameter for fitness check is updated. For example, a weighted average of values of the calculated degrees of spoilage and the stored parameter for fitness check is calculated, and this average is set as a new parameter for fitness check. Thereafter, in the fitness check for the deposited notes, the control unit 106 makes control to house the notes in a note box for spoiled notes if the values of the degrees of spoilage exceed the parameter for fitness check, and withdraw the notes whose degrees of spoilage are less than the parameter for fitness check.

- the automatic teller machine of the fourth example by dynamically updating the parameter for fitness check in the automatic teller machine, degrees of spoilage different from user to user are numerically classified, and a weighted average thereof is obtained.

- the parameter for fitness check can be further approximated to an average value.

- a parameter for fitness check that is a threshold value for fitness check is set for each user.

- the control unit 106 executes fitness check for notes put thereinto to be exchanged, and calculates degrees of spoilage. Then, by using the calculated degrees of spoilage, the parameter for fitness check is updated. For example, a weighted average of values of the calculated degrees of spoilage and the stored parameter for fitness check is calculated, and this average is set as a new parameter for fitness check.

- the control unit 106 makes control to withdraw notes alone whose values of degrees of spoilage are less than the new parameter for fitness check to the same users.

- individual identification information e.g., ID or account number

- the control unit 106 may make control to send the information of the parameter for fitness check for each user through a network 2102 to a shared server 2101, and store the information therein.

- the information of the parameter for fitness check can be shared by a plurality of automatic teller machines (201a, 201b, and 201c). Thus, no matter which automatic teller machine 201 the user uses, the same information of the parameter for fitness check can be shared based on the information of the shared server 2101.

- the automatic teller machine of the fifth illustrative example of this invention by dynamically updating the parameter for fitness check, and sharing the parameter for fitness check through the network 2102, no matter which automatic teller machines installed in a plurality of places the user uses, notes less than the same degree of fitness check can be withdrawn. Moreover, since the notes can be withdrawn not only according to user's note exchanging request but also based on the parameter for fitness check shared during the withdrawal, convenience can be improved for the users.

- the automatic teller machine of the sixth example includes a cleaning mechanism for cleaning notes.

- Components similar in operation to those of the first to fifth examples, or first and second embodiments are denoted by similar reference numerals, and description thereof will be omitted.

- FIG. 27 is a block diagram showing a constitution of the automatic teller machine of the sixth example.

- the automatic teller machine includes a cleaning mechanism 2201.

- the cleaning mechanism 2201 executes wrinkle removal from notes by an iron or sterilization.

- the control unit 106 displays a screen of FIG. 3 for execution/non-execution of note exchanging on a display screen.

- a user puts notes again into the note input/output unit 101.

- the control unit 106 makes control to temporarily house the put notes through the cleaning mechanism 2201 in the temporary stacker 110. In this event, the notes are cleaned by the cleaning mechanism 2201. Then, the cleaned notes are sent again to the note input/output unit 101, and withdrawn to the user.

- the automatic teller machine of the sixth illustrative example of this invention since the notes requested by the user are cleaned and withdrawn, accumulation of the notes more than necessary in the note box 122 for spoiled notes is prevented. Moreover, since the user directly returns the notes housed in the note input/output unit 101, loss caused by counterfeit note exchanging can be prevented, and safety of a withdrawn note exchanging device can be enhanced.

- Each of the automatic teller machines of the first to sixth examples, or first and second embodiments uses the note recycling boxes 120, 121 because of a recycling function of reusing the deposited notes as notes to be withdrawn.

- this invention is not limited to the constitution.

- One of the note recycling boxes 120, 121 may be used as a deposited note housing dedicated box (notes are only taken in, but not withdrawn) which has a note taking-in function only, and the other may be used as a withdrawn note housing dedicated box (notes are only withdrawn, but not taken in) which has a note withdrawing function only. Even in the automatic teller machine which has no recycling functions but the deposit/withdrawal function, notes withdrawn can be exchanged as in the first to sixth examples, or first and second embodiments.

Description

- The present application claims priority from

Japanese application P2003-382555 filed on Nov 12, 2003 - This invention relates to an automatic teller machine, and more particularly to an automatic teller machine which has a function of exchanging spoiled notes for unspoiled notes, an automatic teller method, and an automatic teller program.

- Notes are degraded due to wearing, staining, tearing, wrinkling, foreign object sticking or the like during use. Generally, such rather degraded notes are referred to as "spoiled notes". On the other hand, notes of little degradation are referred to as "unspoiled notes". Unused notes or notes near unused states among the unspoiled notes are referred to as "mint notes". As the spoiled notes that have been rather degraded make users unpleasant, normally, it is only mint notes/unspoiled notes that are withdrawn from the automatic teller machine. A degradation degree of a note depends on individual's subjectivity. Consequently, some users may feel that notes withdrawn from the automatic teller machine are spoiled. To improve services rendered to such users, a function must be provided to exchange spoiled ones of notes withdrawn for unspoiled notes.

- Meanwhile, there has been known a money transaction device which enables selection of withdrawal of new money (mint notes) or withdrawal of circulating money (unspoiled notes, spoiled notes) according to user's selection instruction (e.g.,

JP 9-62895 A -

GB-A-2 247 097 present claims 1 and 2 has been based on this document. -

JP-A-09 062 895 -

EP-A-0 871 149 discloses a self-service deposit apparatus including means for identifying the user. - However, in conventional note exchanging, a function of withdrawing new notes (mint notes) has only been added to the device which has an exchanging function, and the exchanging has been treated separately from a note input/output transaction at a bank. Thus, in the case of exchanging notes withdrawn, note exchanging must be executed after a withdrawal transaction is finished. Additionally, to improve safety, during note exchanging, individual identification is preferably executed to identify who carries out a note exchanging operation. However, the execution of individual identification just to exchange notes involves a problem in terms of reduced usability for the users.

- This invention has been made in light of the aforementioned problems, and it is therefore an object of this invention to provide an automatic teller machine and an automatic teller method which enable exchanging of spoiled notes for unspoiled notes (mint notes) in note transaction (withdrawal).

- The object is met by the automatic teller machine according to this invention as defined in claim 1. It includes a note input/output unit, a control unit for controlling each unit, a memory, a note housing unit for housing notes, and an input unit for accepting user's operation, allows withdrawal of a sum of notes according to an input from the user, accepts a redeposit of at least a part of the notes withdrawn before completion of a transaction, and allows withdrawal of a sum equivalent to the redeposited notes from the notes housed in the housing unit and determined to be mint notes.

- According to this invention, since note exchanging can be executed by a series of note input/output transactions, the user can exchange spoiled notes for unspoiled notes (mint notes) without going to the other device or stopping the transaction, and usability can be improved for the user.

-

-

FIG. 1 is a block diagram of an automatic teller machine according to a first illustrative example of this invention. -

FIGS. 2A and 2B are appearance diagrams of the automatic teller machine according to the first example. -

FIG. 3 is an explanatory diagram of a display and input device according to the first embodiment of this invention. -

FIG. 4 is an explanatory diagram of the display and input device according to the first example. -

FIG. 5 is a flowchart of note exchanging according to the first example. -

FIG. 6 is a flowchart of fitness check and classification of counterfeit/ genuine according to the first example. -

FIG. 7 is a flowchart of another fitness check and classification of counterfeit/ genuine according to the first example. -

FIG. 8 is a flowchart of classification of counterfeit/genuine and fitness check according to the first example. -

FIG. 9 is an explanatory diagram of feature extraction according to the first example. -

FIG. 10 is a block diagram showing a constitution of an automatic teller machine according to a second illustrative example of this invention. -

FIG. 11 is a flowchart of note exchanging according to the second example. -

FIG. 12 is a flowchart of fitness check and classification of counterfeit/genuine according to the second example. -

FIG. 13 is a flowchart of another fitness check and classification of counterfeit/ genuine according to the second example. -

FIG. 14 is a flowchart of note exchanging according to a first embodiment of this invention. -

FIG. 15 is a flowchart of fitness check and classification of counterfeit/ genuine according to the first embodiment of this invention. -

FIG. 16 is a flowchart of another fitness check and classification of counterfeit/genuine according to the first embodiment of this invention. -

FIG. 17 is a diagram showing an example of a display screen according to the first embodiment of this invention. -

FIG. 18 is a flowchart of note exchanging according to a second embodiment of this invention. -

FIG. 19 is a flowchart of fitness check and classification of counterfeit/ genuine according to the second embodiment of this invention. -

FIG. 20 is a flowchart of another fitness check and classification of counterfeit/ genuine according to the second embodiment of this invention. -

FIG. 21 is an appearance diagram of an automatic teller machine according to a third illustrative example of this invention. -

FIG. 22 is a block diagram showing a constitution of the automatic teller machine according to the third example. -

FIG. 23 is a flowchart of note exchanging according to the third example. -

FIG. 24 is a flowchart of fitness check and classification of counterfeit/ genuine according to the third example. -

FIG. 25 is a flowchart of another fitness check and classification of counterfeit/genuine according to thethird example. -

FIG. 26 is a block diagram showing a configuration of a banknote transaction system according a fifth illustrative example of this invention. -

FIG. 27 is a block diagram showing a constitution of an automatic teller machine according to asixth illustrative example of this invention. - Preferred embodiments and illustrative examples of this invention will be described in detail below with reference to the accompanying drawings.

-

FIG. 1 is a block diagram showing a constitution of an automatic teller machine according to a first illustrative example. - A note input/

output unit 101 is a unit that notes are put in and withdrawn from thereof. The note input/output unit 101 includes a note deposit opening and a note withdrawal opening, passes notes which is put into the note deposit opening to aconveying device 141, and allows withdrawal of the notes conveyed by theconveying device 141 to the outside of the automatic teller machine. Anote separator 102 separates the notes put into the note input/output unit 101, and passes the notes one by one to anote validator 103. - The

note validator 103 is a unit which validates fitness or classify counterfeit/ genuine notes. Fitness means quality of a note. And validating fitness means checking whether the note has good quality to be used in the market or not. Thenote validator 103 includes amain memory 104 and asensor 105, detects a deposited/withdrawn note by thesensor 105, and collates the note with a pattern previously stored in themain memory 104 to check fitness or classify counterfeit/genuine thereof. Acontrol unit 106 includes a CPU (not shown) and amain memory 107. Anauxiliary memory 108 consists of a large-capacity memory such as a hard disk drive, and stores programs for controlling the note input/output unit 101, note housing units (120 to 124), thenote validator 103 and the like to carry out note transactions. - A

temporary stacker 110 temporarily houses notes put into the note input/output unit 101. Noterecycling boxes output unit 101. The note recycling boxes 120,121 also house notes suited to withdrawal among the notes put into the note input/output unit 101. Anote box 122 for spoiled notes houses much degraded notes. Noteboxes note validator 103. Notes may be housed in different boxes for counterfeit notes depending on suspicions of counterfeit notes (apparent counterfeit notes, notes suspected to be counterfeit). Thenote conveying device 141 includes a belt, a roller and the like. An arrow of the conveyingdevice 141 indicates a note conveying direction. - A card input/

output unit 202, a bankbook input/output unit 203, and a display and input device (e.g., touch panel type liquid crystal display device) 204 are connected to thecontrol unit 106. - A user of the automatic teller machine puts a card into the card input/

output unit 202. The user puts a bankbook into the bankbook input/output unit 203 when necessary. The user starts a transaction according to contents displayed in the display andinput device 204. Then, the notes put into the note input/output unit 101 are separated one by one by thenote separator 102, and sent one by one to thenote validator 103 by the conveyingdevice 141. The notes subjected to check fitness and to classify into the notes counterfeit/genuine thereof and the like by thenote validator 103. Then the notes are sent to thenote recycling boxes note box 122 for spoiled notes, or thenote boxes note recycling boxes note validator 103 by the conveyingdevice 141. Then the notes are subjected to check fitness and to classify into the notes counterfeit/ genuine thereof and the like by thenote validator 103. The notes sent to the note input/output unit 101 to be housed. The notes housed in the note input/output unit 101 are withdrawn by opening its cover. -

FIGS. 2A and 2B are appearance diagrams of the automatic teller machine according to the first example.FIG. 2A shows an appearance of the automatic teller machine, andFIG. 2B shows a screen example displayed in the display andinput device 204 of the automatic teller machine. - An

automatic teller machine 201 includes the card input/output unit 202, the bankbook input/output unit 203, the display andinput device 204, acard box 206, abanknote box 207, and the like. A card inserted into the card input/output unit 202 is housed in thecard box 206, and information recorded in a magnetic stripe, an IC chip or the like of the card is obtained. A bankbook inserted into the bankbook input/output unit 203 is housed in thebankbook box 207, and information recorded in a magnetic stripe, an IC chip or the like of the bankbook is obtained. The display andinput device 204 is, for example, a touch panel type LCD ( Liquid Crystal Display ), displays transaction contents to the user and a button for accepting user's input, and information indicating pressing/non-pressing of the button is obtained. -

FIGS. 3 and 4 are explanatory views showing screen examples displayed in the display andinput device 204. -

FIG. 3 shows a screen example displayed to the user when the user finishes a transaction by the automatic teller machine and notes are withdrawn from the note input/output unit 101. This screen is displayed to prompt the user to select "end transaction" or "execute exchange".FIG. 4 is a screen example displayed when the user puts notes to be exchanged into the note input/output unit 101, and the automatic teller machine verifies the sum of the put notes. This screen is displayed to prompt verification of coincidence of the sum of the notes put by the user with a displayed sum. - Next, description will be made of an operation for exchanging spoiled notes carried out by the automatic teller machine of the first illustrative example of this invention.

- The user of the automatic teller machine inserts a card into the card input/

output unit 202. When necessary (e.g., when bankbook balance update is desired), the user inserts a bankbook into the bankbook input/output unit 203. The display andinput device 204 includes, e.g., a touch panel type LCD. The user presses a button of ascreen 205 displayed in the display andinput device 204 to select a desired type of transaction (e.g., deposit, withdrawal, transfer, bankbook balance update or the like). Hereinafter, the case of selecting the withdrawal will be described. - The user further operates the display and

input device 204 to input necessary information (e.g., password or the like), and subsequently inputs the sum of money to be withdrawn. By control of thecontrol unit 106, notes corresponding to the sum of money to be withdrawn are delivered one by one from thenote recycling box 120. Thenote recycling boxes sensor 105 of thenote validator 103 to be housed in the note input/output unit 101, and then withdrawn. The user receives the notes withdrawn. According to the conventional note transaction device, the transaction is finished here, and the card is ejected from the card input/output unit 202. If the bankbook has been inserted, the bankbook is ejected from the bankbook input/output unit 203. - According to the automatic teller machine of the present example; the transaction continues more here. A

display screen 301 shown inFIG. 3 is displayed in the display andinput device 204 to prompt the user to select "end transaction" or "execute exchange". When feeling no particular abnormality in the notes withdrawn, the user presses an "END TRANSACTION" button. In this case, the card is ejected from the card input/output unit 202. If the bankbook has been inserted, the bankbook is ejected from the bankbook input/output unit 203 to finish the transaction. - On the other hand, when determining that the notes withdrawn include notes (namely spoiled notes) degraded due to wearing, staining, tearing, wrinkling, foreign object sticking thereon or the like, the user can exchange the spoiled notes for other notes. In this case, the user puts the notes determined to be spoiled into the note input/

output unit 101. The put notes are separated one by one by thenote separator 102 installed in the note input/output unit 101, and sent to thesensor 105. Thenote validator 103 determines a denomination of the notes by using a signal output from thesensor 105. Thecontrol unit 106 makes control to send notes whose denomination is unclear in the denomination determination again to the note input/output unit 101, thereby rejecting acceptance thereof. The note whose denomination is unclear is referred to as a "category 1". - For notes whose denomination has been clarified and classified correctly, the notes are next subjected to classification of counterfeit/ genuine. The following two processing methods are available for notes determined to be counterfeit as a result of the classification of counterfeit/ genuine notes.

- According to the first counterfeit notes processing method, the notes determined to be counterfeit are sent to the note input/

output unit 101 to reject acceptance. In this case, thenote boxes - According to the second counterfeit note processing method, user ID's (e.g., identification information or the like of users recorded in cards) are stored in the

auxiliary memory 108, and the notes determined to be counterfeit are housed in thenote boxes note box 123 for counterfeit notes, and notes suspected to be counterfeit may be housed in thenote box 124 for counterfeit notes. The counterfeit notes may not be classified, and notes determined to be counterfeit may be housed in one note box for counterfeit notes. It should be noted that the note determined to be apparently counterfeit is referred to as a "category 2", and the note suspected to be counterfeit is referred to as a "category 3". - Each of notes whose counterfeit-genuine determination result is genuine is subjected to fitness check by the

note validator 103, and a minimum value of a degree of spoilage, i.e., a value of a note of least degradation among the put notes, is stored in themain memory 104. The note determined to be genuine is referred to as a "category 4". - The

control unit 106 makes control to house the put notes in thetemporary stacker 110. Then, to obtain acceptance from the user, adisplay screen 401 shown inFIG. 4 is displayed in the display andinput device 204 to indicate the sum of notes to be exchanged. Here, if the user presses a "CANCEL" button, the automatic teller machine returns the notes housed in thetemporary stacker 110 through thesensor 105 to the note input/output unit 101. Subsequently, thedisplay screen 301 ofFIG. 3 is displayed again in the display andinput device 204, and the process stands by until a button is pressed. - On the other hand, if the user presses an "ACCEPT" button, the

control unit 106 makes control to first pass the notes housed in thetemporary stacker 110 sequentially throughsensor 105, and houses them in thenote box 122 for spoiled notes. Next, thecontrol unit 106 makes control to send notes corresponding to the sum of the notes put into the note input/output unit 101 by the user from thenote recycling boxes sensor 105, and subjected to fitness check by thenote validator 103. - Notes determined to be higher in a degree of spoilage (degraded) than the degree of spoilage stored in the

main memory 104 as a result of the fitness check are first housed in thetemporary stacker 110. Here, when thetemporary stacker 110 is filled, the notes are sent therefrom to thesensor 105, and subjected to denomination determination by thenote validator 103. Then, based on a result of the denomination determination, the notes are housed in one of thenote recycling boxes - Notes determined to be lower in a degree of spoilage (not degraded) than the degree of spoilage stored in the

main memory 104 as a result of the fitness check are sent to the note input/output unit 101, and withdrawn when notes equivalent to the sum of money put into by the user are prepared. The user receives the notes withdrawn. At this time, the card is ejected from the card input/output unit 202. If the bankbook has been inserted, the bankbook is ejected from the bankbook input/output unit 203. - By such a series of operations, the notes determined to be spoiled are put again by the user to be exchanged for unspoiled notes.

-

FIG. 5 is a flowchart showing a note exchanging operation of the automatic teller machine. - As described above, the withdrawal operation of the user causes the automatic teller machine to pay notes to the user (501). Next, the

control unit 106 displays the display screen 310 shown inFIG. 3 to prompt the user to select "end transaction" or "execute exchange" (502). With the screen, the user selects "execute exchange" or "end transaction" by the button on the screen. In the case of exchanging notes, the user must put the notes into the note input/output unit 101 before button pressing. Then, thecontrol unit 106 determines whether the user has pressed the "END TRANSACTION" button or not (503). If the "END TRANSACTION" button has been pressed, the transaction is finished. If the "END TRANSACTION" button has not been pressed, thecontrol unit 106 determines whether the "EXEC EXCHANGE" button has been pressed or not (504). If the "EXEC EXCHANGE" button has not been pressed, thecontrol unit 106 returns to thestep 503 to repeat the process. If the "EXEC EXCHANGE" button has been pressed, thecontrol unit 106 makes control to take the notes out which put into the note input/output unit 101 one by one, and to send said notes to the note validator 103 (505). Then, each of the put notes is subjected to denomination determination by the note validator 103 (506), and fitness check and classification of counterfeit/genuine are carried out (550). Referring toFIG. 6 , the fitness check and the classification of counterfeit/ genuine will be detailed later. By the fitness check and the classification of counterfeit/genuine, a degree of spoilage of each note is determined, and the note is determined to be genuine or counterfeit. - Next, the

control unit 106 determines whether the fitness check and the classification of counterfeit/ genuine have been completed or not for all the notes in the note input/output unit 101 (514). If not completed, the notes put the note input/output unit 101 are sent again to note validator 103 (505), and the fitness check and the classification of counterfeit/genuine are repeated. When it is determined that the fitness check and the classification of counterfeit/genuine have been completed for all the notes, thecontrol unit 106 displays the sum of money put into the note input/output unit 101 in the display andinput device 204 shown inFIG. 4 to prompt verification (515). The user verifies the returned notes and the sum of put notes, presses the "CANCEL" button when the sum of put notes is determined to be incorrect, and presses the "ACCEPT" button when the sum is determined to be correct. - The

control unit 106 determines whether the "CANCEL" button has been pressed or not (516). Determination that the "CANCEL" button has been pressed is a case in which the user has canceled the note exchanging. In this case, the notes housed in thetemporary stacker 110 are sent to the note input/output unit 101, and withdrawn (522). Then, thecontrol unit 106 returns to the step 502, and executes displaying again to prompt the user to select "end transaction" or "execute exchange". - When it determines that the "CANCEL" button has not been pressed, the

control unit 106 determines whether the "ACCEPT" button has been pressed or not (517). When it determines that the "ACCEPT" button has not been pressed, thecontrol unit 106 returns to thestep 516. When it is determined that the "ACCEPT" button has been pressed, the notes are sequentially delivered from the note recycling box (518). Then, thecontrol unit 106 executes fitness check for the delivered notes (519), and determines, based on the fitness check and classification of counterfeit/genuine in thestep 550, whether a degree of spoilage of the delivered notes is smaller or not than a minimum value (value of a note determined to be cleanest) of the degree of spoilage of the put notes stored in the main memory (511 ofFIG. 6 ) (520). In the case of notes whose degrees of spoilage are determined not to be smaller, i.e., the notes not cleaner than the put notes are sent to the note recycling box to be housed (523). Then, returning to thestep 518, other notes are delivered from the note recycling box to repeat the process. In the case of determination that the degree of spoilage is smaller, since notes cleaner than the put notes can be withdrawn, the notes are sent to the note input/output unit 101, the sum equal to the sum of money put into is withdrawn to the user (521), and the transaction is finished. -

FIG. 6 is a flowchart showing the fitness check and the classification of counterfeit/genuine (550 ofFIG. 5 ) in detail. - As a result of the classification of denomination in the

step 506 ofFIG. 5 , thecontrol unit 106 first determines whether the denomination has been classified correctly or not (507). If the denomination has not been classified correctly, i.e., in the case of the unclarified denomination, acceptance of the notes is rejected, and the notes are sent to the note input/output unit 101 (513), and returned to the user. - The

control unit 106 executes classification of counterfeit/genuine notes if the denomination has been classified correctly (508). If a result of the counterfeit/genuine classification determines that the notes are not genuine (509), acceptance of the notes is rejected, the notes are sent to the note input/output unit 101 (513), and returned to the user. If the result of the counterfeit/genuine classification determines that the notes are genuine (509), the notes are subjected to fitness check (510). - The

control unit 106 makes control to store a degree of spoilage of the notes in the main memory(511). The spoilage degree is determined by the fitness check. In this event, when a plurality of notes are put into the note input/output unit 101, degrees of spoilage are determined for all the notes, and a smallest degree of spoilage (cleanest) is stored in themain memory 104. Next, the notes are housed in the temporary stacker 110 (512), and the process returns to the note exchanging shown inFIG. 5 . -

FIG. 7 is a flowchart showing another example of fitness check and classification of counterfeit/ genuine in detail. - In the process of

FIG. 6 , thecontrol unit 106 returns the notes determined to be counterfeit to the user. However, in the process ofFIG. 7 , the notes determined to be counterfeit are housed in thenote boxes main memory 104. Steps similar to those ofFIG. 6 are denoted by similar reference numerals, and description thereof will be omitted. - In the

step 509, if the result of the counterfeit/genuine classification determines that the notes are not genuine (counterfeit), thecontrol unit 106 makes control to first store the ID of the user in the main memory 104 (601). Then, thecontrol unit 106 determines whether the notes determined to be counterfeit are apparently counterfeit or not (the notes are apparently counterfeit, or the notes are suspected to be counterfeit) (602). - In the case of the apparently counterfeit notes (category 2), the

control unit 106 makes control to house the notes in thenote box 123 for counterfeit notes (603). In the case of the notes which are not apparently counterfeit but suspected to be counterfeit (category 3), thecontrol unit 106 makes control to house the notes in the note box for counterfeit notes (note box 124 for counterfeit notes) different from thenote box 123 for counterfeit notes which houses the apparently counterfeit notes (603). - By the process of

FIG. 7 , it is possible to specify the user who has put the notes determined to be counterfeit again. Further, it is possible to house the apparently counterfeit notes and the notes suspected to be counterfeit separately. - Now, a method of note fitness check and classification of counterfeit/ genuine will be described.

-

FIG. 8 is a flowchart showing the process of classification of counterfeit (508 ofFIG. 6 ) and fitness check (510 ofFIG. 6 ) executed by thenote validator 103. - The

note validator 103 first senses the notes input thereto by thesensor 105, and obtains a sensor signal (701). Then, features of the notes used for the fitness check or the classification of counterfeit/genuine are extracted from the sensor signal (702). -

FIG. 9 is an explanatory diagram showing the feature extraction of thestep 702. - The features used for the fitness check or the classification of counterfeit/genuine include, e.g., a difference value from a standard signal, an integral value, a differential value, amplitude, variation, and the like. The

note validator 103 executes the note fitness check or the classification of counterfeit/ genuine by using one or a plurality of such bits of information. - Next, the

note validator 103 inputs information regarding the extracted feature to a classifier (703), and a classification result of the classifier (i.e., fitness degree or counterfeit/genuine) is output (704). For the classifier, for example, a linear discriminant function, a quadratic discriminant function, a neural network, a support vector machine or the like can be used. - The classification result in the case of the fitness check is a discrete value indicating an unspoiled/ spoiled note. To compare degrees of spoilage, values of spoilage degrees can be directly output. For a method of calculating a degree of spoilage, for example, there are a method of identification which prepares a class for each degree of spoilage, a method which uses a ratio or a difference of distances from a template of an unspoiled note class and a template of a spoiled note class, and a method which uses projection to an axis indicating the spoilage feature in the feature space. The classification result in the case of the classification of counterfeit/genuine becomes a discrete value corresponding to each of genuine and counterfeit notes, or a discrete value corresponding to each of a genuine note, an apparently counterfeit note and a note suspected to be counterfeit.

- As described above, according to the automatic teller machine of the first illustrative example of this invention, in a series of withdrawal transactions, the user puts notes determined to be spoiled among the notes withdrawn again, and thus the spoiled notes can be exchanged for unspoiled notes. Moreover, since the note exchanging is executed without finishing the transaction, convenience of withdrawal to the user can be improved. If the notes are determined to be counterfeit, the measures can be taken to reject acceptance of the notes and to return the notes to the user, house the notes together with the ID of the user, or the like. Thus, it is possible to improve safety of the automatic teller machine without mixing counterfeit notes during the note transaction.