KR20140000508A - Method and system for processing subscription of internet banking using automatic teller machine - Google Patents

Method and system for processing subscription of internet banking using automatic teller machine Download PDFInfo

- Publication number

- KR20140000508A KR20140000508A KR1020120067629A KR20120067629A KR20140000508A KR 20140000508 A KR20140000508 A KR 20140000508A KR 1020120067629 A KR1020120067629 A KR 1020120067629A KR 20120067629 A KR20120067629 A KR 20120067629A KR 20140000508 A KR20140000508 A KR 20140000508A

- Authority

- KR

- South Korea

- Prior art keywords

- internet banking

- customer

- teller machine

- automated teller

- banking application

- Prior art date

Links

Images

Classifications

-

- G—PHYSICS

- G06—COMPUTING; CALCULATING OR COUNTING

- G06Q—INFORMATION AND COMMUNICATION TECHNOLOGY [ICT] SPECIALLY ADAPTED FOR ADMINISTRATIVE, COMMERCIAL, FINANCIAL, MANAGERIAL OR SUPERVISORY PURPOSES; SYSTEMS OR METHODS SPECIALLY ADAPTED FOR ADMINISTRATIVE, COMMERCIAL, FINANCIAL, MANAGERIAL OR SUPERVISORY PURPOSES, NOT OTHERWISE PROVIDED FOR

- G06Q40/00—Finance; Insurance; Tax strategies; Processing of corporate or income taxes

- G06Q40/02—Banking, e.g. interest calculation or account maintenance

-

- G—PHYSICS

- G07—CHECKING-DEVICES

- G07F—COIN-FREED OR LIKE APPARATUS

- G07F19/00—Complete banking systems; Coded card-freed arrangements adapted for dispensing or receiving monies or the like and posting such transactions to existing accounts, e.g. automatic teller machines

- G07F19/20—Automatic teller machines [ATMs]

- G07F19/211—Software architecture within ATMs or in relation to the ATM network

Abstract

Internet banking new subscription processing method using the automated teller machine according to an embodiment of the present invention comprises the steps of receiving at the customer terminal, the Internet banking application information including the customer information and account number in a temporary database; Receiving, at the automated teller machine, the internet banking application information from the customer terminal, and displaying an internet banking application page for application for internet banking in response to the internet banking application information; In the automated teller machine, if an ID, password, and transfer limit of the customer are input through the internet banking application page, an internet banking application is generated based on the customer information, the account number, the ID, the password, and the transfer limit. Making; And if a signature is inputted into the internet banking application, at the bank server, processing a new subscription to the internet banking based on the internet banking application.

Description

Embodiments of the present invention relate to a method and system for processing a new subscription of Internet banking using an automated teller machine.

Financial automation equipment is an automation device that can provide basic financial services such as deposit or withdrawal without regard to time and place and bank staff without regard to financial services.

The automated teller machines can be divided into cash dispensers and cash dispensers depending on whether they are deposited or withdrawn. In recent years, the above-mentioned automated teller machines have been used for various purposes such as check deposit / withdrawal, checkbook settlement, payment of a fee, and ticket issuance.

On the other hand, as the financial industry develops, alliances between the financial industry and the distribution sector and other industries are increasing. Accordingly, it is necessary to develop multiple products and diversify sales channels. Particularly, due to the nature of financial products, it is necessary to be careful in counseling.

Internet banking new subscription processing method and system using a financial automation device according to an embodiment of the present invention, Korean Patent Publication No. 2002-0085295 (Invention: Banking system for businesses using the Internet, published date: November 2002 16 days).

One embodiment of the present invention to reduce the workload of the bank branch window by processing a new subscription of Internet banking using the automated teller machine, to reduce the waiting time of the customer to provide convenience to use the financial services, Provides a method and system for processing a new subscription to a financial product using a financial automation device.

The problems to be solved by the present invention are not limited to the above-mentioned problem (s), and another problem (s) not mentioned can be clearly understood by those skilled in the art from the following description.

Internet banking new subscription processing method using the automated teller machine according to an embodiment of the present invention comprises the steps of receiving at the customer terminal, the Internet banking application information including the customer information and account number in a temporary database; Receiving, at the automated teller machine, the internet banking application information from the customer terminal, and displaying an internet banking application page for application for internet banking in response to the internet banking application information; In the automated teller machine, if the user's ID, password and transfer limit are inputted through the internet banking application page, an internet banking application is generated based on the customer information, the account number, the ID, the password and the transfer limit. Making; And if a signature is inputted into the internet banking application, at the bank server, processing a new subscription to the internet banking based on the internet banking application.

Internet banking new subscription processing method using the automated teller machine according to another embodiment of the present invention comprises the steps of receiving at the customer terminal, the Internet banking application information including the customer information and account number in a temporary database; Receiving, at the automated teller machine, the internet banking application information from the customer terminal, and displaying an internet banking application page for application for internet banking in response to the internet banking application information; In the automated teller machine, if an ID, password, and transfer limit of the customer are input through the internet banking application page, an internet banking application is generated based on the customer information, the account number, the ID, the password, and the transfer limit. Making; At the automated teller machine, printing the internet banking application form through a printer module for signature input by a customer; And when the signature of the customer is input to the printed internet banking application, at a bank teller terminal, processing a new subscription to the internet banking based on the internet banking application in association with the bank server.

Internet banking new subscription processing method using the automated teller machine according to an embodiment of the present invention, the bank server, after the completion of the processing of the new subscription to the automated teller machine instructions for issuing a security card associated with the Internet banking Transmitting; And in the automated teller machine, issuing the security card in association with the bank server in response to a command regarding the issuance of the security card.

According to another aspect of the present invention, there is provided a method for processing a new Internet banking subscription using an automated teller machine, after the bank server completes processing of the new subscription, instructs the bank teller terminal to issue a security card associated with the internet banking. The method may further include transmitting.

Internet banking new subscription processing method using the automated teller machine according to embodiments of the present invention, the financial teller machine receives the customer information stored in the temporary database from the customer terminal from the financial information linked to the bank server Storing in a database; And performing a real name verification on the customer information by referring to the financial information database at the automated teller machine, and displaying the real information on the internet banking request page when the real name of the customer information is confirmed. It may include the step of displaying on the screen.

Internet banking new subscription processing method using the automated teller machine according to embodiments of the present invention, if the ID, the password and the transfer limit is input through the Internet banking application page in the automated teller machine, the Internet banking application The method may further include checking the integrity of the ID, the password, and the transfer limit before generating the ID.

Internet banking new subscription processing method using the automated teller machine according to an embodiment of the present invention, the step of generating the Internet banking application in the automated teller machine and displaying on the screen; When the signature of the customer is input through the screen, recognizing the input signature through the signature recognition module and generating the signature data by imaging the signature; And synthesizing the signature data with the internet banking application to the bank server in the automated teller machine.

Internet banking new subscription processing method using the automated teller machine according to the embodiments of the present invention, the automatic teller machine, receiving a photo stored in the smart phone via a wired or wireless communication with the smart phone of the customer; Calculating, in the automated teller machine, a print cost of the received picture according to a screen operation of the customer related to photo printing, and calculating the print cost based on a transaction result of the financial product corresponding to the account number; ; In the automated teller machine, processing the calculated printing cost in cooperation with a payment server; And printing and printing the received photograph when the payment processing is completed in the financial automatic machine.

Internet banking new subscription processing system using the automated teller machine according to an embodiment of the present invention is a customer terminal for receiving the Internet banking application information including the customer information and account number in a temporary database; Receiving the Internet banking application information from the customer terminal, and displays the Internet banking application page for the application of Internet banking in response to the Internet banking application information on the screen, the ID and password of the customer through the Internet banking application page And a financial automatic device for generating an internet banking application based on the customer information, the account number, the ID, the password, and the transfer limit when the transfer limit is input. And a bank server processing a new subscription to the internet banking on the basis of the internet banking application, when a signature is input to the internet banking application.

Internet banking new subscription processing system using the automated teller machine according to another embodiment of the present invention is a customer terminal for receiving the Internet banking application information including the customer information and account number in a temporary database; Receiving the Internet banking application information from the customer terminal, and displays the Internet banking application page for the application of Internet banking on the screen in response to the Internet banking application information, the user's ID, password through the Internet banking application page And when the transfer limit is input, generates an internet banking application based on the customer information, the account number, the ID, the password, and the transfer limit, and prints the internet banking application through a printer module for signature input by a customer. Automated printing machines; And a bank teller terminal that processes a new subscription to the internet banking on the basis of the internet banking application in conjunction with a bank server when the signature of the customer is input to the printed internet banking application.

The bank server sends a command regarding issuance of a security card associated with the internet banking to the automated teller machine after completion of the processing of the new subscription, and the automated teller machine responds to the command relating to the issue of the security card. The security card may be issued in association with a server.

The bank server may send a command regarding issuance of a security card associated with the internet banking to the bank teller terminal after completion of the processing of the new subscription.

The automatic teller machine generates the Internet banking application and displays it on the screen, and when the signature of the customer is input through the screen, the signature recognition module recognizes and images the input signature to generate signature data. The signature data may be synthesized in the internet banking application and transmitted to the bank server.

The automated teller machine receives a photo stored in the smart phone through wired or wireless communication with the smart phone of the customer, and calculates a print cost of the received photo according to a manipulation of the screen of the customer related to photo printing. Calculating the printing cost based on the transaction performance of the financial product corresponding to the account number, and billing the calculated printing cost in association with a payment server; and printing the received picture when the payment processing is completed. You can print

The details of other embodiments are included in the detailed description and the accompanying drawings.

BRIEF DESCRIPTION OF THE DRAWINGS The advantages and / or features of the present invention, and how to accomplish them, will become apparent with reference to the embodiments described in detail below with reference to the accompanying drawings. It should be understood, however, that the invention is not limited to the disclosed embodiments, but is capable of many different forms and should not be construed as limited to the embodiments set forth herein. Rather, these embodiments are provided so that this disclosure will be thorough and complete, To fully disclose the scope of the invention to those skilled in the art, and the invention is only defined by the scope of the claims. Like reference numerals refer to like elements throughout the specification.

According to an embodiment of the present invention, by processing a new subscription of the Internet banking using the automated teller machine, it is possible to reduce the workload of the bank branch window, and to reduce the waiting time of the customer to provide convenience to use the financial service. .

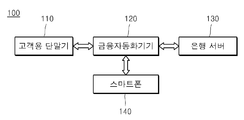

1 is a block diagram illustrating a new system for processing internet banking subscription using an automated teller machine according to an embodiment of the present invention.

2 is a block diagram illustrating a new system for processing internet banking subscription using an automated teller machine according to another embodiment of the present invention.

3 is a flowchart illustrating a method for processing a new internet banking subscription using an automated teller machine according to an embodiment of the present invention.

4 is a flowchart illustrating a method for processing a new internet banking subscription using an automated teller machine according to another embodiment of the present invention.

FIG. 5 is a flowchart illustrating a method of printing a photograph using a financial automatic apparatus according to an exemplary embodiment of the present invention. Referring to FIG.

Hereinafter, embodiments of the present invention will be described in detail with reference to the accompanying drawings.

1 is a block diagram illustrating a new system for processing internet banking subscription using an automated teller machine according to an embodiment of the present invention.

1, the new Internet banking

The

The

A bank employee may reside next to the

The

The

The

When the real name of the customer information is confirmed, the

When the ID, the password, and the transfer limit are input through the subscription page, the financial

For example, the

In addition, the

The

When the signature of the customer is input to the internet banking application through the screen, the financial

The

The

The

The

In this case, the

Herein, the transaction results of the financial product include the input / withdrawal related to the financial product, the frequency with which the account transfer is used, the registration of the transfer money transfer account, the example / deposit sold by the bank, the fund, the insurance, Usage results, and the like.

The

The

Alternatively, the

Alternatively, the

When the payment processing for the printing cost is completed, the

Alternatively, the

On the other hand, the Internet banking new

2 is a block diagram illustrating a new system for processing internet banking subscription using an automated teller machine according to another embodiment of the present invention.

2, the new Internet banking

The

The

A bank employee may reside next to the

The

The

The

When the real name of the customer information is confirmed, the

When the ID, the password, and the transfer limit are input through the subscription page, the financial

For example, the

In addition, the

The

When the customer's signature is input to the printed internet banking application, the

The

The

The

In this case, the

Herein, the transaction results of the financial product include the input / withdrawal related to the financial product, the frequency with which the account transfer is used, the registration of the transfer money transfer account, the example / deposit sold by the bank, the fund, the insurance, Usage results, and the like.

The financial

The

Alternatively, the

Alternatively, the

When the payment processing for the printing cost is completed, the

Alternatively, the

On the other hand, the Internet banking new

3 is a flowchart illustrating a method for processing a new internet banking subscription using an automated teller machine according to an embodiment of the present invention.

1 and 3, in

Next, in

Next, in

Next, in

Next, in

Next, in

Next, if a signature is entered in the internet banking application (YES direction 370), in

4 is a flowchart illustrating a method for processing a new internet banking subscription using an automated teller machine according to another embodiment of the present invention.

2 and 4, in

Next, in

Next, in

Next, in

Next, in

Next, in

Next, in

Next, when a signature is input to the internet banking application (Yes direction 480), in

FIG. 5 is a flowchart illustrating a method of printing a photograph using a financial automatic apparatus according to an exemplary embodiment of the present invention. Referring to FIG.

1 and 5, in

Next, in

Next, in

Next, in

As such, in one embodiment of the present invention, a new subscription of Internet banking can be processed using a financial automation device. Thus, according to the embodiment of the present invention, it is possible to reduce the work burden of the bank branch office and shorten the waiting time of the customer, thereby providing convenience in using the financial service.

Embodiments of the present invention include computer readable media including program instructions for performing various computer implemented operations. The computer-readable medium may include program instructions, local data files, local data structures, etc., alone or in combination. The media may be those specially designed and constructed for the present invention or may be those known to those skilled in the computer software. Examples of computer-readable media include magnetic media such as hard disks, floppy disks and magnetic tape, optical recording media such as CD-ROMs and DVDs, magneto-optical media such as floppy disks, and ROMs, And hardware devices specifically configured to store and execute the same program instructions. Examples of program instructions include machine language code such as those produced by a compiler, as well as high-level language code that can be executed by a computer using an interpreter or the like.

While the present invention has been described in connection with what is presently considered to be practical exemplary embodiments, it is to be understood that the invention is not limited to the disclosed embodiments. Therefore, the scope of the present invention should not be limited to the described embodiments, but should be determined by the scope of the appended claims and equivalents thereof.

While the present invention has been particularly shown and described with reference to exemplary embodiments thereof, it is to be understood that the invention is not limited to the disclosed exemplary embodiments, but, on the contrary, Modification is possible. Accordingly, the spirit of the present invention should be understood only in accordance with the following claims, and all equivalents or equivalent variations thereof are included in the scope of the present invention.

110, 210: a customer terminal

120, 220: Financial automation equipment

130, 240: Bank server

140, 250: Smartphone

230: Bank window terminal

Claims (14)

Receiving, at the automated teller machine, the internet banking application information from the customer terminal, and displaying an internet banking application page for application for internet banking in response to the internet banking application information;

In the automated teller machine, if an ID, password, and transfer limit of the customer are input through the internet banking application page, an internet banking application is generated based on the customer information, the account number, the ID, the password, and the transfer limit. Making; And

If a signature is entered in the internet banking application, at the bank server, processing a new subscription to the internet banking based on the internet banking application;

Internet banking new subscription processing method using a financial automated device comprising a.

Receiving, at the automated teller machine, the internet banking application information from the customer terminal, and displaying an internet banking application page for application for internet banking in response to the internet banking application information;

In the automated teller machine, if an ID, password, and transfer limit of the customer are input through the internet banking application page, an internet banking application is generated based on the customer information, the account number, the ID, the password, and the transfer limit. Making;

At the automated teller machine, printing the internet banking application form through a printer module for signature input by a customer; And

When the signature of the customer is input to the printed internet banking application, at a bank teller terminal, interworking with the bank server to process a new subscription for the internet banking based on the internet banking application;

Internet banking new subscription processing method using a financial automated device comprising a.

Sending, at the bank server, a command regarding issuance of a security card associated with the internet banking to the automated teller machine after completion of the processing of the new subscription; And

Issuing the security card in association with the bank server in response to a command regarding issuance of the security card at the automatic teller machine;

Internet banking new subscription processing method using a financial automation device further comprising a.

Sending, at the bank server, an instruction regarding issuance of a security card associated with the internet banking to the bank teller terminal after completion of the processing of the new subscription.

Internet banking new subscription processing method using a financial automation device further comprising a.

Receiving, at the automated teller machine, the customer information stored in the temporary database from the customer terminal and storing the customer information in a financial information database associated with the bank server; And

In the automated teller machine, performing real name verification on the customer information with reference to the financial information database;

Further comprising:

The step of displaying

If the real name of the customer information is confirmed, displaying the internet banking request page on the screen;

Internet banking new subscription processing method using a financial automated device comprising a.

In the automated teller machine, if the ID, the password, and the transfer limit are input through the internet banking application page, checking the integrity of the ID, the password, and the transfer limit before generating the internet banking application;

Internet banking new subscription processing method using a financial automation device further comprising a.

Generating, at the automated teller machine, the internet banking application on the screen;

When the signature of the customer is input through the screen, recognizing the input signature through the signature recognition module and generating the signature data by imaging the signature; And

In the automated teller machine, synthesizing the signature data into the internet banking application form and transmitting it to the bank server;

Internet banking new subscription processing method using a financial automation device further comprising a.

Receiving, at the automated teller machine, a photograph stored in the smartphone through wired or wireless communication with the smartphone of the customer;

Calculating, in the automated teller machine, a print cost of the received picture according to a screen operation of the customer related to photo printing, and calculating the print cost based on a transaction result of the financial product corresponding to the account number; ;

In the automated teller machine, processing the calculated printing cost in cooperation with a payment server; And

In the automated teller machine, when the settlement processing is completed, printing the received photograph and outputting

Further comprising the steps of: (a) receiving a new financial product from the financial institution;

Receiving the Internet banking application information from the customer terminal, and displays the Internet banking application page for the application of Internet banking in response to the Internet banking application information on the screen, the ID and password of the customer through the Internet banking application page And a financial automatic device for generating an internet banking application based on the customer information, the account number, the ID, the password, and the transfer limit when the transfer limit is input. And

When a signature is entered in the internet banking application, a bank server that processes a new subscription to the internet banking based on the internet banking application.

Internet banking new subscription processing system using a financial automation device comprising a.

Receiving the Internet banking application information from the customer terminal, and displays the Internet banking application page for the application of Internet banking on the screen in response to the Internet banking application information, the user's ID, password through the Internet banking application page And when the transfer limit is input, generates an internet banking application based on the customer information, the account number, the ID, the password, and the transfer limit, and prints the internet banking application through a printer module for signature input by a customer. Automated printing machines; And

When the customer's signature is entered in the printed Internet banking application, a bank teller terminal that interworks with a bank server to process a new subscription for the internet banking based on the internet banking application.

Internet banking new subscription processing system using a financial automation device comprising a.

The bank server

Send a command regarding issuance of a security card associated with the internet banking to the automated teller machine after the processing of the new subscription is completed;

The automated teller machine

Internet banking new subscription processing system using the automated teller machine, characterized in that for issuing the security card in conjunction with the bank server in response to a command regarding the issue of the security card.

The bank server

And a command for issuing a security card associated with the Internet banking to the bank teller terminal after completion of the processing of the new subscription.

The automated teller machine

The Internet banking application is generated and displayed on the screen, and when the signature of the customer is input through the screen, the signature recognition module recognizes and images the input signature to generate signature data, and generates the signature data. The Internet banking new subscription processing system using a financial automation device, characterized in that the synthesized in the Internet banking application and transmitted to the bank server.

The automated teller machine

Receiving a photo stored in the smartphone through a wired or wireless communication with the customer's smartphone, and calculates the print cost of the received photo according to the screen operation of the customer associated with the photo print, but not in the account number The printing cost is calculated based on the transaction performance of the corresponding financial product, and the printout is processed in connection with a payment server. When the payment processing is completed, the printout is printed and output. New financial product subscription processing system using the automated teller machine.

Priority Applications (1)

| Application Number | Priority Date | Filing Date | Title |

|---|---|---|---|

| KR1020120067629A KR20140000508A (en) | 2012-06-22 | 2012-06-22 | Method and system for processing subscription of internet banking using automatic teller machine |

Applications Claiming Priority (1)

| Application Number | Priority Date | Filing Date | Title |

|---|---|---|---|

| KR1020120067629A KR20140000508A (en) | 2012-06-22 | 2012-06-22 | Method and system for processing subscription of internet banking using automatic teller machine |

Publications (1)

| Publication Number | Publication Date |

|---|---|

| KR20140000508A true KR20140000508A (en) | 2014-01-03 |

Family

ID=50138369

Family Applications (1)

| Application Number | Title | Priority Date | Filing Date |

|---|---|---|---|

| KR1020120067629A KR20140000508A (en) | 2012-06-22 | 2012-06-22 | Method and system for processing subscription of internet banking using automatic teller machine |

Country Status (1)

| Country | Link |

|---|---|

| KR (1) | KR20140000508A (en) |

-

2012

- 2012-06-22 KR KR1020120067629A patent/KR20140000508A/en not_active Application Discontinuation

Similar Documents

| Publication | Publication Date | Title |

|---|---|---|

| US11687906B1 (en) | Systems and devices controlled responsive to data bearing records | |

| JP5953048B2 (en) | Clerk support type window reception system and window processing method | |

| AU2006283438A1 (en) | Front counter and back counter workflow integration | |

| KR20140000509A (en) | Method and system for issuing check card using automatic teller machine | |

| GB2482659A (en) | Tax refund system for purchase transactions | |

| US10915949B2 (en) | Real-time creation of bank account and dispensing welcome kit for the bank account through ATM | |

| US9811856B2 (en) | System and method for reducing a processing time for a bank transaction | |

| JP2014203388A (en) | Tax/public money receipt system | |

| KR20110014958A (en) | Transaction support method | |

| JP6688016B2 (en) | Electronic bookkeeping system and slip drafting method | |

| US20060187698A1 (en) | System and method for dynamic checking | |

| KR101414394B1 (en) | Method and system for processing subscription of financial product using automatic teller machine | |

| KR20140000508A (en) | Method and system for processing subscription of internet banking using automatic teller machine | |

| US20150106132A1 (en) | Processing insurance payments | |

| JP2008083823A (en) | Contract acceptance terminal and contract system | |

| US11810375B2 (en) | Transaction processing system, transaction processing method, and non-transitory computer-readable memory medium | |

| JP2009146170A (en) | Card issuing method, card issuing system, and card validating device | |

| JP4821307B2 (en) | Contract reception terminal and contract system | |

| JP2018128922A (en) | Client transaction system, client terminal device and client transaction method | |

| KR101937222B1 (en) | Banking machine with printing function, banking system with printing function and printing method using banking machine | |

| JP2024000451A (en) | Article sales data processor, article sales data processing server, and program | |

| JP2022072663A (en) | Cooperation program, cooperation method, and cooperation device | |

| KR20130069371A (en) | Method for generating electronic documents using electronic documents terminal for transacting banking | |

| JP2020123083A (en) | Application processing system | |

| JP2018170041A (en) | Customer guidance system and customer guidance method |

Legal Events

| Date | Code | Title | Description |

|---|---|---|---|

| A201 | Request for examination | ||

| E902 | Notification of reason for refusal | ||

| E601 | Decision to refuse application |